It now allows more borrowers to use personal income to cover shortfalls in rental income for BTL properties

Gatehouse Bank, a Shariah-compliant ethical bank, has reintroduced top slicing for UK expats and international residents purchasing buy-to-let properties.

Top slicing, also known as income top-up, allows applicants to use their personal income to cover shortfalls when rental income does not sufficiently cover the mortgage payment.

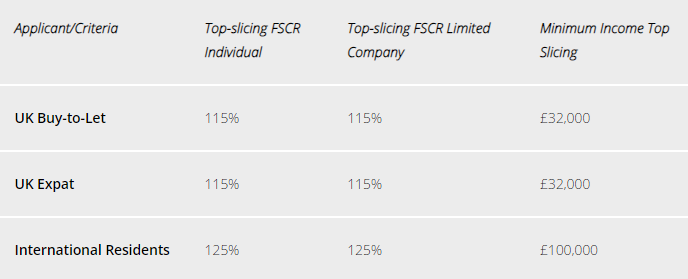

To qualify, UK expats must have a minimum annual income of £32,000, while international residents need £100,000. Both UK expats and residents fall under the same financial service coverage ratio (FSCR) band, with a 115% rate applying to individuals and limited companies. International residents face a slightly higher FSCR rate of 125%. The FSCR measures the customer’s ability to cover their payments based on their rental income.

The bank had already reinstated top slicing for UK residents in June.

“Today’s announcement is a natural next step for Gatehouse Bank, following the same changes being reintroduced for UK residents earlier this year,” said John Mace, senior product manager at Gatehouse Bank. “We have reintroduced top slicing for uk expats and international residents to ensure that customers seeking Shariah-compliant buy-to-let products have a wider range of options.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.