It also updates its finance service coverage ratio bandings

Gatehouse Bank has reintroduced top slicing for UK residents purchasing buy-to-let properties.

Top slicing, also known as income top-up, allows applicants to use their personal income to cover the shortfall when the rent paid by the tenant does not meet the bank’s monthly payment requirements, subject to certain limits.

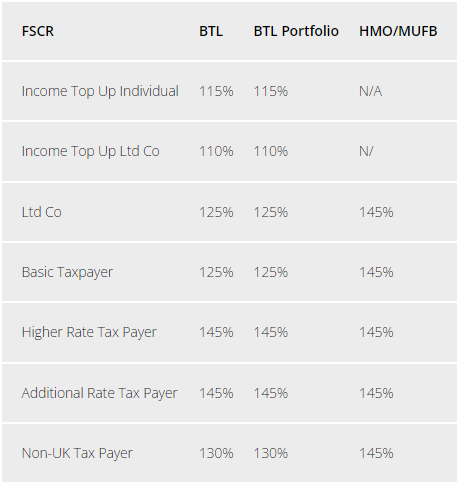

The challenger bank has also updated its finance service coverage ratio (FSCR) bandings.

Limited companies and basic rate taxpayers purchasing individual BTL properties or portfolios will have a 125% rate. Higher and additional rate taxpayers purchasing properties individually or as part of a portfolio, as well as those buying houses in multiple occupation (HMOs) or multi-unit freehold blocks (MUFBs), will have a 145% rate.

We’ve reintroduced top slicing for UK residents purchasing a Buy-to-Let property.

— Gatehouse Bank (@gatehousebank) June 12, 2024

Read more: https://t.co/PYYmrZRLvY#HomeFinance #IslamicFinance #GatehouseBank pic.twitter.com/mgzfa8K2qs

To qualify for top slicing, applicants must have a minimum annual income of £32,000 from at least one UK-based applicant. The FSCR bandings for top slicing will be 110% for limited companies and 115% for individuals.

“We continuously review our products and criteria to ensure that we are providing our customers with the most suitable outcomes for their needs,” said John Mace, senior product manager at Gatehouse Bank. “We have reintroduced top slicing to broaden our criteria and subsequently help more buy-to-let customers achieve their financial goals.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.