More pressure for landlords could depress the market even more as Labour threatens a "battle"

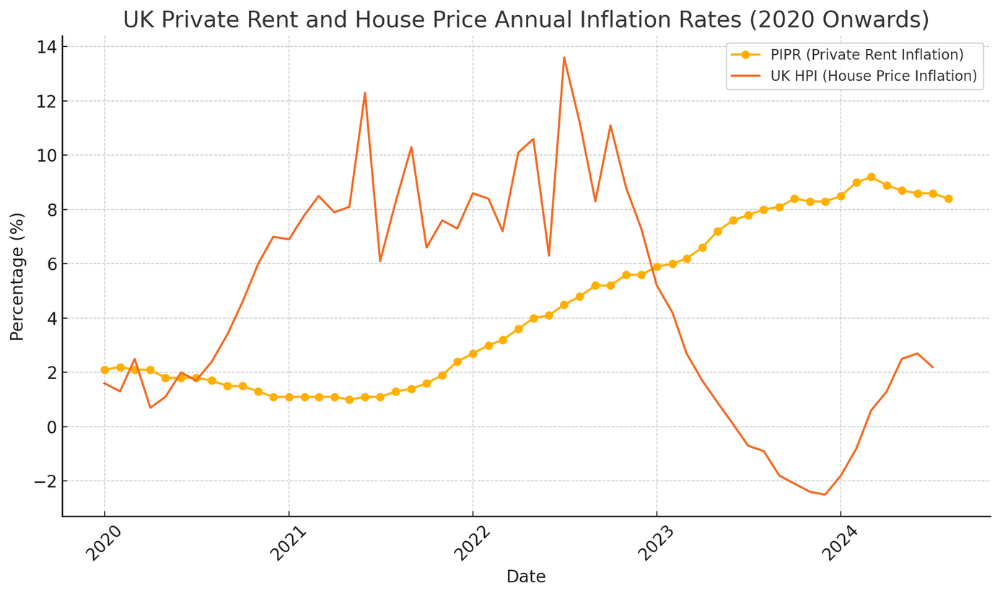

It’s a strange conundrum. While it might seem logical to try to get more landlords competing to drive down renting costs, it seems like the new government is happy to make things more difficult for landlords. According to the latest ONS figures rents rose by 8.4% to August this year, following a very similar 8.6% the year before. The buy-to-let (BTL) sector, already facing significant challenges, may be hit even harder as Labour revives a withdrawn Tory policy that mandates rented properties to achieve an Energy Performance Certificate (EPC) rating of 'C' or above by 2030. This announcement comes at a time when the sector is grappling with reduced lending and potential tax hikes, adding further pressure on landlords and property investors.

Ed Miliband, Labour’s Energy Secretary, made the announcement during the Labour Party conference in Liverpool, stating that “every rented home reaches decent standards of energy efficiency” by the end of the decade. This policy, first proposed by the Conservatives but abandoned in 2022, will require landlords to upgrade properties or face restrictions on letting them out. A consultation later this year is expected to outline a spending cap for landlords, likely around £10,000 for necessary energy efficiency improvements, similar to previous plans.

However, the buy-to-let market has already been under strain this year. In the first quarter of 2024, only 41,149 new buy-to-let loans worth £7.0 billion were issued—a 17.3% drop in value compared to the same period in 2023. This decline comes despite the Bank of England’s recent interest rate cuts and increased competition among lenders, and the situation could worsen as landlords brace for additional financial burdens.

The uncertainty surrounding potential capital gains tax (CGT) increases in the upcoming October Budget is also dissuading property investors, causing a surge in activity. Many are rushing to sell properties before any tax hikes are announced, driven by fears that Labour may raise taxes to address a £22 billion deficit in public finances. As Sir Keir Starmer hinted earlier this week, the Budget “is going to be painful,” and those with greater financial means should expect to shoulder more of the burden.

The National Residential Landlords Association (NRLA) has expressed concerns about Labour’s plans to improve the energy efficiency of rental properties, emphasising the need for clear guidance and financial support. Chris Norris, policy director for the NRLA, said: “The sector needs a clear trajectory setting out what will be expected of it and by when. This plan must also ensure sufficient numbers of tradespeople are in place to undertake the work that will be required.”

While the NRLA supports improving energy efficiency, the combination of tax increases and regulatory changes is creating a difficult environment for landlords. Property investors, especially those with older homes that are harder to upgrade, may find it challenging to meet the new EPC standards without significant financial strain. Furthermore, with a growing shortage of tradespeople—estimated to reach 250,000 by 2030—the costs and delays associated with upgrades are likely to escalate.

This uncertainty has created a “frenzy,” according to Tim Stovold, a partner at Moore Kingston Smith, with many landlords exploring asset sales or other strategies to lock in current tax rates before the October Budget. Capital gains on assets such as second homes are currently taxed at lower rates than income, but a rise in CGT could dramatically reduce post-sale profits for landlords. Some investors are also considering alternative methods, such as transferring assets into family trusts, to mitigate the potential impact of tax changes.

At present, nearly 45% of privately rented properties in England have an EPC rating of at least 'C', a significant improvement from previous years. However, older homes, particularly those built before 1919, remain among the most difficult to upgrade. These properties represent a substantial portion of the UK’s rental stock, making compliance with the new standards even more challenging.

As Labour pushes forward with its energy efficiency goals, Miliband acknowledged that tensions with landlords may arise. According to The Times, “Labour sources say they are willing to risk a battle with landlords to reach their green goals.” Miliband has promised government support for insulation and other energy upgrades, but landlords remain concerned about the financial burden they will face in meeting the 2030 deadline.

Amid these challenges, there are signs of recovery in other parts of the property market. Some lenders have softened borrowing requirements, and the Bank of England’s recent rate cuts are contributing to increased activity. While these factors may bring relief to homeowners, the buy-to-let sector continues to navigate significant headwinds, with regulatory changes and tax uncertainties making it increasingly difficult for investors to plan ahead.

For landlords, the combination of rising costs, stricter energy efficiency standards, and potential tax hikes could signal a tough road ahead, forcing many to reconsider their positions in the market. As the October Budget approaches, the future of the buy-to-let sector remains uncertain, and landlords will be watching closely to see how these policies and proposals unfold.