One offers new limited edition five-year fixed BTL products

Several lenders have announced changes to their buy-to-let mortgage products, offering new options and reduced rates for brokers and landlords.

West One has reduced rates across its first charge buy-to-let fixed rate product range. Standard five-year fixed rates are down by five to 15 basis points (bps), while the standard two-year fixed rate and specialist two-year fixed rate have seen cuts of 20 to 25bps.

Rates now start from 2.84% for two-year fixed rates and 4.29% for five-year fixed rates. Additionally, the maximum loan size for standard and specialist products has increased to £3 million, with greater flexibility for applications from foreign nationals and expatriates.

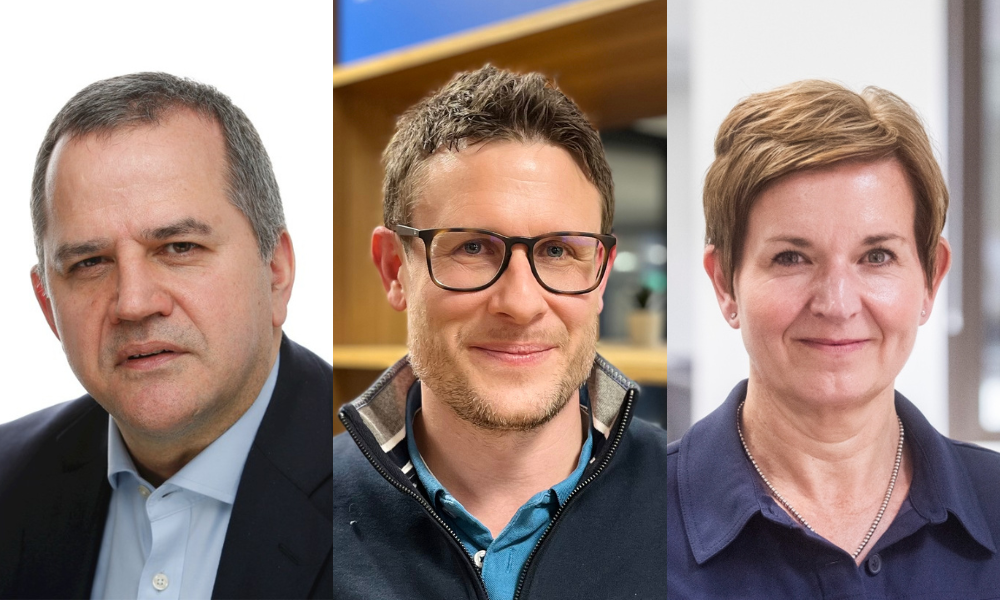

“Providing competitive, convenient, and cost-effective products is at the forefront of our mission,” said Andrew Ferguson (pictured left), managing director of buy-to-let at West One Loans. “We anticipate further enhancements and offers for our customers in the near future.”

The Mortgage Works (TMW) has also reduced selected buy-to-let rates by up to 25bps, with new business rates starting at 3.54%.

Highlights include a two-year fixed rate at 3.54% for up to 65% loan-to-value (LTV), and a five-year fixed rate at 3.94% for up to 65% LTV. Switcher rates for existing customers have also been reduced slightly, with two-year fixed rates now at 3.84% for up to 55% and 65% LTV.

“These latest reductions make us one of the most competitive providers of buy-to-let mortgages, with rates now starting from 3.54%,” said Joe Avarne (pictured centre), senior manager of buy-to-let mortgages at The Mortgage Works.

Meanwhile, Paragon Bank has introduced four new limited edition five-year fixed rate buy-to-let mortgages.

These products cater to both small and large portfolio landlords, with two products for those with up to three properties and two for those with four or more. The mortgages, available at up to 65% LTV, come with a £2,995 fee. Rates start at 5.45% for properties with EPC ratings of ‘A’ to ‘C’ and 5.50% for properties rated ‘D’ or ‘E’.

“We launched these limited edition products to offer solutions that suit a broader spectrum of customers, from new entrants to established landlords,” said Louisa Sedgwick (pictured right), mortgages commercial director at Paragon Bank.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.