It lowers interest cover ratios and stress test rates

The Mortgage Works (TMW) has improved its affordability criteria with changes to its interest cover ratios (ICR) and stress test rates, effective immediately.

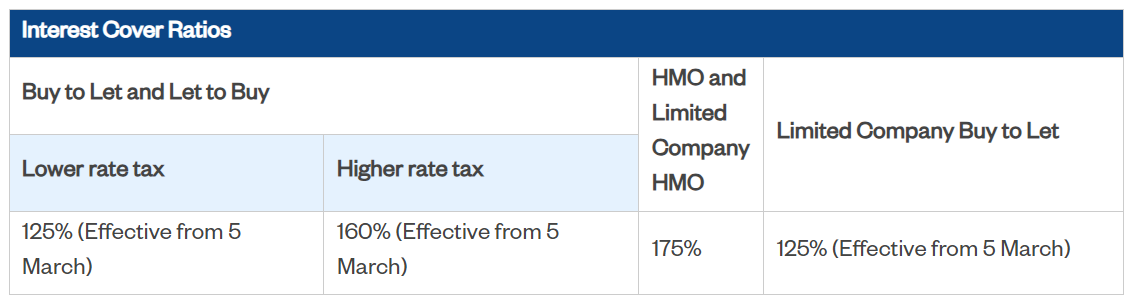

The changes, aimed at making borrowing more sustainable for landlords, include a reduction in the ICR for higher rate taxpayers from 165% to 160%, and for limited company and lower rate taxpayers, from 130% to 125%.

In addition, the existing portfolio rental calculation stress rate has been lowered from 5% to 4.5%.

Under the new affordability policy, the ICR will be structured as follows:

“We regularly review our affordability policy to ensure borrowing is sustainable for our landlords,” said Joe Avarne (pictured), senior manager for buy-to-let mortgages at The Mortgage Works. “With these latest changes, we’re pleased to be able to reduce our interest cover ratios so that landlords can borrow more and achieve their buy-to-let aspirations.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.