Halifax research also examines why these areas stand out for first-time buyers

New research from mortgage lender Halifax has identified the most popular locations for first-time buyers in Britain, highlighting areas where these buyers are significantly influencing the local housing market.

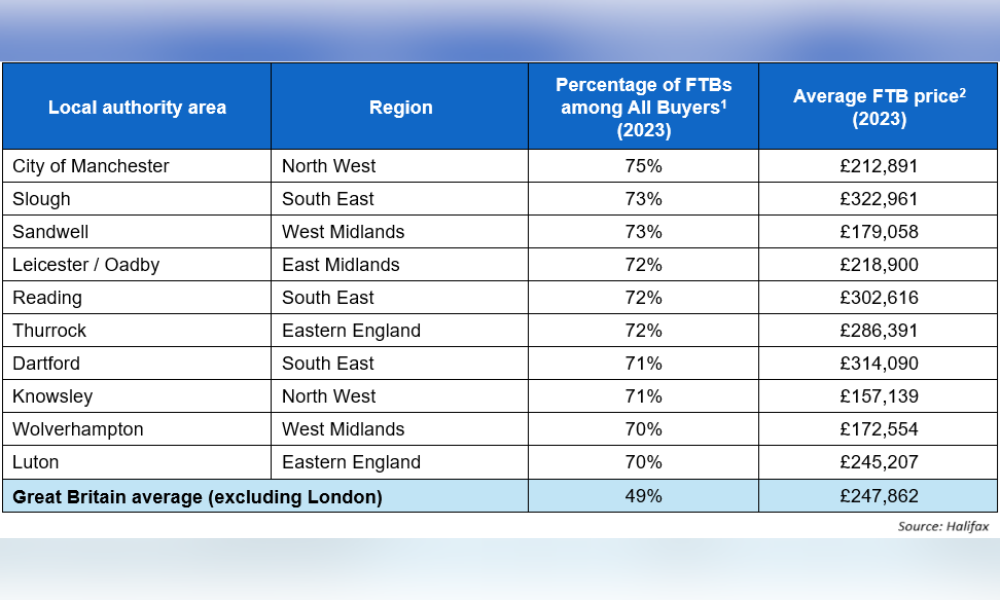

The study, which used data from the Halifax House Price Index, focused on regions outside London where first-time buyers represent the largest share of home sales. Despite a housing market characterised by high property prices and increased borrowing costs, these first-time buyer hotspots have shown resilience, driven by various factors that enhance their appeal.

Manchester topped the list, with first-time buyers accounting for 75% of all mortgage-financed home purchases in the city last year, up from 65% in 2020. Halifax said Manchester’s affordable housing, strong job market, excellent transport links, vibrant cultural scene, and ongoing urban regeneration are key factors attracting first-time buyers. The average price for a first home in Manchester is £212,891, approximately £35,000 below the national average.

Slough in Berkshire ranks second, where first-time buyers made up 73% of mortgage-financed purchases last year, a significant increase from 54% in 2020. Halifax said the town’s appeal is bolstered by substantial investment in regeneration projects and its excellent transport links to London, including the Elizabeth line and proximity to Heathrow Airport. The average property price for first-time buyers in Slough is £322,961, lower than London’s average but higher than the national average.

Read next: The 11 cheapest places to live in London

Sandwell in the West Midlands also saw 73% of mortgage-financed purchases by first-time buyers last year, up from 71% in 2020. The high street lender noted that the area’s affordability, with an average first-time buyer property price of £179,058, combined with good transport connections and significant economic regeneration, makes it an attractive option, particularly for young families.

“Deciding when and where to buy your first home is a deeply personal choice,” said Amanda Bryden (pictured), head of Halifax Mortgages. “While saving for a deposit and navigating higher interest rates pose a significant challenge for many prospective homeowners, life often intervenes and major milestones such as starting a new job or beginning a family can sway the decision.

“Deciding when and where to buy your first home is a deeply personal choice,” said Amanda Bryden (pictured), head of Halifax Mortgages. “While saving for a deposit and navigating higher interest rates pose a significant challenge for many prospective homeowners, life often intervenes and major milestones such as starting a new job or beginning a family can sway the decision.

“First-time buyers are often more willing to relocate to new areas in pursuit of finding the ideal home within their financial reach. This flexibility opens up a broader range of possibilities and can lead to more affordable housing options.

“Buying your own home remains one of the best long-term financial decisions you can make, and across the UK several locations stand out for their appeal to first-time buyers. Notably, Manchester, with its diverse property styles and vibrant cultural scene, has become a magnet for those taking their first steps into homeownership.”

Lloyds Banking Group, which includes Halifax, recently introduced the First-time Buyer Boost, increasing the loan-to-income multiple for eligible first-time buyers from 4.49 times to 5.5 times their household income. The move, designed to help more first-time buyers enter the market, is expected to result in an additional £2 billion in lending. In 2023, the bank lent £12 billion to first-time buyers.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.