They plan to release home equity primarily to pay for care, boost retirement income, and fund travels

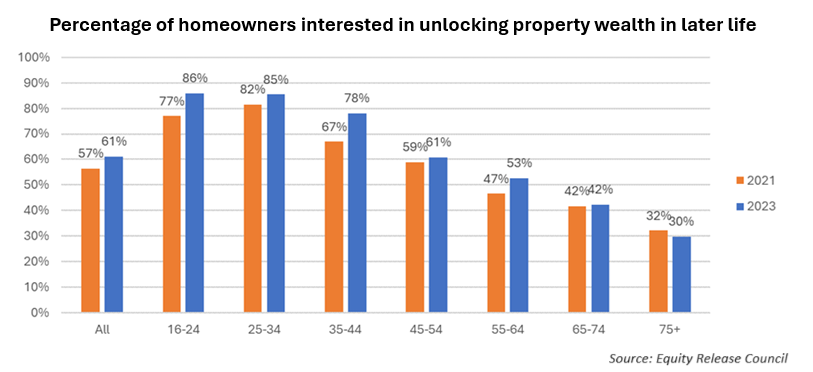

More than three in five UK homeowners, around 61% or equivalent to 18.7 million people, are interested in releasing money from their home in later life to meet various financial needs, according to new findings from the Equity Release Council (ERC).

The figure has risen from 57% in 2021, as revealed by the council’s Home Advantage study, which surveyed 5,000 UK adults and was supported by Equity Release Supermarket.

The research highlights the growing acceptance of borrowing into older age, with property increasingly seen as a means to fund a comfortable retirement. The concept of ‘ultra-long mortgages’ extending beyond state pension age is becoming more accepted, with only 26% of homeowners ruling out accessing money from their homes in later life. Nearly 40% believe it is becoming more common and acceptable to have a mortgage in later life, up from 34% in 2021.

Almost half or 46% of homeowners aged 55 and over view property wealth as a way to meet their needs in later life. Younger homeowners show even greater interest, with 75% of those under 55 open to using their property wealth in later life. The most significant shift since 2021 is seen in the 35 to 44 age group, with 78% now interested in accessing their home’s value, up from 67%.

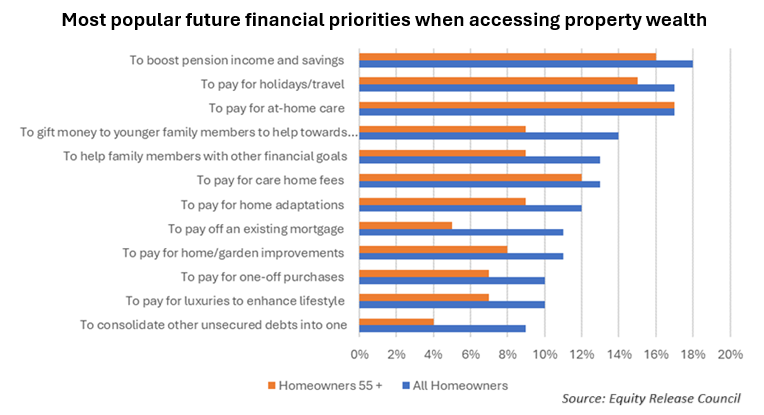

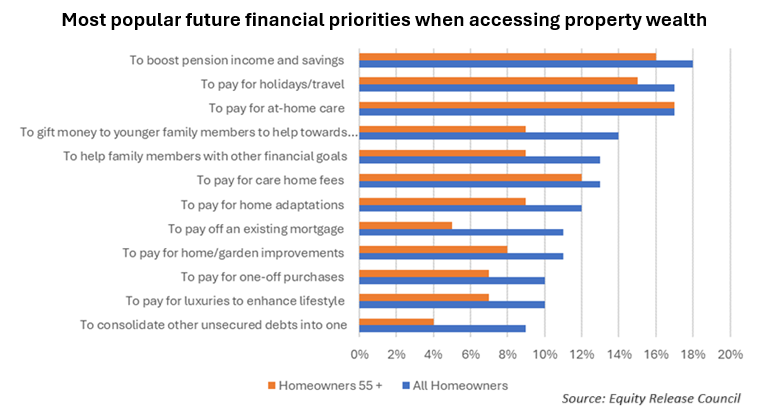

Key motivations for homeowners aged 55 and older to release money from their homes include paying for care at home (17%), boosting retirement income (16%), and funding travel plans (15%). Additionally, supporting younger family members financially is a priority, with 14% interested in using their property wealth to help family members with a home deposit, and 13% looking to support other financial goals.

With annual residential care costs approaching £46,000 in major UK cities, equity release is increasingly used to pay for at-home care, according to separate research from Care UK.

“In an ideal world, most people would retire with a mortgage-free home and a substantial pension, but that is not the reality of modern Britain,” said Jim Boyd (pictured left), chief executive of the Equity Release Council. “People are choosing products such as ultra long mortgages out of necessity as the lower repayments allow them to purchase a home, save into their pensions and finance their day-to-day living expenses.

“The rise of products such as ultra long mortgages highlight the changing relationship people have with property wealth as it is increasingly being seen as an asset rather than simply bricks and mortar. Almost half of over-55s see property wealth as a means to meeting later life needs and the younger generation is even more wedded to this approach.

“We need to support people to look at all their options when it comes to funding retirement whether it is pensions, property or investments. One size does not fit all. Encouraging people to have realistic conversations will provide more people with the type of retirement they want and need.”

Mark Gregory (pictured right), founder and chief executive of Equity Release Supermarket, highlighted the various reasons people opt for equity release, including changes in consumer behaviour, market competitiveness, and the need to support longer life expectancy and declining pension provisions.

“The equity release sector has significantly evolved in line with these consumer demands and now encompasses far greater opportunities around later life living and finance,” Gregory added. “The beauty of the market today is that there are tools and platforms that exist, which help consumers to navigate these choices, enable them to review all options, view real-time rates and gain whole of market advice.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.