While banks are more capitalised than before the credit crunch car finance, unsecured personal loans and credit card lending are seen as risky ways consumers are funding their spending.

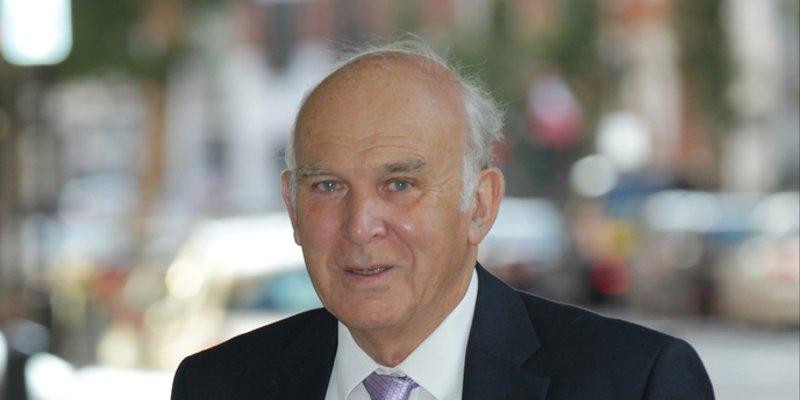

Britain is “sleepwalking” towards another economic crisis due to its reliance on unsustainable debt, Liberal Democrat leader Sir Vince Cable (pictured) has warned.

While banks are more capitalised than before the credit crunch, car finance, unsecured personal loans and credit card lending are seen as risky ways in which consumers are funding their spending to compensate for falling real earnings.

Sir Vince is credited with predicting the credit crunch of 2008.

He said: “10 years on since the collapse of Northern Rock, Britain is sleepwalking into another economic crisis.

“Banks are now safer and better capitalised, and the Liberal Democrat policy in government of splitting retail banking from more risky ‘casino banking’ has added to stability.

“But despite progress made during the coalition years, the country has still not fully recovered from the economic heart attack it suffered a decade ago.”

He added: “The economy remains overly reliant on consumer spending fuelled by unsustainable debt.

“Living standards are being eroded by the fall in the pound, while the uncertainty caused by Brexit is undermining business investment and consumer confidence.

“A bold new approach is needed to steady the ship, drive up productivity and living standards, and prevent the economy from tipping into recession.”

The Treasury’s quantitative easing programme, where money is created electronically, has been running in the UK since 2009 and, while it encourages lending, it devalues the currency in the long-term.

Similarly the UK's historically low interest rates of 0.25% encourages lending but causes savers to struggle and devalues the value of the currency.