The partnership will enable Emma users to access Trussle’s mortgage advice via an integration on Emma’s platform.

Trussle has formed a partnership with Emma to provide users with access to mortgage advice.

The partnership will enable Emma users to access Trussle’s mortgage advice via an integration on Emma’s platform. Customers can manage their personal finances, with a focus on budgeting, tracking and saving money, which will support their mortgage application.

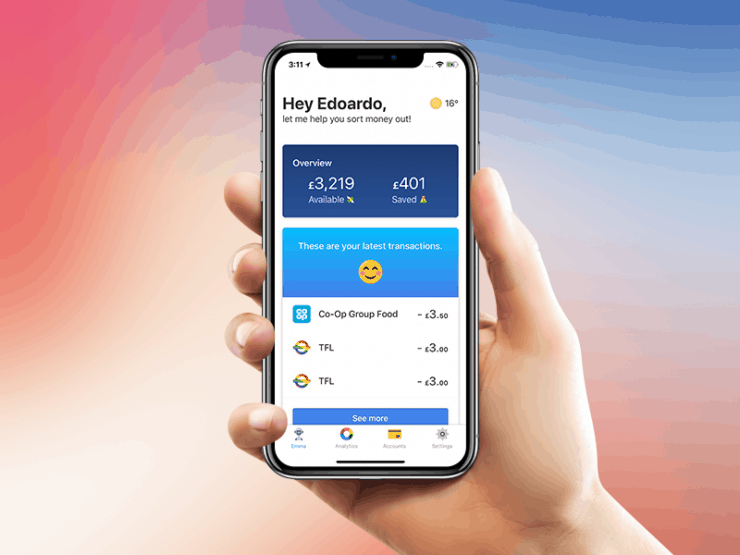

Emma, the personal finance management app that bills itself as your “financial best friend” aims to help users understand how much money they have left until payday, track and find wasteful subscriptions or alert you when you are paying over the odds-on utility bills.

Ian Larkin, Trussle’s CEO, said: “Buying a home is one of the biggest financial commitments someone will face in their lifetime. And with that comes a lot of emotion and stress.

"By using Emma, customers can not only manage their money matters by budgeting, tracking spending and saving money, but they can now also easily access mortgage advice to help finance their home.

"Understanding how much you can afford to save and borrow is an important part of your mortgage application. By using Emma, customers can manage their money matters by budgeting, tracking and saving money, and this will support their mortgage application.

"Partnering with Emma is another step towards removing the anxieties that exist when it comes to financing a home. Emma and Trussle have both set out to empower users to take control of their finances, and we’re excited to be able to support more customers throughout this partnership.”

Edoardo Moreni, founder and CEO of Emma, added: “At Emma, our goal has always been helping people live a better financial life. We have started from saving money by setting budgets and now we are expanding to real actions in people’s lives.

"That’s why we are thrilled to be partnering with Trussle to help our users buy their first home or save by remortgaging. This will unlock endless opportunities and enable Emma to have a much bigger impact in everyone’s financial journey."