What's the biggest barrier to greater take-up of Islamic mortgages?

Over three in four Muslims in the UK, or 76%, find it crucial to access financial products that align with their religious beliefs, new research has found.

The study, conducted by research and consultancy services Pegasus Insight in behalf of Shariah-compliant home finance provider StrideUp, also revealed a strong preference within the Muslim community for Islamic finance, with 82% agreeing that it corresponds with their values and beliefs.

Moreover, 65% of those currently holding conventional mortgages expressed a desire to switch to an Islamic finance product for their next property finance venture.

StrideUp said it aims to cater to Muslims who, due to their faith, seek alternatives to traditional interest-based financial products. The company offers a Home Purchase Plan (HPP), designed to facilitate homeownership without compromising religious principles.

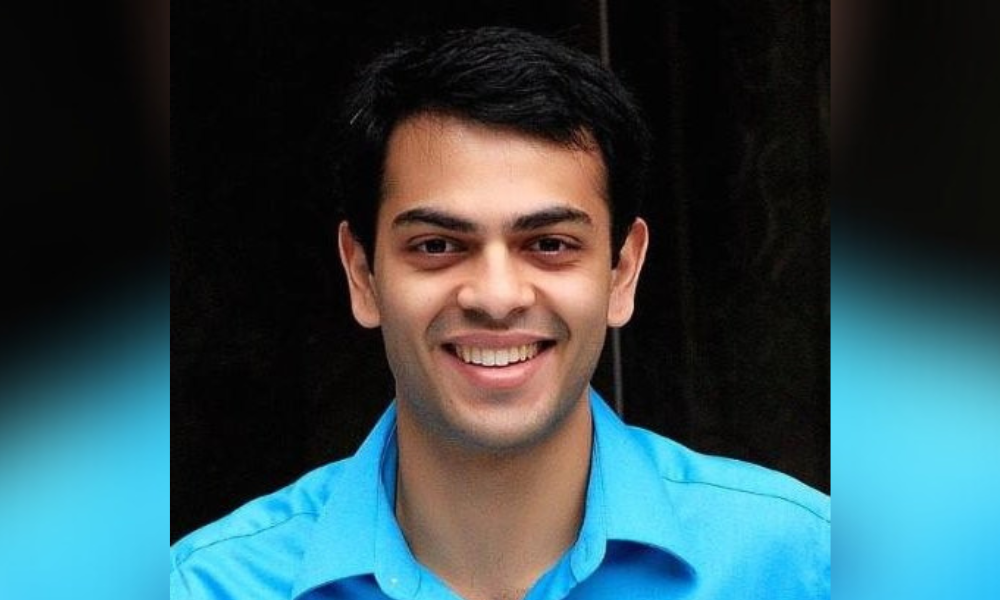

“Our recent study has confirmed the importance of Shariah-compliant finance products for the Muslim population,” said Sakeeb Zaman (pictured), chief executive at StrideUp. “A key differentiator of Islamic finance versus conventional products is the absence of interest – which is prohibited in Islam. Most Muslims see it as a more ethical option which aligns with their values, and our research points to these products as being highly regarded in the community.

“However, the biggest barrier to greater take-up is the lack of available information about home purchase plans, so brokers have an important role to play in helping their Muslim clients access the products they need to buy a new home or refinance their existing property.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.