Will real estate giant upend the UK's mortgage market too?

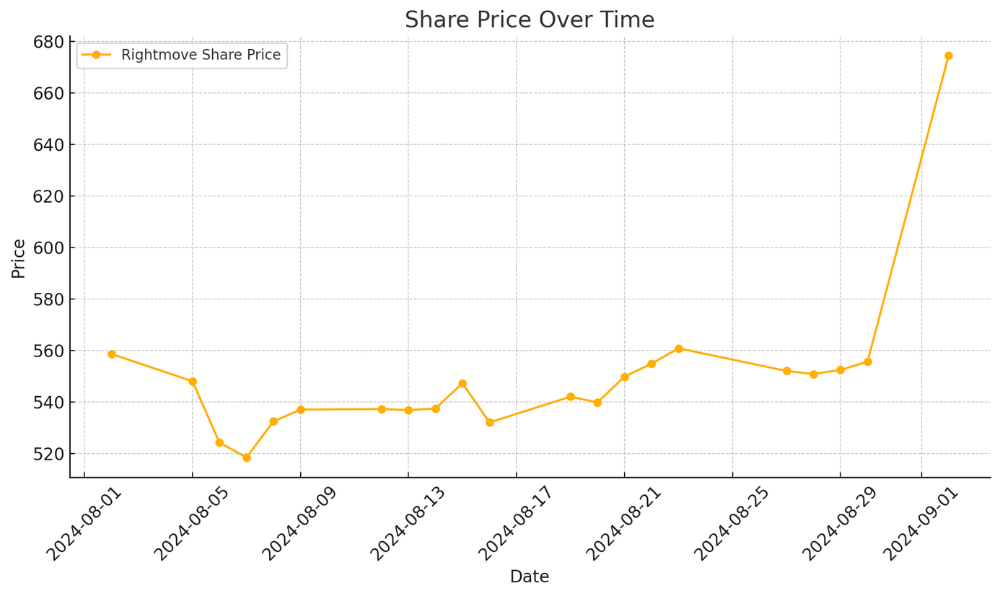

Rightmove shares have surged by 25% this morning following news that Australian property listings giant, REA Group, controlled by Rupert Murdoch’s News Corp, is considering a potential acquisition of the UK-based real estate platform. REA Group, which owns one of Australia’s largest mortgage brokerages, described this possible acquisition as a “transformational opportunity”, noting the “clear similarities” between the two companies. Rightmove’s chief executive Johan Svanstrom has already identified mortgage services as a growth area for Britain’s dominant listing portal, and REA’s ownership of Mortgage Choice – one of Australia’s largest mortgage brokers would certainly help turbocharge that expansion.

Though REA has yet to make a formal offer, the company acknowledged its interest after reports emerged about its collaboration with Deutsche Bank on a significant overseas acquisition. As a result, Rightmove’s shares saw a substantial increase, bringing the company’s valuation to approximately £5.4 billion.

The UK’s takeover regulations now give REA Group until the end of September to either present a formal offer or withdraw its interest. This potential acquisition could significantly impact the competitive landscape of the UK property market, where Rightmove holds over 80% market share, outpacing competitors like Zoopla and OnTheMarket.

The UK’s takeover regulations now give REA Group until the end of September to either present a formal offer or withdraw its interest. This potential acquisition could significantly impact the competitive landscape of the UK property market, where Rightmove holds over 80% market share, outpacing competitors like Zoopla and OnTheMarket.

Earlier this year, Rightmove, which is part of the FTSE 100 index, warned that its customer base might experience a slight decline in 2024 due to the ongoing market downturn affecting estate agents and housebuilders. Despite this, the company reported 7% revenue growth in the first half of 2024, driven by increased spending on property listings. As well as mortgage services, Svanstrom has identified rental properties and commercial real estate as key growth areas and has invested in digital solutions to streamline the home-buying process.

REA investors aren’t as keen as Rightmove shareholders however - REA Group faced a 7% drop in its share price on Monday following the news, with investors wary of the potential equity raising that might be required to fund the acquisition. Nevertheless, REA’s stock has performed well over the past year, buoyed by the perennially strong Australian housing market.

Owen Wilson, REA’s CEO since 2018, was praised by stockbroker Angus Aitken speaking to the Financial Times as a “sensible” executive pursuing a “common sense” acquisition, emphasising that the move is driven by long-term economic returns rather than ego.

REA Group, which began in the mid-1990s in a Melbourne garage, has grown substantially under News Corp’s ownership, now boasting a market value of AU$26 billion (£13.4 billion). News Corp first acquired a stake in REA in 2001, eventually increasing it to 62% in 2005. This stake has been under scrutiny, with activist investor Starboard Value urging News Corp to separate its property holdings from its broader media business to unlock value.

REA has previously dipped its toes into the UK market, acquiring Propertyfinder in 2005 before selling it to Zoopla four years later. The company also has operations in India and holds a 20% stake in Move Inc., a US online listings firm. Despite some exits from international markets, including the sale of its European online listings business in 2016 and its minority stake in PropertyGuru last month, REA’s global footprint remains significant.

Of most interest to the UK’s mortgage intermediaries, REA Group’s acquisition of Mortgage Choice in 2021 marked its significant entry into the mortgage industry. Mortgage Choice, a well-established Australian mortgage broking firm, was integrated with REA’s Smartline broker franchise, bolstering REA’s position in the financial services sector. This acquisition expanded Mortgage Choice’s network to over 940 brokers and 720 franchises across Australia, significantly increasing its influence in the mortgage market.

Mortgage Choice now offers a comprehensive range of financial services, including access to over 40 lenders, further strengthening REA’s portfolio and providing a robust platform for its potential expansion into the UK through the Rightmove acquisition. As the September deadline approaches, the industry will be closely watching REA Group’s next steps, with the potential acquisition of Rightmove poised to reshape the real estate and mortgage markets across both Australia and the UK.