They anticipate the rate-cutting cycle will resume next year

The Bank of England (BoE) decided to keep the base interest rate unchanged at 4.75% on Thursday — a decision widely anticipated and deemed prudent by industry experts.

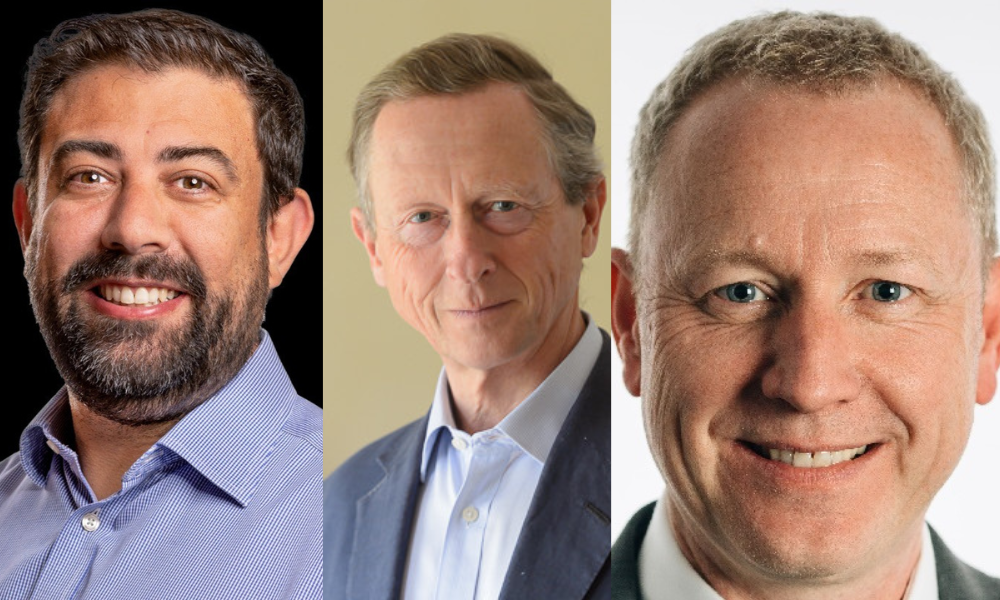

Adam Ruddle (pictured left), chief investment officer at insurance mutual LV=, said the central bank’s move was “widely expected” given ongoing wage and services inflation.

“We believe this is a pause in the rate-cutting cycle, which will resume next year,” he said. “Despite services inflation currently standing at 5% and private sector wage growth at 5.4%, the bank rate of 4.75% remains restrictive, and we expect rates to be cut by 1% in 2025.

“The bank will have to finely balance maintaining restrictive rates to battle stubborn inflation with cutting interest rates to stimulate the economy, which continues to suffer from weakening levels of employment and an increase in job vacancies.”

The Monetary Policy Committee voted by a majority of 6-3 to maintain #BankRate at 4.75%. Find out more: https://t.co/FWuXvEhN0R pic.twitter.com/9724Z6Edhd

— Bank of England (@bankofengland) December 19, 2024

Nick Leeming (pictured centre), chairman of property sales and letting firm Jackson-Stops, echoed Ruddle’s sentiments, saying the BoE’s rate decision reflects the complexities of the current economic climate, particularly the tension between wage growth and persistent inflation.

“This cautious approach is understandable as the bank seeks more clarity and fiscal headroom before considering a reduction in rates,” Leeming said. “Rates rise much quicker than they fall, but the Bank of England must avoid cutting too soon and undermining the progress being made on inflation.”

Leeming also pointed to broader economic challenges, including higher costs for businesses following the Autumn Budget, but welcomed the stability provided by holding rates steady.

“For the property sector, mortgage customers will continue to carefully evaluate their financial options and long-term plans,” he added. “Stability in government and economic growth is essential to bolster buyer confidence, which in turn can drive increased sales and completions.”

Looking ahead, Leeming said a stable economic footing would be key for the BoE to gradually lower rates, ultimately supporting a healthier property market for buyers and sellers alike.

Rob Clifford (pictured right), chief executive of mortgage and protection network Stonebridge, expressed disappointment at the lack of a rate cut but acknowledged the rationale behind the decision.

“The Bank of England’s Monetary Policy Committee (MPC) has played Scrooge this Christmas, refusing to deliver the gift of a rate cut for borrowers,” he said. “However, that shouldn’t come as a surprise. While inflation has eased significantly from its peak, its persistent stickiness made a December cut highly unlikely.

“That said, the reasons are understandable. Business confidence is wavering and the economy contracted in October, which clearly impacted on this decision today. Despite this, we still expect the MPC to act decisively in February, delivering a quarter of a percent cut to kick-start the economy.”

Clifford expects a quarter-point rate cut in the next MPC meeting, followed by at least two more reductions in 2025, which he predicts will bring the benchmark rate down to between 3.5% and 4%. Such cuts, he said, would result in more competitive mortgage pricing and lower monthly repayments, delivering relief to households.

He emphasised the importance of brokers in helping borrowers navigate the implications of the BoE’s decisions.

“For everyone else grappling with what this means for their own unique personal circumstances, MPC decisions and what they actually mean for mortgage rates can be baffling,” Clifford said. “The value in providing timely reminders to customers that they have a subject matter expert on-hand cannot be overstated.”

Any thoughts on this story? Share them with us by leaving a comment in the discussion box at the bottom of the page.