With a significant amount of brokers self-employed there had been concerns that they could fall outside the government safety net.

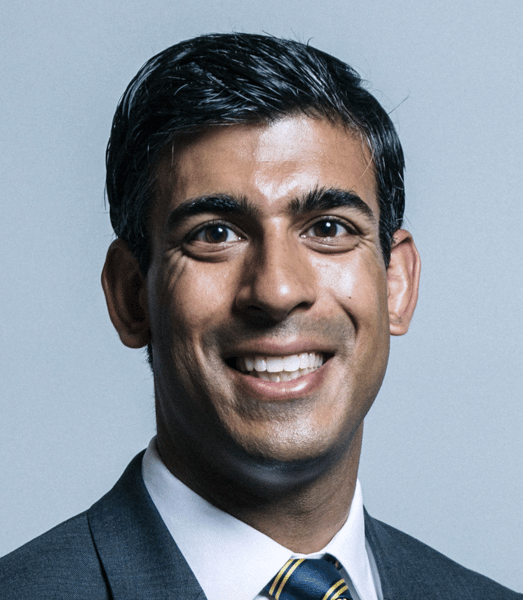

Chancellor Rishi Sunak has laid out the details of a direct cash grant for the self employed of 80% of their profits, up to £2,500 per month.

Under the Chancellor's new scheme ,illions of self-employed individuals will receive direct cash grants.

In the latest step to protect individuals and businesses, Rishi Sunak has set out plans that will see the self-employed receive up to £2,500 per month in grants for at least three- months.

The Self-Employed Income Support Scheme will see those eligible receiving a cash grant worth 80% of their average monthly trading profit over the last three years.

This covers 95% of people who receive the majority of their income from self-employment.

This brings parity with the Coronavirus Job Retention Scheme, announced by the Chancellor last week, where the government committed to pay up to £2,500 each month in wages of employed workers who are furloughed during the outbreak.

Chancellor Rishi Sunak said: "Self-employed people are a crucial part of the UK’s workforce who’ve understandably been looking for reassurance and support during this national emergency.

"The package for the self-employed I’ve outlined today is one of the most generous in the world that has been announced so far. It targets support to those who need help most, offering the self-employed the same level of support as those in work.

"Together with support packages for businesses and for workers, I am confident we now have the measures in place to ensure we can get through this emergency together."

The scheme will be open to those with a trading profit of less than £50,000 in 2018-19 or an average trading profit of less than £50,000 from 2016-17, 2017-18 and 2018-19.

To qualify, more than half of their income in these periods must come from self-employment.

To minimise fraud, only those who are already in self-employment and meet the above conditions will be eligible to apply. HMRC will identify eligible taxpayers and contact them directly with guidance on how to apply.