Under the scheme, employers can claim a grant covering 80% of the wages for a furloughed employee, subject to a cap of £2,500 a month.

The Coronavirus Job Retention Scheme website has gone live to allow businesses to claim for the salaries of furloughed workers.

Under the scheme, employers can claim a grant covering 80% of the wages for a furloughed employee, subject to a cap of £2,500 a month.

In a move that could save businesses an extra £300 a month for each employee under the scheme, the government will now cover the employer national insurance and minimum auto-enrolment pension scheme contributions employers pay on the wages they must pay their furloughed staff – on top of the wages covered under the scheme.

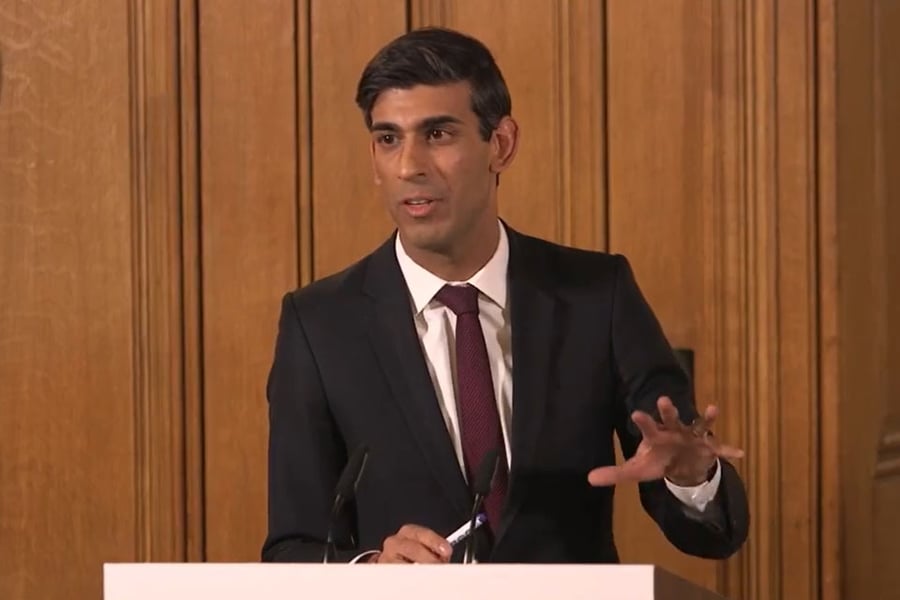

Chancellor of the Exchequer Rishi Sunak (pictured) said: "Since the start of the coronavirus outbreak, I’ve made it clear that hard-working employers and employees should not have to suffer hardship unnecessarily.

"Our Coronavirus Job Retention Scheme supports workers and businesses up and down the UK – and today we’re strengthening it because we will do whatever it takes to support jobs."

New guidance on the Coronavirus Job Retention Scheme published by the government also confirmed that those made redundant after 28 February can be reemployed and placed on furlough.

For those looking to claim they will need:

- to be registered forPAYE online

- your UK bank account number and sort code

- your employer PAYE scheme reference number

- the number of employees being furloughed

- each employee’s National Insurance number

- each employee’s payroll or employee number

- the start date and end date of the claim

- the full amount you’re claiming for including employer National Insurance contributions and employer minimum pension contributions

- your phone number

You also need to provide either:

- your Corporation Tax unique taxpayer reference

- your Self Assessment unique taxpayer reference

- your company registration number

The site can be visited here and payments are expected to take six days.