Lloyds, Santander, Barclays have all suffered – was it the regulator's fault?

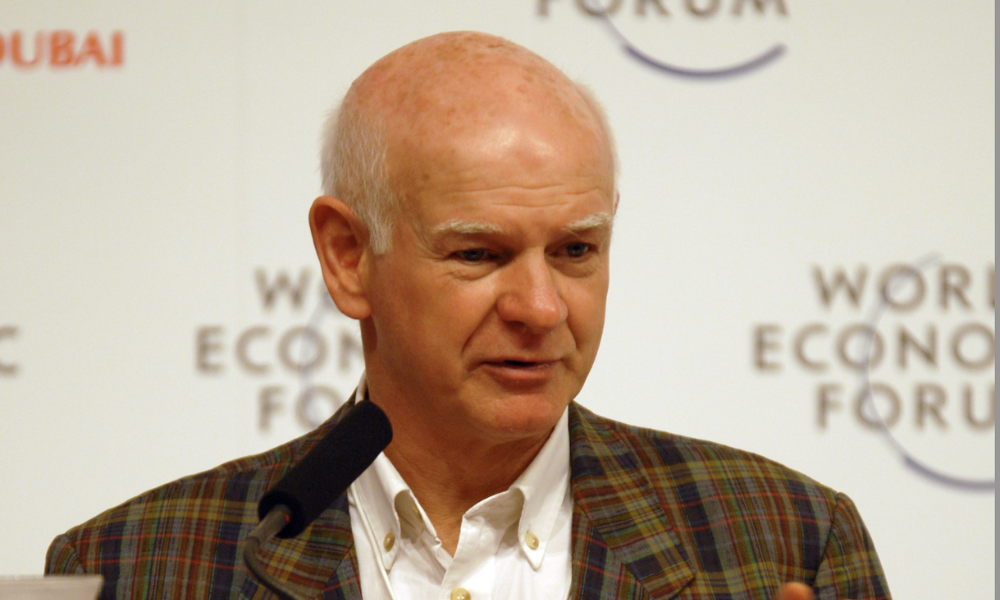

Earlier this year, former regulator and NatWest chief Sir Howard Davies (pictured) made headlines for saying that it wasn’t hard to buy a house. (Critics did say that perhaps it isn’t, if you have a £750,000 salary).

In the last few days, however, he has spoken up to criticise the Financial Conduct Authority (FCA), saying that the ongoing turmoil on lending in the car industry is to blame for the regulator’s unclear regulatory guidance.

Davies, who previously led the FCA’s predecessor, the Financial Services Authority, expressed disappointment over the lack of regulatory precision – which in turn, he says, has led to significant investor anxiety.

Read more: Lending case contagion spreads as another bank stops asset finance

The crisis intensified as numerous car finance lenders, responding to a recent Court of Appeal decision, suspended lending on both new and used cars. The judgment has heightened disclosure requirements for commissions, compelling credit providers to reassess their policies, and some to even pause lending.

When news broke, shares in mortgage lenders like Lloyds Banking Group and finance lenders like Close Brothers saw values plummet, reflecting investor concerns about potential compensation liabilities for car buyers. Santander UK even postponed its financial results at the last minute as the ramifications of the case sank in.

Read more: Major lenders at risk, according to Fitch, as trouble looms

During a testimony to a Lords committee on financial regulation, Davies remarked, “I’m disappointed there has not been enough regulatory clarity on the rulebook that has meant the court has been able to step in with its own interpretation,” he elaborated, “My general experience is that if the regulator is very clear about the expectations on firms, then the courts are usually very reluctant to substitute their judgment for that of the regulator within a statutory context.” The decision by the Court of Appeal to intervene, he noted, signals a lack of clear guidance from the FCA.

With credit providers appealing the decision to the Supreme Court, uncertainty within the motor finance sector - and maybe other commission-based lending - could persist for several months, analysts warn.

Davies observed that the consumer protection framework, including the recently introduced consumer duty on firms, had led to "extreme nervousness" among foreign investors, who find it challenging to interpret the new requirements.

Read more: New Court of Appeal decision could expose multiple lenders to billions in losses

Adding to the concerns, Davies highlighted the role of the Financial Ombudsman Service, whose rulings often diverge from FCA guidelines, further unsettling investors. “Sometimes [the Ombudsman’s judgments] go well beyond what the FCA recommended,” he said, which can obviously add to concern at lenders.

An FCA spokesperson responded, clarifying that the court's decision was based on the established legal principle of fiduciary duty, rather than any specific FCA regulations.

What actually happened in the commission case?

The case focused on appeals made by several customers against two finance companies—FirstRand Ltd, which operates under the MotoNovo Finance brand, and Close Brothers Group Plc, a lender specialising in property and motor finance. The main issue revolved around whether brokers properly informed customers about the commissions they were receiving from lenders for setting up finance agreements.

These customers had secured car finance through brokers who acted both as sellers of the vehicles and as intermediaries arranging hire-purchase or loan agreements. However, borrowers were unaware that brokers were receiving commissions from lenders based on the terms of the loans, which created a conflict of interest. In some cases, brokers’ commissions were calculated through a “difference in charge” (DIC) model, which incentivised them to arrange higher interest rates to increase their earnings.

Read more: Santander in shock move to delay results, shares plummet

According to the court’s findings, the borrowers—many of whom were students, workers, and first-time car buyers—placed their trust in brokers to act in their best interests. Instead, brokers prioritised their own earnings by pushing finance deals that came with hidden commissions, which could make up a large portion of the total credit cost. In one example, a customer ended up with an inflated loan rate, unaware that almost 70% of the interest paid went to the broker.

The court also pointed out that small-print disclosures by lenders about potential commissions were insufficient to make customers aware of these hidden fees. It determined that both FirstRand and Close Brothers had failed in their duty to ensure transparency in the agreements, setting a concerning precedent for the industry on commission payments.

“This is about trust and fairness,” stated the judges. “The consumers were very poorly served by the brokers and the lenders alike.”

In response to the ruling, Close Brothers announced it would temporarily suspend issuing new motor finance deals in the UK - Metro Bank quickly followed suit. FirstRand, on the other hand, maintained that its disclosures met legal requirements, even though the court had ruled otherwise.

The decision has sent shockwaves across the banking industry, with financial experts warning that banks, including Lloyds, may face billions in claims. Citigroup analysts suggest that compensation could exceed their initial £9 billion estimate if similar claims continue to arise.

The Financial Conduct Authority (FCA) is expected to launch a broader review into motor finance practices to ensure the industry adheres to clearer, more transparent rules going forward.

Photo: World Economic Forum This file is licensed under the Creative Commons Attribution-Share Alike 2.0 Generic license.