"Housing market finding its feet in an era of higher interest rates"

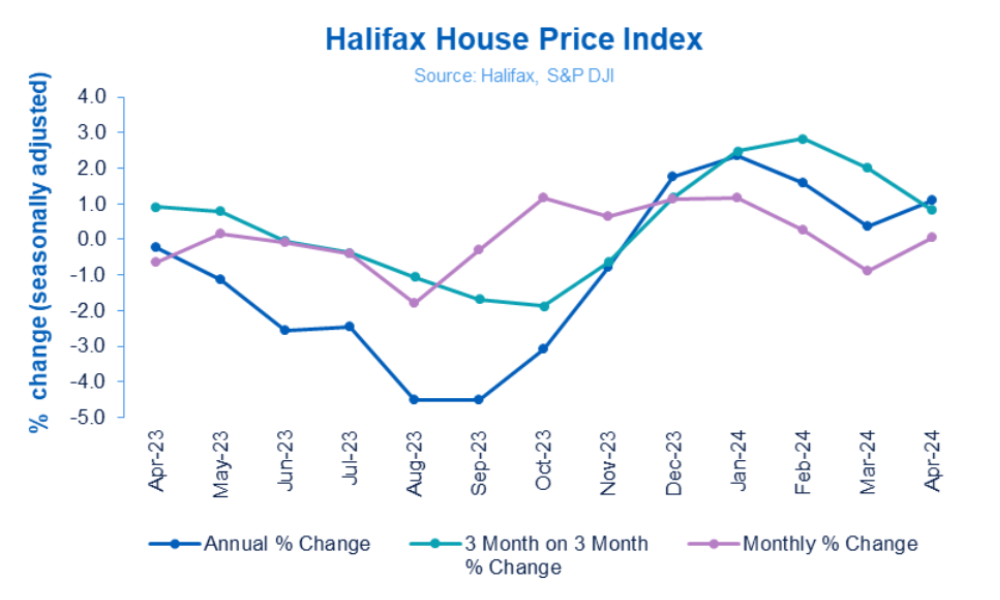

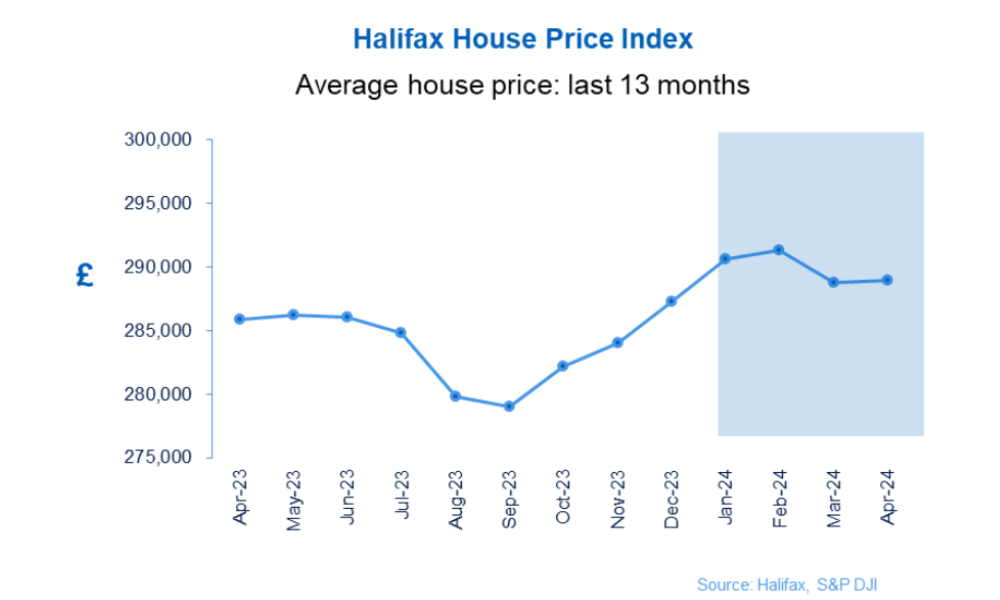

House prices in the UK remained stable in April, with a marginal increase of 0.1%, or less than £200 in cash terms, mortgage lender Halifax has reported.

Yearly house price growth showed a slight improvement, rising to 1.1% from 0.4% in March, influenced by a weaker growth period during the same time last year.

The latest Halifax House Price Index shows that the average price of a property now stands at £288,949, up from £287,244 at the beginning of the year. Despite the frequent fluctuations in monthly price changes, overall, average house prices have shown signs of stabilising in early 2024.

“This reflects a housing market finding its feet in an era of higher interest rates,” said Amanda Bryden (pictured), head of mortgages at Halifax. “While borrowing costs remain more expensive than a few years ago, homebuyers are gaining confidence from a period of relative stability.

“Activity and demand is improving, evidenced by greater numbers of mortgage applications so far this year, while at an industry level mortgage approvals have reached their highest point in 18 months.”

Research from Halifax also suggests that first-time buyers are adjusting their expectations by opting for smaller properties to manage higher borrowing costs – a trend evident in the early months of this year, with the prices of flats increasing significantly, narrowing the historical price gap with larger properties.

“However, we can’t overlook the fact that affordability constraints are still a significant challenge, for both new buyers and those rolling off fixed term deals,” Bryden said. “Mortgage rates have edged up again in recent weeks, primarily as a result of expectations around future Bank of England base rate changes, with markets now pricing in a slower pace of cuts.

“If, as is still expected, downward moves in bank rate come into play later this year, fixed mortgage rates should fall. Combined with the resilience displayed by the housing market over recent months, we now expect property prices to rise modestly over the course of 2024.”

Ed Phillips, chief executive of estate and letting agency group Lomond, agreed that property market conditions have improved so far this year.

“It’s to be expected that the monthly rate of growth remains subdued, although the positive to take is that annually, property values are still climbing and the market has continued to stand firm,” he said.

However, for Gareth Lewis, managing director of property lender MT Finance, the housing market desperately needs some stimulus to give buyers and sellers more confidence to transact.

“The slight uptick in prices compared with March suggests there is a level of confidence in the market but it only goes so far with not enough properties coming to market or buyers able and willing to transact,” he said.

“The housing market is a work in progress. Prices haven’t fallen off a cliff, which is encouraging, but some form of stamp duty stimulus would really boost activity and transaction numbers, which are far more important than prices.”

House price growth varies across the nations and regions

According to the latest Halifax House Price Index, Northern Ireland leads the UK in house price growth, recording a 3.4% annual increase in April, although this marks a slowdown from 4.1% in March. The average property price in Northern Ireland now stands at £192,502.

In Wales, the annual growth in property prices decelerated to 1.1% in April from 1.9% in March, with homes averaging £218,775. Scottish house prices also saw an increase, rising by 1.5% year-on-year to an average of £204,579.

The North West of England reported significant growth, with house prices climbing by 3.3% over the year to an average of £231,599, while the South of England continues to experience a decline in property prices, maintaining the existing North-South divide.

The most substantial price drop was in Eastern England, where house prices fell by 1.1%, reducing the average property value to £329,723 — a yearly decrease of £3,541.

London remains the most expensive region in the UK to purchase a property, with an average price of £539,336. However, price movements in the capital have been minimal, with only a 0.1% increase over the past year.

Any thoughts on the latest Halifax House Price Index? Share them with us by leaving a comment in the discussion box at the bottom of the page.