Research shows more homeowners extend mortgages beyond pension age

Staff at the Bank of England have raised concerns about the growing trend of taking out mortgages later in life, warning that it could lead to a retirement debt crisis.

James Waddell and Meghna Shrestha, who work in the central bank’s macro-financial risks division, cautioned that the increasing number of homeowners borrowing past the state pension age poses risks that could escalate over time, potentially affecting the financial system.

“Longer-term mortgages allow borrowers to manage the affordability pressures associated with higher house prices to incomes, cost-of-living, and higher mortgage rates,” they wrote in the Bank Underground blog. “This, however, comes with some associated risks which could build over time if the trend continues.”

Data from the Financial Conduct Authority (FCA) reveals that in the first quarter of the year, 42% of new mortgage lending extended beyond the state pension age of 67. This marks a sharp rise from pre-pandemic levels, where around 25% of mortgages extended beyond this age threshold. The rise reflects the challenges many face due to skyrocketing property prices and stagnant wage growth, prompting borrowers to take out longer-term mortgages.

“Longer mortgage terms could affect financial stability by pushing debt repayments beyond retirement, where incomes are less certain,” Waddell and Shrestha pointed out. “They allow borrowers to take on a higher level of debt relative to income, and could cause greater debt persistence.

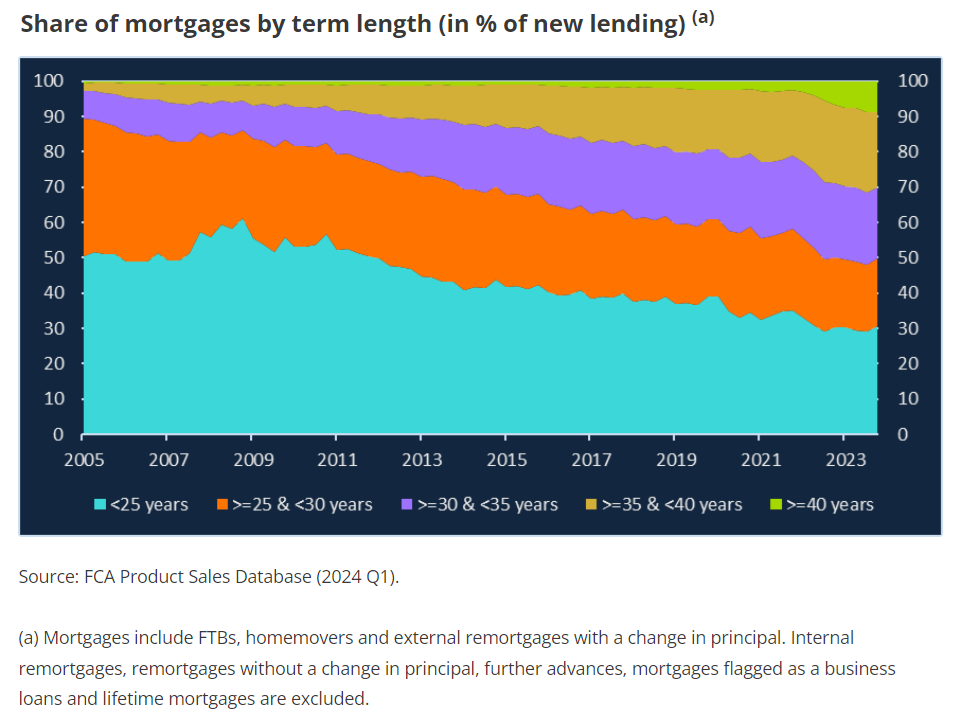

Younger borrowers, particularly first-time buyers, are increasingly opting for ultra-long mortgage terms, with many choosing loans that last 30 years or more. The share of borrowers with such long-term mortgages has tripled since 2005. Currently, about 30% of new borrowers are taking out mortgages with terms of 35 years or longer, and around 10% have loans stretching 40 years or more, according to the bank’s research. This is a significant shift from the more typical 25-year mortgage terms seen in previous decades.

In addition to higher risks for individuals, the analysts highlighted that borrowers would have fewer options if they encountered financial difficulties. For instance, they would be unable to extend their mortgage term further to reduce monthly payments, leaving them vulnerable to default. The longer repayment periods also mean borrowers will pay significantly more interest over the life of the loan.

Despite these warnings, the writers suggested that strict lending criteria may help mitigate some of the risks to the broader financial system.

“We judge these risks are relatively small and are mitigated by rules from the FCA that guard against the risk that mortgage payments become unaffordable, and by the FPC’s LTI policy that limits risky borrowing in the aggregate.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.