Try, try and try again – but Murdoch acquisition attempt is still hitting a wall

British property website Rightmove has turned down a third acquisition attempt by REA Group, increasing pressure on the suitor, which is backed by Rupert Murdoch, as a deadline at the end of September approaches.

On Monday, REA raised its cash-and-share offer to £7.70 per Rightmove share, marking a rise of more than 9% from its initial bid, and placing the total value of the UK firm at £6.1 billion ($11.9 billion). For the first time, Rightmove didn’t immediately reject the offer, instead stating it would “carefully consider” the new proposal.

However, in an announcement made on Wednesday via the London Stock Exchange, Rightmove said the updated offer had dropped slightly to £7.59 per share based on REA’s September 24 stock price. Rightmove said this was still insufficient to draw them into negotiations.

REA Group Ltd. is reportedly exploring the possibility of securing a multibillion-dollar bridge loan to fund its potential acquisition of the UK property portal, according to Bloomberg. The Australian real estate company, which is part of Rupert Murdoch’s business empire and owns mortgage broker Mortgage Choice, has been in talks with financial institutions such as Bank of America Corp. and Deutsche Bank AG to assist with arranging the loan, Bloomberg sources said.

These discussions suggest that banks might be willing to provide a loan package totalling $5 billion or more if necessary, although insiders say REA is expected to borrow less than this amount. The exact size of the loan has not yet been finalised. Additional banks may also join in providing the financing, one of the sources mentioned, while stressing that ongoing deliberations could still result in changes to the loan structure.

This potential financial move shows serious nature of REA’s pursuit of Rightmove, following three prior takeover bids that have been rejected. As the deadline for a formal offer is just days away, REA’s financing preparations highlight its determination to bring the deal to fruition, even as Rightmove continues to resist engagement.

Rightmove, the largest of the three online property platforms in the UK, asserted that it had reviewed the revised offer in collaboration with its financial advisers. "The board considered the increased proposal, together with its financial advisers, and concluded that the increased proposal continues to be unattractive and materially undervalues the company and its future prospects," read Rightmove's statement. "Accordingly, the board unanimously rejected the increased proposal on 24 September.”

In response, REA Group, which is listed on the ASX, expressed disappointment with Rightmove’s stance. The company said, “REA is disappointed by the latest rejection from the board of directors of Rightmove and is frustrated that, save for the rejection of REA’s three previously disclosed proposals, REA has still had no substantive engagement with Rightmove.”

Under UK takeover regulations, once a bid becomes public, the interested party has 28 days to formalise an offer. This leaves REA with a deadline of October 1 (AEST). While both parties could agree to extend this timeframe, if Rightmove declines, REA would be blocked from submitting further bids for six months.

REA is urging Rightmove shareholders to press the board to enter into constructive talks. “REA called on Rightmove shareholders ‘to encourage the board of directors of Rightmove to engage in constructive discussions with REA to work towards a recommended transaction, ahead of the upcoming deadline’,” the company said.

This shows that REA might now attempt to engage directly with key shareholders, bypassing Rightmove’s board.

Some Rightmove shareholders have indicated that they would prefer to see the company negotiate but warned that REA, which is 61% owned by Rupert and Lachlan Murdoch’s News Corporation, would likely need to increase its offer. They also pointed out that the share-based element of the proposal could reduce the Murdochs’ control if it leads to a diluted stake.

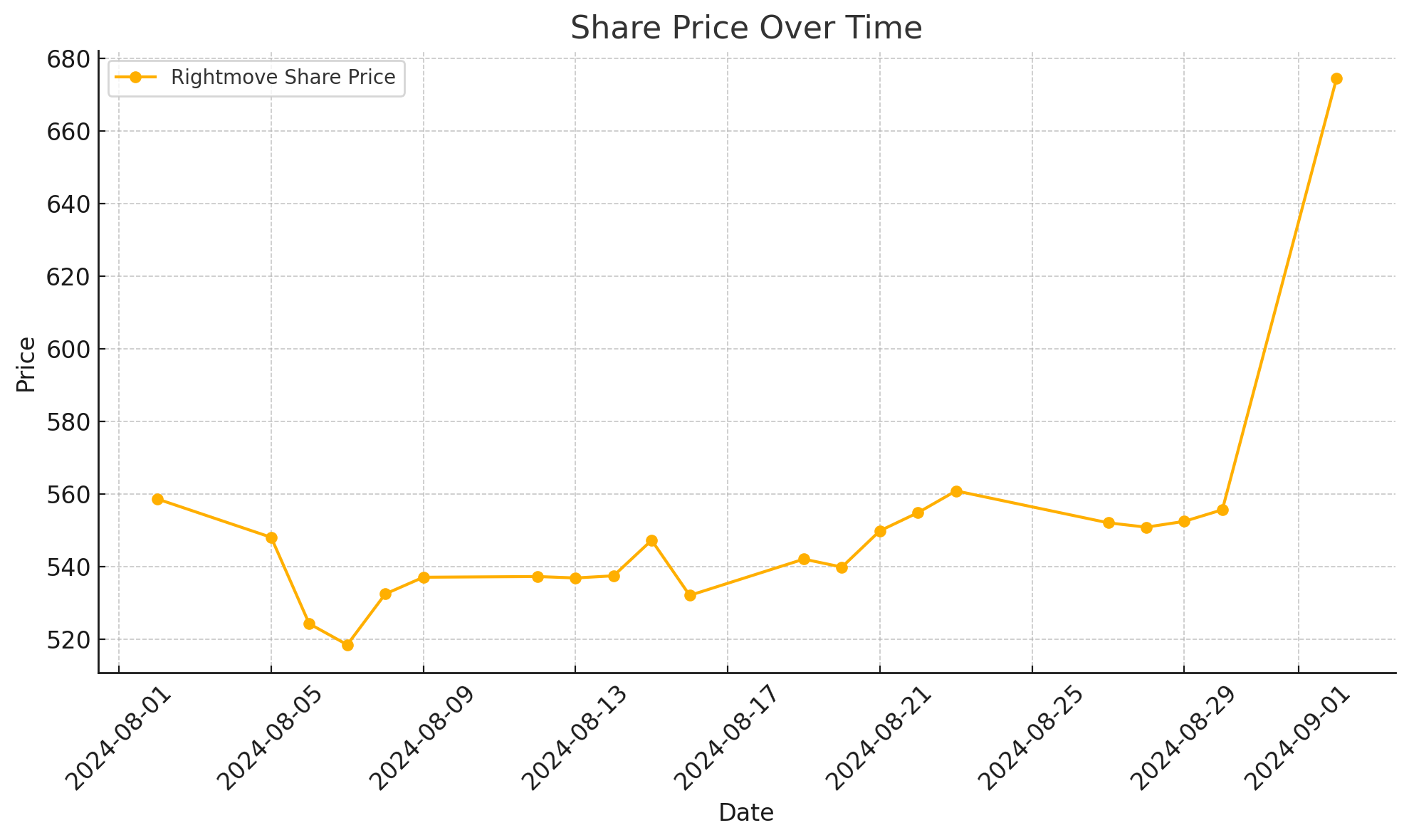

Despite rejecting the bid as "wholly opportunistic," Rightmove shareholders seem open to negotiations if the price is right. REA's CEO Owen Wilson has defended the offer, stating it provides Rightmove with “an increasing opportunity in core digital property and adjacencies where we have much expertise,” especially given Rightmove's stagnating share price before REA's interest became public.

Rightmove is being advised by UBS and Morgan Stanley, while REA is working with Deutsche Bank as the bid deadline approaches.