The Competition and Markets Authority’s retail banking market investigation has been praised as a "giant step in the right direction" by NACFB cheif executive Adam Tyler, but he has warned that it must be implemented swiftly.

The report concluded that older and larger banks do not have to compete hard enough for customers’ business, and smaller and newer banks find it difficult to grow.

This means that both consumers and businesses are paying more than they should and are not benefiting from new services.

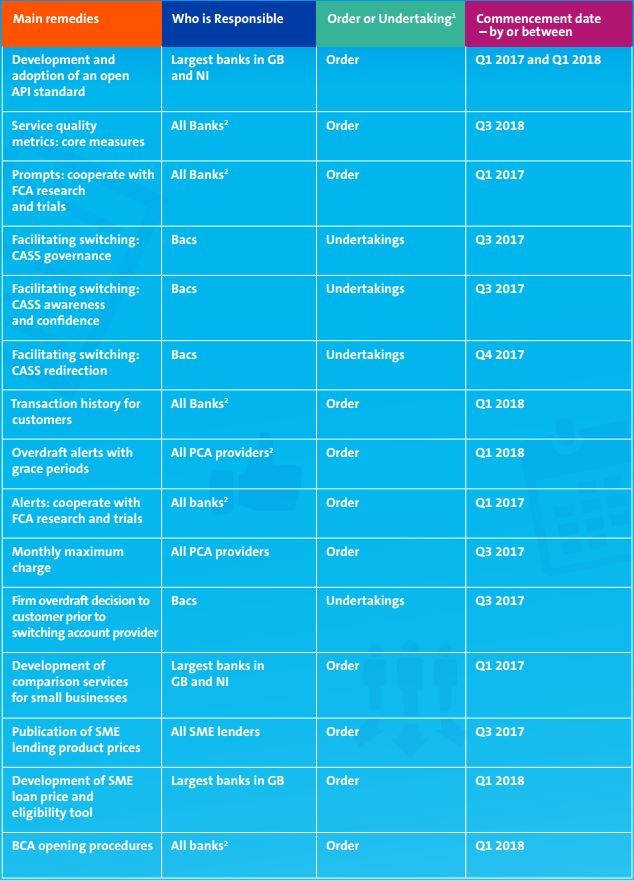

To tackle these problems, the CMA is implementing a wide-reaching package of reforms.

Tyler said: "This report is a giant step in the right direction, but these measures need to be implemented swiftly.

"If the small business community is going to take advantage of the opportunities presented post-Brexit, the government must drum home the message that banks aren’t the only route to funding.

"With the diversity of funding options now available to SMEs, it's staggering that most small business owners turn to their existing bank for finance.

"There needs to be greater awareness and transparency of the types of funding available to small businesses, beyond the high street."

And Tyler added that more could be done to highlight the different funding options available to businesses at a national level.

"Business owners shouldn't see their existing business account provider as their default lender and their only source of finance.

"At a time when the banks are still ultra cautious about who they lend to, there are more lenders than there's ever been in the commercial finance sector who are happy to provide finance to small businesses.

"It would be a positive message from the government if they highlighted the alternative funding options that are available.

"And I hope that Margot James, in her new position as minister for small business, will support the measures recommended by the CMA, and ensure they are acted upon."

Key points

The key measures, which will benefit personal and small business customers, include:

- Requiring banks to implement Open Banking by early 2018, to accelerate technological change in the UK retail banking sector. Open Banking will enable personal customers and small businesses to share their data securely with other banks and with third parties, enabling them to manage their accounts with multiple providers through a single digital ‘app’, to take more control of their funds (for example to avoid overdraft charges and manage cashflow) and to compare products on the basis of their own requirements.

- Requiring banks to publish trustworthy and objective information on quality of service on their websites and in branches, so that customers can see how their own bank shapes up. Whether a personal customer or small business is willing to recommend their bank to friends, family and colleagues will be a core measure but we will also be requiring banks to publish and make available through Open Banking a range of other quality measures.

- Requiring banks to send out suitable periodic and event-based ‘prompts’ such as on the closure of a local branch or an increase in charges, to remind their customers to review whether they are getting the best value and switch banks if not. Unlike many other financial products such as home insurance, current accounts do not have annual renewal dates to act as natural reminders and other possible triggers like business growth are not prompting customers to review what they are getting from their bank.

What next?