Brokers react to the rate increase

Nationwide Building Society has increased rates across selected fixed term and tracker new business and switcher products, effective from last Friday, March 3.

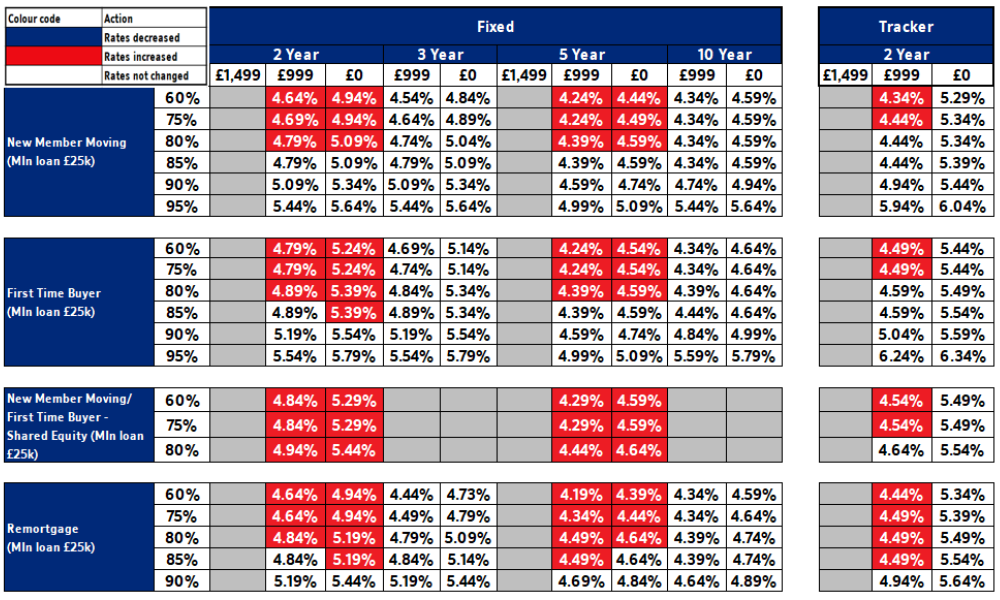

Below is a table of the lender’s new business products, with the increased rates highlighted in red.

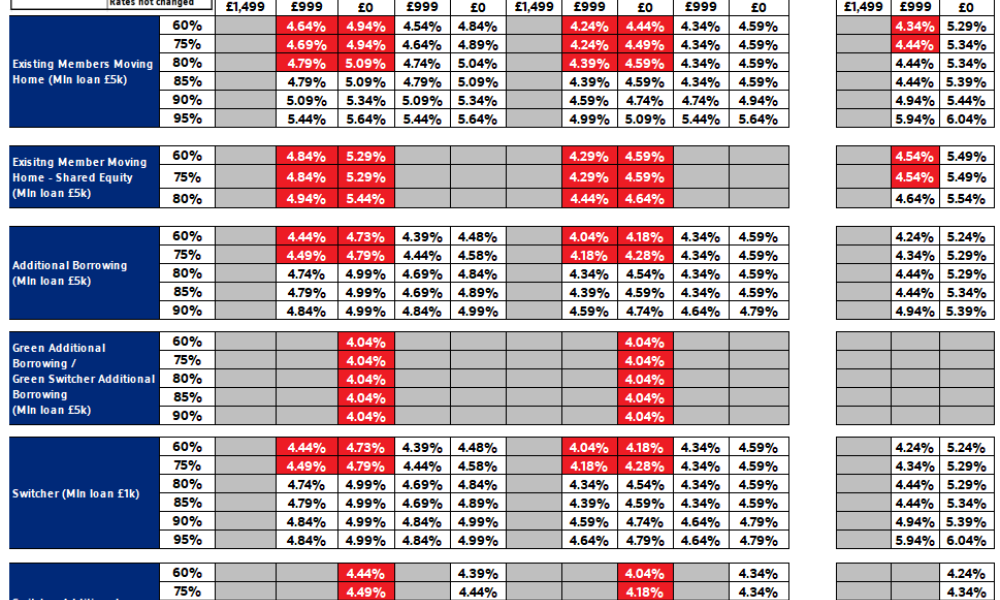

The following shows Nationwide’s products for existing customers, with those that had its rates raised marked in red.

Brokers share views on the rate hike

Anil Mistry, director and mortgage broker at RNR Mortgage Solutions, said the recent increase in swap rates is the driving force behind the current rate hikes.

“However, this development is not expected to significantly affect new business, given that the prevailing rates remain more favourable than those that followed the ‘Kamikwasi budget’,” he added. “It is worth noting that anyone seeking a mortgage will need to accept the applicable rate, so that is another reason for minimal impact to new business.

“As the budget approaches on March 15, the trajectory of swap rates and the possible impact of any additional increases to base rates remains to be seen. It is conceivable that this could herald a period of stability, with only marginal increases anticipated before further reductions come into effect.

Graham Cox, director at SelfEmployedMortgageHub.com, agreed that the catalyst for the increased mortgage rates had been the higher borrowing costs for lenders in the swaps market.

“It’s likely we’ll see more major lenders increase their rates slightly over the coming days,” Cox stated. “But they could easily go back down again if any good news on the economy comes along.”

Lewis Shaw, founder of Shaw Financial Services, said that the mortgage rate hike “has been written in the stars for weeks.”

“Those of us that predicted it have been ignored, with talk of rate price wars dominating the narrative,” he remarked. “This is all driven by increases in gilt yields which push SONIA (Sterling Overnight Index Average) swaps higher, leading to rising fixed rate pricing.

“However, most of the issue is from the US, whose inflation looks like it will stay higher for longer. That means the US Federal Reserve may raise their rates more than expected. The implication is that the Bank of England may have to further hike the base rate to prevent sterling from devaluing and worsening our inflation. So, markets are starting to price in these eventualities.

“Sadly, this is lousy news for the 1.4 million people due to renew their mortgages this year. This isn’t the first lender, and it certainly won’t be the last.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter.