Lender makes announcement after NatWest ups the ante with 'best in market' interest rate offer – more cuts to come "thick and fast"

The war for market share seems to be heating up after the Bank of England’s rate cut.

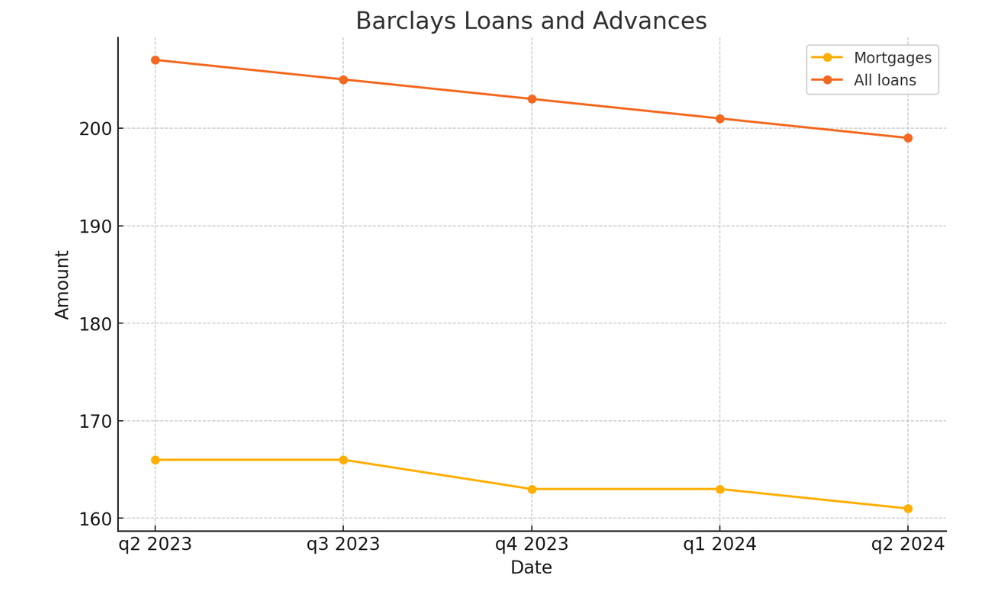

Just last week Barclays figures showed that the country’s fifth biggest lender had lost mortgage market share, with HSBC in sixth grabbing more home loan business in a sign of what could be an escalating battle for market position.

And as other lenders realise that they need to move quickly, Nationwide Building Society’s mortgage lender, The Mortgage Works (TMW), has announced another round of interest rate reductions across its product range, offering a significant boost for prospective property buyers.

The news follows yesterday’s announcement by NatWest that it was offering a mortgage rate that beat Nationwide’s headline grabbing fixed mortgage rate offer.

Starting today, TMW is cutting rates by up to 0.45 percentage points on various mortgage products.

Here are the new rates:

- Two-year fixed rate (purchase and remortgage) buy-to-let at 3.49% with a 3% fee, available up to 65% loan-to-value (LTV), reduced by 0.05 percentage points.

- Five-year fixed rate (purchase and remortgage) limited company buy-to-let at 4.59% with a 5% fee, available up to 70% LTV, reduced by 0.25 percentage points.

- Five-year fixed rate (purchase and remortgage) limited company buy-to-let at 4.99% with a 3% fee, available up to 75% LTV, reduced by 0.30 percentage points.

- Two-year fixed rate (purchase and remortgage) limited company houses in multiple occupation (HMO) at 4.94% with a 3% fee, available up to 75% LTV, reduced by 0.45 percentage points.

Joe Avarne, senior manager for buy-to-let mortgages at TMW, stated: “We are pleased to announce more rate cuts as it further demonstrates our ongoing commitment to brokers and landlords.” Avarne, who joined Nationwide from the UK’s biggest mortgage lender Lloyds Bank continued: “These latest reductions make us most competitive buy-to-let mortgage lenders in the sector with rates now starting from 3.49%.”

More rate cuts coming?

Following the Bank of England’s decision to reduce the base interest rate from 5.25% to 5%, lenders are competing aggressively to offer the most attractive rates. The move is anticipated to help revitalise the market for intermediaries, as those looking to enter the property market start to take action.

The reduction in the consumer price index (CPI) to the Bank’s target of 2% has also led analysts to predict further rate cuts from the Monetary Policy Committee (MPC) later this year. And pressure for more interest rate cuts is growing as global stock markets start to jitter.

Janet Mui, head of market analysis at investment management firm RBC Brewin commenting on global share prices told Sky News yesterday that the BoE “will certainly feel that pressure to cut interest rates further. If you have a floating rate mortgage, you could potentially see more relief down the line. And if you’re going to remortgage or have a new mortgage, I think you’re very likely to be getting a much lower rate.”

Despite the base rate cut benefiting those with base rate tracker mortgages or payments linked to their lender’s standard variable rate (SVR), nearly seven million of the UK’s 8.4 million residential mortgages are on fixed rates, meaning most homeowners will not see an immediate change.

David Hollingworth of L&C Mortgages told GB news: “I’d fully expect further improvements and more lenders looking to break through to sub-4% five-year rates. It continues the edging down in rates and there’s likely to be more looking to join in. The cut to base rate last week came sooner than many had expected and that should strengthen anticipation that another cut comes before the end of the year. The Bank of England has been keen to downplay that cuts will come thick and fast, but this should help to reduce costs for lenders.”

As the battle for market share heats up, the big lenders are also slashing costs – with Lloyds, Barclays, HSBC and others restricting discretionary spend and targeting headcount. These are certainly interesting times for mortgage lenders in Britain at the moment.