High rates had weakened demand, but homeowners are returning to the market

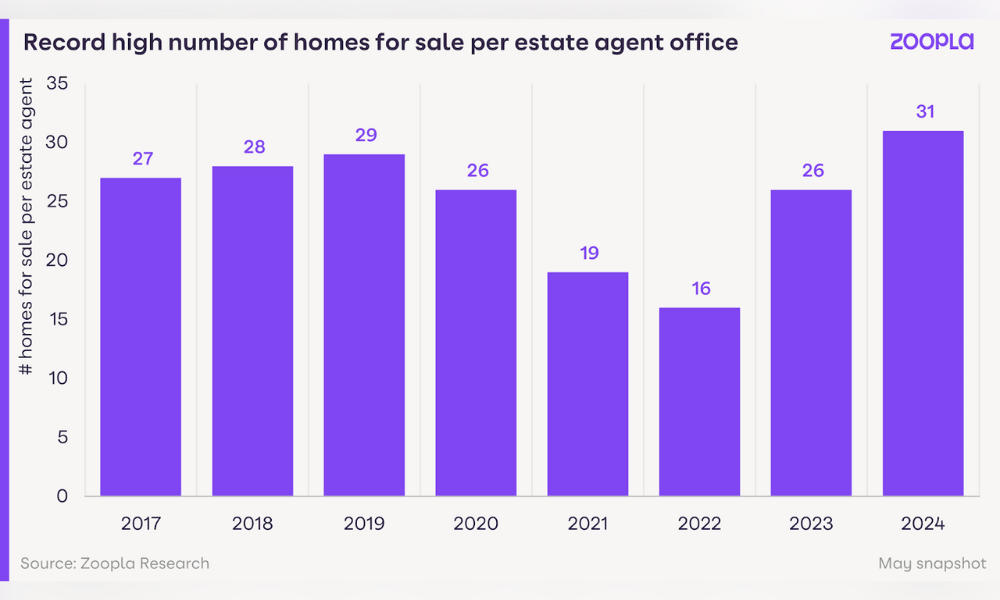

Greater choice for buyers is expected to stabilise house prices for the remainder of 2024, with the UK experiencing its highest supply of homes for sale in eight years, according to Zoopla.

The property website reported that while sales are growing, they are not keeping pace with the increase in homes for sale. The current supply, which has reached an eight-year high compared to the same period last year, is driven by a rise in the number of three- and four-bedroom homes as existing owners regain confidence to move.

The average estate agent office now has 31 properties for sale, up from 26 properties last year. Although most homes on the market are newly listed, 31% were initially marketed in 2023.

Rising mortgage rates had weakened demand, but homeowners are returning to the market. This increase in supply is expected to keep house price growth in check for the rest of 2024. Sales agreed are up 13% year on year, yet the growth in new listings outpaces the number of sales being agreed in most regions.

The latest Zoopla House Price Index also revealed regional trends, with the South West posting significant growth and having a third more homes for sale than last year. Tax and planning changes regarding holiday lets and the potential for double council tax on second homes are likely contributing to this rise, given the region’s high level of second home ownership.

The latest Zoopla House Price Index also revealed regional trends, with the South West posting significant growth and having a third more homes for sale than last year. Tax and planning changes regarding holiday lets and the potential for double council tax on second homes are likely contributing to this rise, given the region’s high level of second home ownership.

Zoopla said the upcoming general election in early July is expected to have a modest impact on the housing market. With 392,000 homes in the sales pipeline, an increase in fall-throughs is unlikely due to minimal policy differences between the main parties.

While some buyers may delay decisions, strong underlying motivations to move will keep many in the market. The pace of sales is expected to slow, potentially dropping the total number of sales for 2024 below 1.1 million.

The north-south divide in house price growth persists, with modest declines in Southern England. Cities like Belfast (+3.6%), Burnley (+2.5%), and Bolton (+2.4%) show the strongest growth, while Ipswich (-3%), Hastings (-2.7%), and Norwich (-2.4%) experience the highest falls.

Affordability pressures due to higher mortgage rates are driving this variation, with price declines in coastal cities and those that saw significant increases during the pandemic’s ‘race for space’. Zoopla expects this trend to continue as incomes and house prices realign.

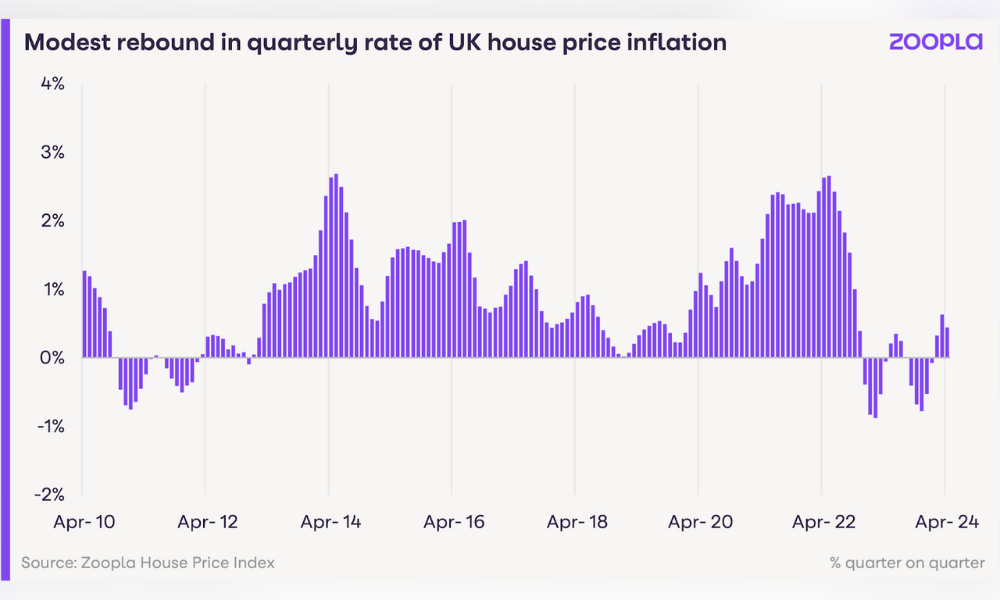

“The growth in the supply of homes for sale is evidence of renewed confidence among homeowners, some of whom delayed moving decisions in 2023,” said Richard Donnell (pictured), executive director at Zoopla. “The quarterly rate of house price inflation has picked up in recent months as more sales are agreed and prices firm.

“The growth in the supply of homes for sale is evidence of renewed confidence among homeowners, some of whom delayed moving decisions in 2023,” said Richard Donnell (pictured), executive director at Zoopla. “The quarterly rate of house price inflation has picked up in recent months as more sales are agreed and prices firm.

“The announcement of the election will slow the pace at which new sales are agreed while greater choice for buyers will keep house prices in check over 2024. It’s essential that those serious about moving in 2024 price their homes realistically if they want to achieve a sale.”

Any thoughts on the findings of the latest Zoopla House Price Index? Tell us by leaving a comment in the discussion box at the bottom of the page.