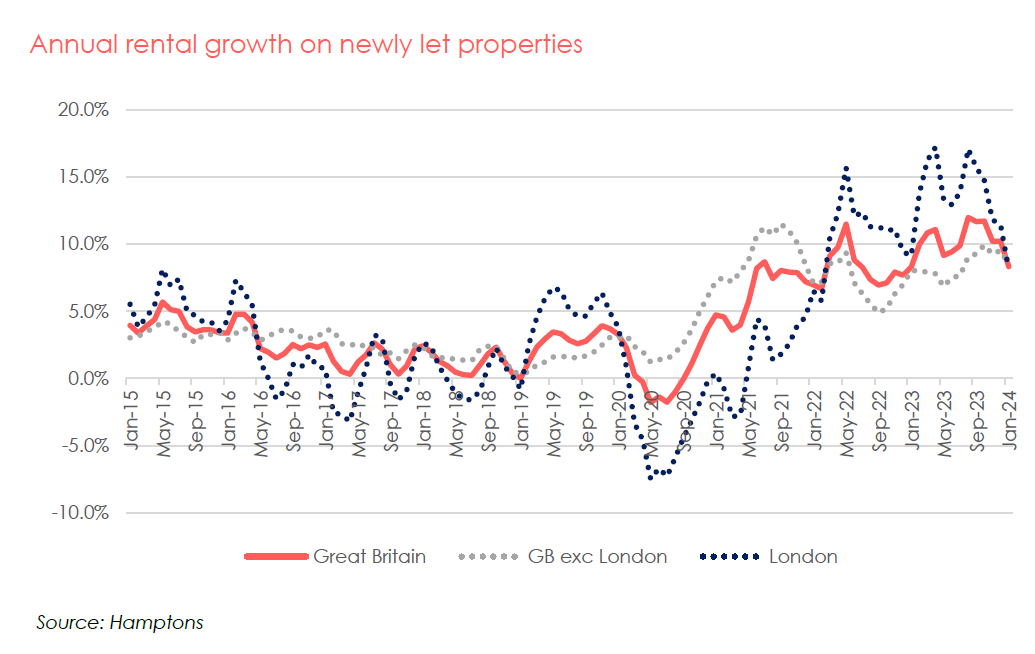

Growth rates drop to a single-digit figure for the first time in six months

Rents across Great Britain continue to increase but the growth rate has notably slowed down, figures from residential estate agent Hamptons have revealed.

Average rents on newly let properties in Great Britain increased by 8.3%, marking the slowest growth rate in 13 months. This signifies a deceleration from the peak growth rate of 12% observed in August 2023, which had slightly decreased to 10.2% by December.

For the first time in six months, January saw rental growth rates drop to a single-digit figure, with only the East of England and the West Midlands experiencing double-digit rental growth rates in January, a reduction from six regions in August.

The deceleration in rental growth across eight of Great Britain’s 11 regions from August 2023 to January 2024, as shown in the latest Hamptons Monthly Lettings Index, was led by a significant slowdown in London, where the annual rental growth rate dropped from 17.1% in August to 8.1% in January – its lowest in two years.

The percentage of landlords who managed to secure higher rents upon re-letting properties also decreased. In January, 59% of landlords achieved a higher rent, a decline from 81% in January 2022 and 79% in January 2023. Landlords in Yorkshire & The Humber were most successful, with 66% securing higher rents.

According to Hamptons, the increase in rents during 2022 and 2023 was predominantly driven by the demand for smaller, more affordable homes, reflecting the impact of the cost-of-living crisis. However, early 2024 data indicates a narrowing gap between rent increases across different property sizes.

Despite the slowdown, the percentage of landlords achieving higher rents remains above pre-pandemic averages, indicating persistent upward pressure on rents. Between 2015 and 2019, an average of 49% of landlords were able to increase rents, often aligning with or falling below inflation rates.

Currently, the rental market has 34% more homes listed than at the same time last year, attributed mainly to longer letting periods rather than an influx of new rental properties. Yet, rental home availability is 43% lower compared to 2019, with no immediate signs of returning to pre-pandemic levels. The market dynamics show first-time buyers significantly outnumbering potential investors, a trend not seen since early 2016.

Aneisha Beveridge (pictured), head of research at Hamptons, commented on the trend, suggesting that the peak in rental growth might have occurred last summer.

“Since then, fewer landlords have been putting up the rent,” she said. “Where they have, in cash terms, monthly increases have tended to be in double rather than triple figures.

“The scale of mortgage rate rises kickstarted two years of record-breaking rental growth. As landlords have rolled off fixed terms, they’ve been partly feeding these higher costs through to tenants in the form of higher rents. But just over two years on from the first Bank of England rate hike, higher rents coupled with higher prices more generally have placed an increasingly tight straitjacket around tenants’ finances, curtailing their ability to pay more.”

Beveridge added that with mortgage rates now declining, the pressure on rents could ease in 2024. However, she noted that challenges such as reduced returns and the costs associated with rental reform may continue to restrict the entry of new landlords into the market.

“This looks set to keep rental growth running ahead of inflation this year,” she said.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.