That is according to Yolande Barnes, professor of real estate at Bartless Real Estate Institute, UCL, who spoke at UK Finance’s annual mortgage conference this week.

Investors in housing shouldn’t worry about dramatic rises in interest rates – because the high rates of the 1970s were a 'one-off'.

That is according to Yolande Barnes, professor of real estate at Bartless Real Estate Institute, UCL, who spoke at UK Finance’s annual mortgage conference this week.

Barnes said: “A lot of future thinking is very much concentrating on the prospect of interest rates rising and the potential for that to start pushing asset prices down.

“I’m want to show why we perhaps don’t need to worry about that quite so much as maybe some people are.

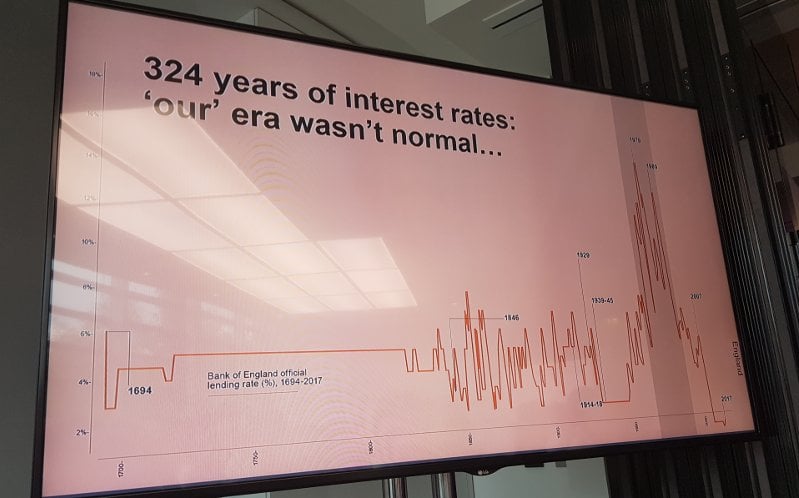

“And in order to do this I like to put things in a historic context. This is the Bank of England base rates going back to 1694 (pictured).

“The reason I like to show this at the moment is because for a lot of us… the era that has shaped our era and our expectations of interest rates was actually in historic terms a completely abnormal era.

“So these are base rates over the 60s, 70s, 80s, peaking at 17% in 1979.

“This was an exceptional one-off; globally one-off era in Western Countries of exceptionally high inflation and high interest rates.”

Despite offering these reassurances Barnes said the market is shifting away from geared investors. Those looking to turn equity into income are now the ones putting money into property.

And – on the day UK Finance revealed buy-to-let purchase lending would likely hit just £9bn this year – she predicted this slowdown to continue by 2023.

Barnes added: “By 2023 the number of transactions generally in the market – sorry to pile the bad news on – as far as gross mortgage lending is concerned will be significantly down on past levels.”