Great news for homeowners, not great for first time buyers

Sometimes, being a property owner or investor can be, well, so disheartening. Mortgage rates shoot up, everything gets expensive, and then just when you think perhaps those pesky mortgage payments are going to start getting smaller – Rachel Reeves happens.

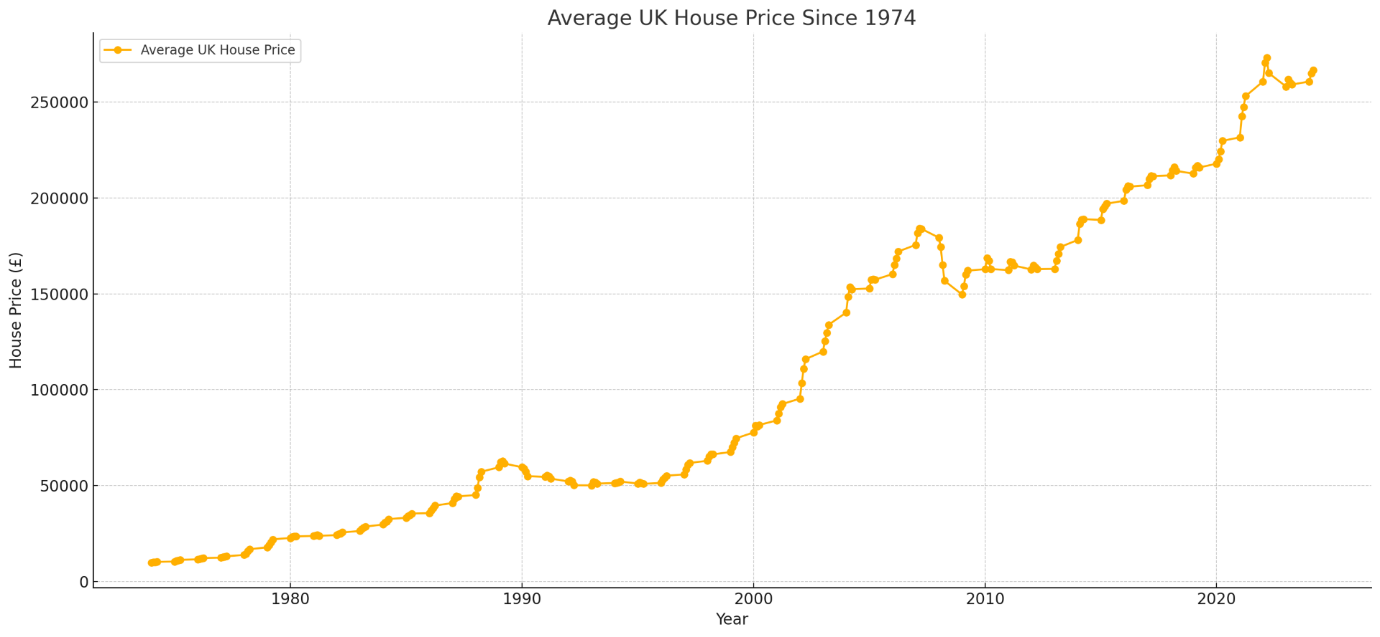

Step back from all the gloom, however, and maybe having a house is better than not having one (apart from the whole ‘living somewhere’ thing). Yes there are all those annoying mortgage payments to consider BUT – look at the latest numbers (thanks Mojo Mortgages) and you can see that house prices are actually beating wage increases. A detailed study tracking house prices, salaries, and deposits since 1974 has shed light on the increasing challenges faced by people trying to purchase their first home in today’s market.

We know that houses all cost more than they did, but, according Mojo Mortgages’ research, house prices have skyrocketed by an astonishing 2,534% over the past 50 years. While rough maths dividing the total by 50 years makes that 50% a year, the reality, of course, is that compound interest is at work here. That means, on average, UK property has increased by roughly 6.6% a year. Salaries? Less so.

In 1974, the average property price was just £10,027. Fast forward to 2024, and the figure has jumped to £265,012—an increase of £254,985, based on Nationwide's data. Meanwhile, average individual salaries have grown by 1,791% during the same period, reaching £33,644, according to the Office for National Statistics.

The numbers show that, if salaries had risen at the same pace as house prices, today’s average income would stand at £47,320—£13,676 higher than current levels. Alternatively, if property prices had increased in line with slower salary growth, the average home would cost £189,100, nearly £76,000 less than they do today.

"If average house prices had risen only in line with salaries, they would be £76,000, or 29% cheaper than they are today," the report highlights.

The required deposit for a home has also soared. In 1974, the average deposit was £537. Today, the average deposit is 22%, or £58,303—an increase of 10,575%. Back when flares were trendy and Tiger Feet was the country’s best selling record, a deposit accounted for just 15.05% of a couple's annual income, compared to 86.65% in 2024.

It now takes an average couple 11 years to save for what the average deposit is, compared to just six months in 1974. The deposit amount as a proportion of the property price has also grown from 5.36% in 1974, to 22% today.

The average age of a first-time buyer couple has climbed from 26 in 1974 to 33 today. While inflation in 1974 was around 16%—significantly higher than the current 2.3%—mortgage rates were also steeper, posing their own challenges.

In the 1980s, house prices tripled to £30,833, while joint incomes rose to £13,095, resulting in a more manageable price-to-income ratio of 2.2. By 1994, house prices averaged £51,362, and salaries had reached £21,000.

In 2004, the average property cost £147,462, with joint incomes of £43,711, increasing the affordability ratio to 3.4. By 2014, house prices had risen further to £186,544, while joint incomes hit £54,122, slightly improving the ratio to 2.45.

Today, the average house costs £265,012, and salaries sit at £33,644. This equates to a record-high house price-to-income ratio of 3.94, the steepest of the periods analysed.

John Fraser-Tucker, head of mortgages at Mojo Mortgages, commented: “Our analysis has made it clear that today’s first-time buyers are navigating a much tougher landscape than those who entered the market in 1974.”

Despite the challenges, there is a glimmer of hope. “First-time buyer activity is up by 21% in 2024 compared to the previous year. This increase suggests that many are still finding ways to make their homeownership dreams a reality, even amid rising costs,” Fraser-Tucker added.