"What happens next remains uncertain"

UK house prices posted a fifth consecutive month of growth in February, marking a 0.4% increase, equivalent to a £1,091 rise in cash terms, bringing the average house price to £291,699.

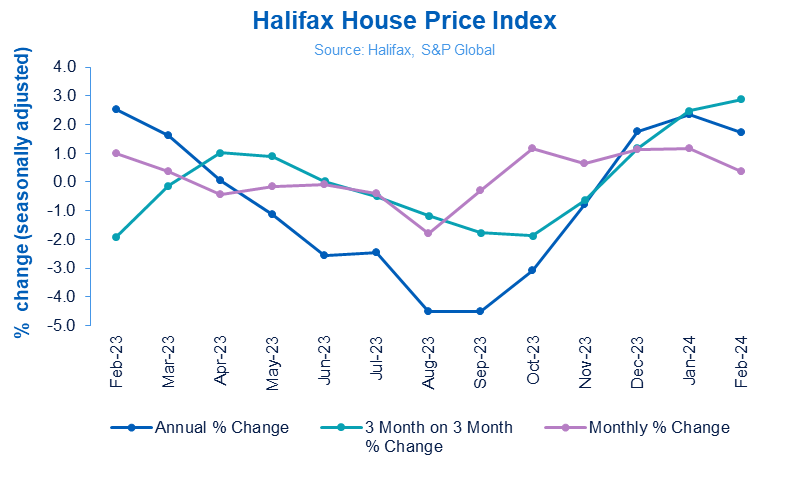

The latest Halifax House Price Index has also revealed that house prices have risen by 1.7% annually, a slight decrease from January’s 2.3% growth rate – a trend indicating a stable start to 2024, complemented by signs of increased housing activity, including a rise in mortgage approvals.

The average home price is now just £1,800 below the June 2022 peak, highlighting recent months’ growth amid ongoing market uncertainties.

“The corner is being turned and the market is picking up speed,” commented Jonathan Hopper, chief executive of Garrington Property Finders. “The Halifax data shows house prices have risen for five months in a row, though the annual pace of inflation slowed slightly compared to last month.

“While the supply of homes for sale is still limited in some areas, the market has finally become more free flowing. ‘For sale’ signs are becoming an increasingly common sight, and we are seeing rising interest from both buyers and sellers.”

Chris Baguley, group channel development director at Together, said the further rise in house prices brings with it the green shoots of market recovery as it edges closer to the busier ‘springtime selling-up season’.

“With the chancellor announcing that the higher rate of capital gains tax on residential property sales will be cut by 4%, we could see a new wave of activity across the market from those who have put off the option of downsizing, opening up more family homes and spaces for first-time buyers,” he said.

However, Kim Kinnaird, director at Halifax Mortgages, offered a reminder that while it is encouraging to see growth in recent months, what happens next remains uncertain.

“Although lower mortgage rates, alongside expectations of Bank of England interest rate cuts this year, should help buyer confidence in the short term, the downward trend on rates is showing signs of fading.

“Even with growing wages and inflation falling back, raising a deposit and affording a sizeable mortgage remains challenging, especially for those looking to join the property ladder, so it remains a possibility that there could be a slowdown in the housing market this year.”

Regionally, Northern Ireland led with a 5% annual price increase, setting the average house price at £195,956, which is £9,359 higher than the previous year. The North West and North East of England, along with Wales, have also seen significant annual growth rates of 4.4%, 4.2%, and 4.1%, respectively.

London, with the highest average house price of £536,996, experienced a 1.5% annual increase, marking its first positive annual growth since January 2023. Eastern England faced the most significant monthly decline among UK regions, with average prices falling by 0.8% to £329,927, a £2,794 drop from last year.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.