"Drive to get onto the property ladder is bigger than ever"

The average mortgage term for first-time buyers has increased, rising from 30 years in 2021 to 32 years in 2023, data from mortgage lender TSB has revealed.

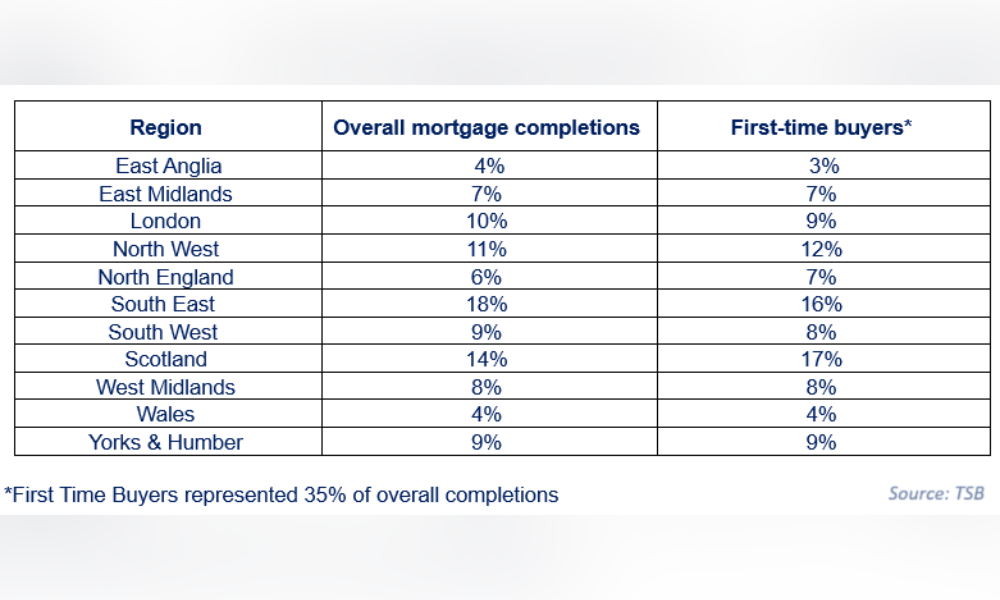

First-time buyers made up 35% of all mortgage completions last year, with the average age of these buyers slightly decreasing from 32 to 31.

Majority, or 57%, of these first-time buyers opted for joint mortgages, while 43% embarked on property ownership individually.

Regionally, Scotland leads in the number of first-time buyers using TSB, at 17%, closely followed by the South East with 16%, and the North West at 12%.

Meanwhile, TSB said its video banking technology contributed to speeding up the mortgage process, cutting down the average time to receive a mortgage offer to just 11 days from 22. Video banking emerged as the preferred method for nearly two-thirds (63%) of TSB’s direct mortgage purchases in 2023.

According to the lender, the technology offers conveniences, including allowing joint customers to join calls from separate locations and scheduling appointments outside of regular business hours, seven days a week, with over 37% of appointments conducted in this manner.

“Across the UK, the drive to get onto the property ladder is bigger than ever – with first-time buyers taking out extended repayment terms to acquire a home,” said Roland McCormack (pictured), TSB’s mortgage distribution director.

“At TSB, video banking is proving a popular and convenient route to securing a mortgage and has helped halve the time taken for customers to secure a deal in a rapidly changing mortgage market.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.