Is the housing market struggling to bounce back?

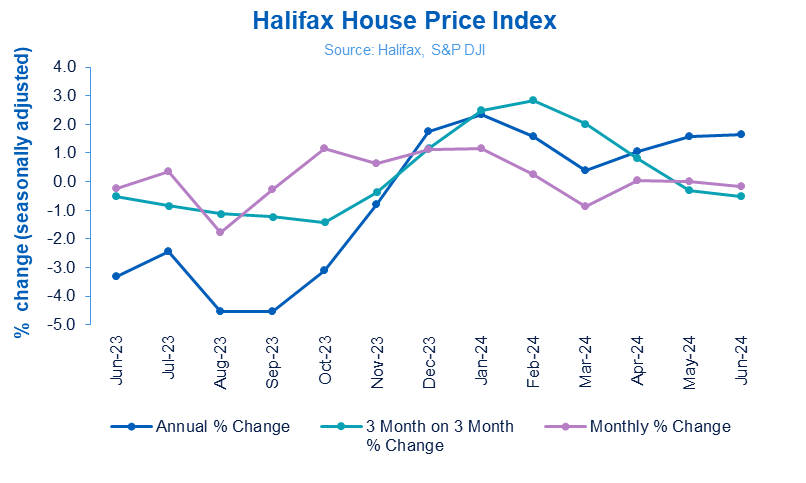

UK house prices remained relatively stable for the third consecutive month in June, with a slight decrease of less than £500 in average prices, mortgage lender Halifax has reported.

Annually, house prices have seen a seventh straight month of year-on-year growth, bringing the average UK property value to £288,455.

“This continued stability in house prices – rising by just 0.4% so far this year – reflects a market that remains subdued, though overall activity has been recovering,” said Amanda Bryden (pictured), head of mortgages at Halifax. “For now, it’s the shortage of available properties, rather than demand from buyers, that continues to underpin higher prices.

“Mortgage affordability is still the biggest challenge facing both homebuyers and those coming to the end of fixed-term deals. This issue is likely to be eased gradually, through a combination of lower interest rates, rising incomes, and more restrained growth in house prices.

“While in the short-term, the housing market is delicately balanced and sensitive to the pace of change to base rate, based on our current expectations, property prices are likely to rise modestly through the rest of this year and into 2025.”

“The housing market appears to be struggling to bounce back, as today’s figures show that prices cooled last month,” commented Liz Edwards, money expert at personal finance site finder.com.

“The housing market appears to be struggling to bounce back, as today’s figures show that prices cooled last month,” commented Liz Edwards, money expert at personal finance site finder.com.

“Late May saw the announcement of the General Election, and it appears that this may have hindered the housing market, as potential buyers wait to see how the results might impact the economy. Many buyers are also still patiently waiting for the base rate to finally come down before they commit to purchasing a property. It’s likely that we could continue to see house prices sit on the cooler side until buyers can be confident of more stability in the market.”

Read next: Top 10 most expensive cities in the UK ...aside from London!

Amy Reynolds, head of sales at Richmond estate agency Antony Roberts, said that while prices have fallen again month-on month, it’s only the cream off the top of the high prices achieved in 2021.

“It’s more of a correction in real terms,” she pointed out. “With higher borrowing costs, homeownership is out of reach for many.

“The new government must tackle planning issues, making local councils take a commercial view and less of a NIMBY approach to development that will house those most in need and boost the economy through employment of builders et cetera as the chain of suppliers used to build a new home is substantial.”

House price movements by nation and region

The latest Halifax House Price Index saw Northern Ireland record the strongest property price growth in the UK, increasing by 4% annually in June, up from 3.3% the previous month. The average property price there is now £192,457.

Scotland also saw an increase in house prices, with a typical property now costing £204,663, up 1.6% from the previous year. In Wales, house prices grew annually by 2.7% to reach £220,197.

In England, the North West recorded the steepest house price inflation, with a 3.8% annual increase, bringing the average price to £231,351. Eastern England was the only region to register a decline in house prices over the last year, averaging £328,747, down 0.9% annually in June.

London continues to have the most expensive property prices in the UK, averaging £536,306, up 0.9% compared to last year.

Any thoughts on the latest Halifax House Price Index? Share them with us by leaving a comment in the discussion box at the bottom of the page.