Property commentators talk up blue chip UK real estate boom

If you speak to brokers dealing with borrowers looking at prime London real estate, they aren’t exactly the most cheerful bunch. “We've seen a huge decrease in activity in terms of people buying from abroad, obviously, with the turbulent economy and the issues with conflicts around the world. It seems like that part of the market has shrunken significantly,” Jed Newton a director at Trinity Financial told Mortgage Introducer. Add to that the fact that according to Knight Frank, average prices in prime central London (PCL) have fallen by 18% since their peak in mid-2015 and it doesn’t sound like the most enticing cocktail for property growth.

Read more: What's going wrong with prime London real estate?

But maybe it shouldn’t all be doom and gloom in the Big Smoke’s wealthiest enclaves. As political tensions have sharply escalated in the US, according to some estate agents, London’s prime property market is experiencing a wave of inquiries from wealthy Americans seeking stability across the Atlantic. There has already been a notable increase in rental requests according to some, with claims (however unlikely) that phone lines were buzzing from the early hours following the Presidential election. Apparently properties on prestigious London streets, from Notting Hill townhouses to penthouses with full amenities, are attracting high-net-worth American clients looking to distance themselves from a new president.

Becky Fatemi of Sotheby’s International Realty told The Standard that her team received a flurry of calls from key US cities like New York and Los Angeles. “The most immediate requests are for rentals,” she said, noting a preference for spacious, upscale residences. The demand for short-term accommodations in Prime Central London (PCL), the city’s elite housing market, reflects a desire for luxury and security during this time of political and economic ambiguity.

“We have seen a lot of US clients looking to buy in the UK in recent years,” confirmed Newton (Trinity Financial is the mortgage partner for high-end estate agent Winkworths). “We would very much welcome any Americans disillusioned by the election outcome who wanting to settle in London. An influx of high earning Americans would likely lead to a higher level of competition in the more desirable parts of the London market, such as family sized houses in South West and North London. “

James Gow, head of residential sales at Strutt & Parker told The Standard that he sees this trend influencing the sales market as well – which could be good news for brokers who would like some new HNW foreign clients.

Data from Savills shows that American interest in London properties has been building throughout the year, even as other foreign buyers pulled back amid domestic political changes. By August, Americans had become the largest group of non-UK visitors to Savills’ website, accounting for 14% of deals over the past year.

“We've seen still quite, quite significant competition for good large family houses in in good areas of London,” says Newton. “They're sold before they even get to the point of being advertised.”

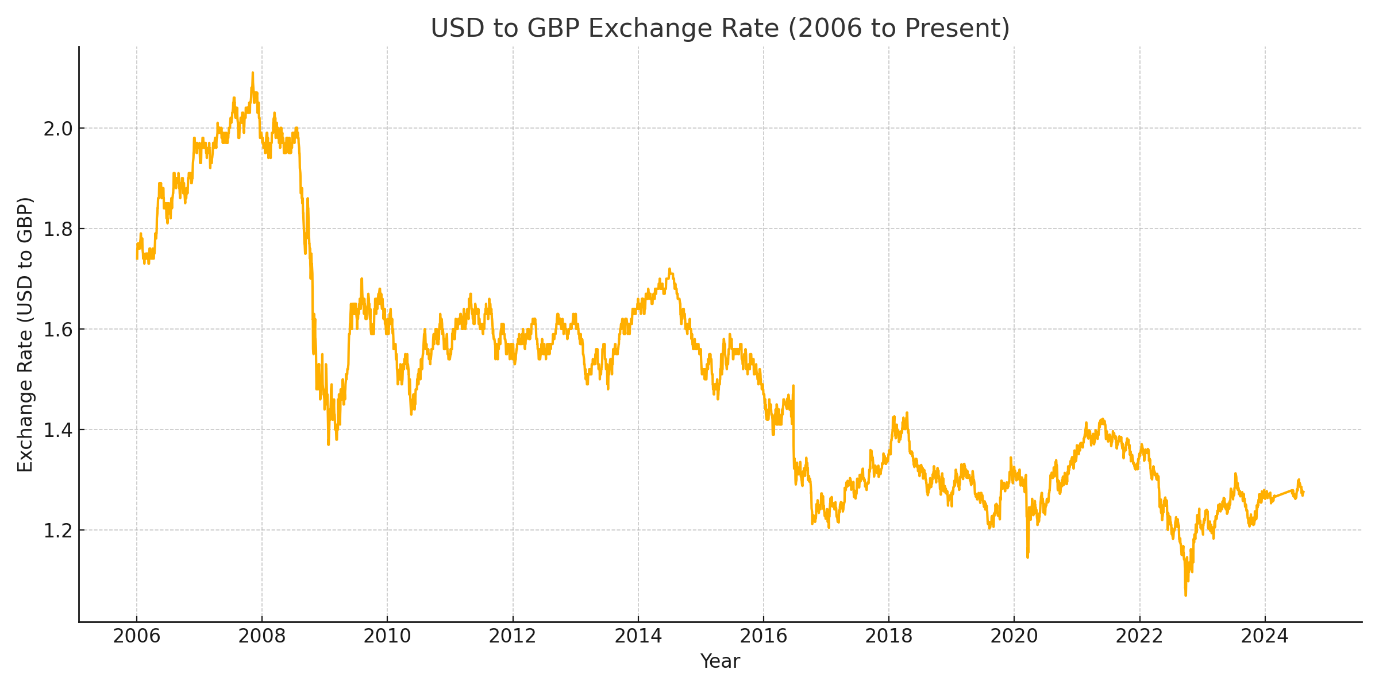

The strong US dollar has made prime London real estate more accessible, allowing Americans to benefit from relatively lower prices. According to Knight Frank, prices in prime central London have declined by 18% since their peak in 2015, creating opportunities for buyers seeking discounted properties in desirable locations.

Rory McCullen from Savills explained that this migration isn’t limited to established investors but includes younger, mobile wealth holders from sectors like tech and private equity too. This generation, increasingly working remotely, has embraced international mobility and flexibility..