Non-major banks roundtable discusses further investment in broker channel

Listening and acting on brokers’ feedback is vital to the strength and success of the non-major bank sector.

Second-tier banks rely heavily on the third party channel to provide a steady source of lending for their business.

In a highly competitive lending market, brokers are leading the charge over the direct to customer segment. Broker market share is at a record high, with the MFAA reporting in April that 71.8% of all new residential home loans were written by brokers in the December 2023 quarter.

Non-major banks have taken a proactive approach to broker relationships, working closely with them to assist thousands of customers as they roll off low fixed rates onto higher variable rates.

They are also building new tech platforms and investing in staff to ensure the entire lending process is efficient, fast, easy to use and meets the needs of brokers and their customers.

Retention is the key and this can be achieved by consistently delivering for brokers and clients.

Non-major bank leaders know that growth and success can’t be reached without the buy-in of brokers and that’s why they are keen to work with them and gain their feedback.

MPA invited third party leaders from leading non-major banks to join its annual industry roundtable at Sydney’s Silks restaurant. Attending the event were Troy Fedder (Suncorp Bank); Paul Herbert (AMP Bank); Johnny Lockwood (BOQ Group) and Ian Rakhit (Bankwest). George Thompson of ING Australia was unable to be there in person, but provided his comments in writing.

Two brokers also attended – Deborah Brincat from Aussie Parramatta and Stephen Michaels of Catalyst Advisers.

Q. Non-major banks faced a number of challenges in 2023, including rising interest rates and inflation and the fixed rate cliff. How have you dealt with these and other challenges, especially in partnership with brokers?

Troy Fedder (pictured below), acting executive general manager of home lending at Suncorp Bank, agreed that 2023 presented a number of challenges for the industry.

“It also had some tailwinds,” Fedder said. “I think one of the great things for the broker industry is, regardless of challenges, the broker model continues to shine.

“For Suncorp Bank, the word partnership is really important – the fact that as a non-major, you can genuinely partner with the broker community to look after our customers.”

Fedder said in an environment of rising interest rates “we should acknowledge that some customers are doing it tough”.

“I’ve been really grateful to witness how Suncorp Bank’s relationship with brokers has continued to grow over the past few years. The volume of brokers we work with has helped grow our customer base and allowed us to provide better outcomes for our customers.”

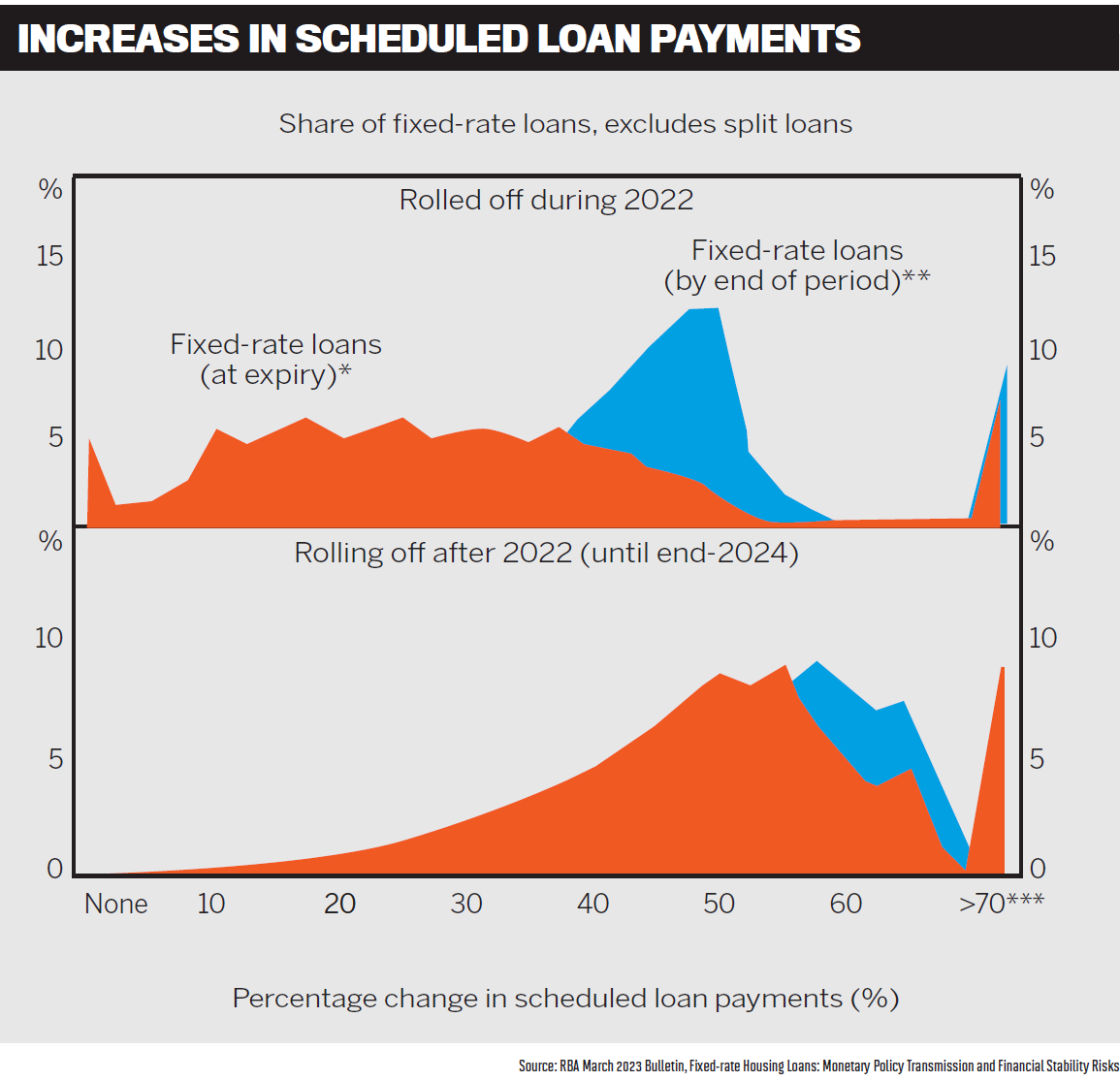

Johnny Lockwood (pictured below), BOQ Group general manager broker and strategic partnerships, said there had been 13 interest rate rises since May 2022, with a lot of fixed rates maturing, and brokers had helped customers deal with these challenges.

“A lot of customers out there may not service with other banks, so it’s important for us to continue to honour both customer relationships and broker relationships,” Lockwood said.

This meant having good retention policies and assisting customers to deal with rate rises.

Lockwood said BOQ Group had been proactive in educating customers about what fixed rate maturities meant for them.

“We’ve got navigation hubs, we’ve got a lot of proactive engagement with customers to help them understand their options.”

The lender also reached out to customers at risk of hardship “to smooth the landing for them”.

Lockwood said it was important for brokers to know that their customers would be looked after.

“I’ve noticed over the last six to 12 months that when a broker asks what are you good at, they want to know about your retention policies.

“It’s not about what’s your lowest rate and then considering another lender in a few years’ time. Brokers want to put customers into genuine, good, and long-lasting relationships.”

AMP Bank head of intermediary distribution and finance, Paul Herbert (pictured below), said the approach it had taken over the last 12 to 18 months had been to focus on educating customers and brokers.

“Informing them that this is coming up, this is what we’re going to do, this is what the rate is going to do,” Herbert.

“We’ve been really early with our communications to customers, to give them as much notice as possible to help prepare for the higher interest rate environment. We worked with brokers and customers, ensuring we gave them a competitive rate for that time based on broader competition.”

Herbert said a number of brokers had spoken to AMP Bank about their retention and rollover conversations with customers, explaining exactly what their fortnightly payments would be once fixed rate terms ended.

“It’s all about being clear and upfront in those direct-to-customer conversations that we’ve supported brokers with. We found that had a really positive impact.”

It also meant brokers could have other conversations with customers to determine if they had the right loan structures in place.

“That was a really important step change that we took to support customers through that transition,” Herbert said. “Pleasingly, the roll-off of customers leaving AMP has been quite low through that transition period, as has the arrears.”

While this different approach to customer conversation required more work, Herbert said it had been worthwhile.

George Thompson (pictured below), head of mortgages at ING Australia, said the economic uncertainty and interest rate environment had challenged many Australians.

He said from an ING and a broker perspective, they combined on efforts to support and reassure customers.

This included breaking down all the information to explain what it meant to the customer, especially those who were facing difficulties, showing customers how ING could assist them and the steps customers could take, and informing them what options were available.

“We started reaching out to fixed rate customers last year, following a well-thought-out process that involved pre-emptively talking to customers about budgeting and other helpful tools,” Thompson said.

“As the time to a fixed rate expiry draws closer, the team makes outbound calls to customers to ensure they have all they need to make a well-informed decision. This important investment helps customers to be best prepared.”

Lockwood said brokers were receptive to banks being proactive in handling fixed rate maturities.

He said in the past these situations involved “some churn”, but if there were extenuating circumstances it meant brokers talked to banks and customers and came up with other solutions.

Catalyst Advisers managing director Stephen Michaels (pictured below) said brokers set up home loans with the aim of not moving the loan for five to 10 years.

“If a broker takes a long-term view on their customer, and we get remunerated by the trail to align ourselves with them long term, you want to place them in the right product at the right time,” said Michaels.

Customers who had taken out home loans between 2021 and 2023 had been confronted with rapidly rising interest rates, but Michaels found that his brokers hadn’t needed to move clients to different banks for a better deal.

“The banks were very accommodating to the customer, whether it’s a variable rate that’s only ever increased as soon as they signed up, or it’s a fixed interest rate that’s expired. There have been very honest and thought-out efforts to give that customer the right rate at the right time.”

Michaels said refinancing inquiries had been high but the number of customers moving from one bank to another had been below normal. This was because the banks were looking after the customer to retain them long term.

Deborah Brincat (pictured below), a franchisee at Aussie Parramatta, said there were not many banks that told her when a customer was about to come off a fixed rate.

“So who’s contacting this customer?,” Brincat said. “Is the bank contacting the customer? Or am I, as the broker who gets remunerated for this, contacting the customer?

“I dislike when a customer flicks me an email from a bank to say my fixed rate is coming off – this is the information that brokers need access to.”

Brincat said she wanted to know when a fixed rate was expiring well ahead of time, so she could talk to the customer and have some leeway if problems arose.

“I think the communication piece around fixed rate is interesting, because as a broker, I feel like it’s my responsibility to be in front of my customer and saying your fixed rate is coming off, let’s have that conversation. Are you comfortable? Are you okay? This is the rate that they’ve offered.

“However, it is difficult to have that conversation if the revert rate is not provided to us.”

Responding to Brincat’s comments, Ian Rakhit (pictured below), general manager third party banking at Bankwest, said the bank had responded in different ways.

“The first was how do we give the broker all the tools that they need to have the conversation? The visibility in the portal of your customers, the rates that they’ll move to, key dates like fixed rates, and so on.

“I think it makes commercial sense for us to give you that information, as well as relationship-wise. You’re the point of contact for the customer. We shouldn’t need to pay you trail and do your communication to customers, we should respect your relationship.”

Bankwest had also determined which cohort of customers was most at risk, based on serviceability at the time of application and factoring in multiple rate rises.

Rakhit said the bank notified brokers that these customers were not yet in difficulty but they might want to ask them if they were OK.

“That’s a better conversation coming from you [the broker] than coming from the bank.”

Bankwest had also looked at broker welfare, because brokers had high work levels through the interest rate cycle and were dealing with stressed customers. The bank had allowed brokers to access its high-quality internal employee assistance program through CommBank, acknowledging that 2023 had been a tough year for brokers.

Looking at the broader market, Fedder said there were a few other dynamics at play.

“Home loan system growth came down in 2023 – the total was close to 4%. In the past, it’s been higher. To see that and to still see broker businesses hold up indicates the growth that brokers continue to enjoy.

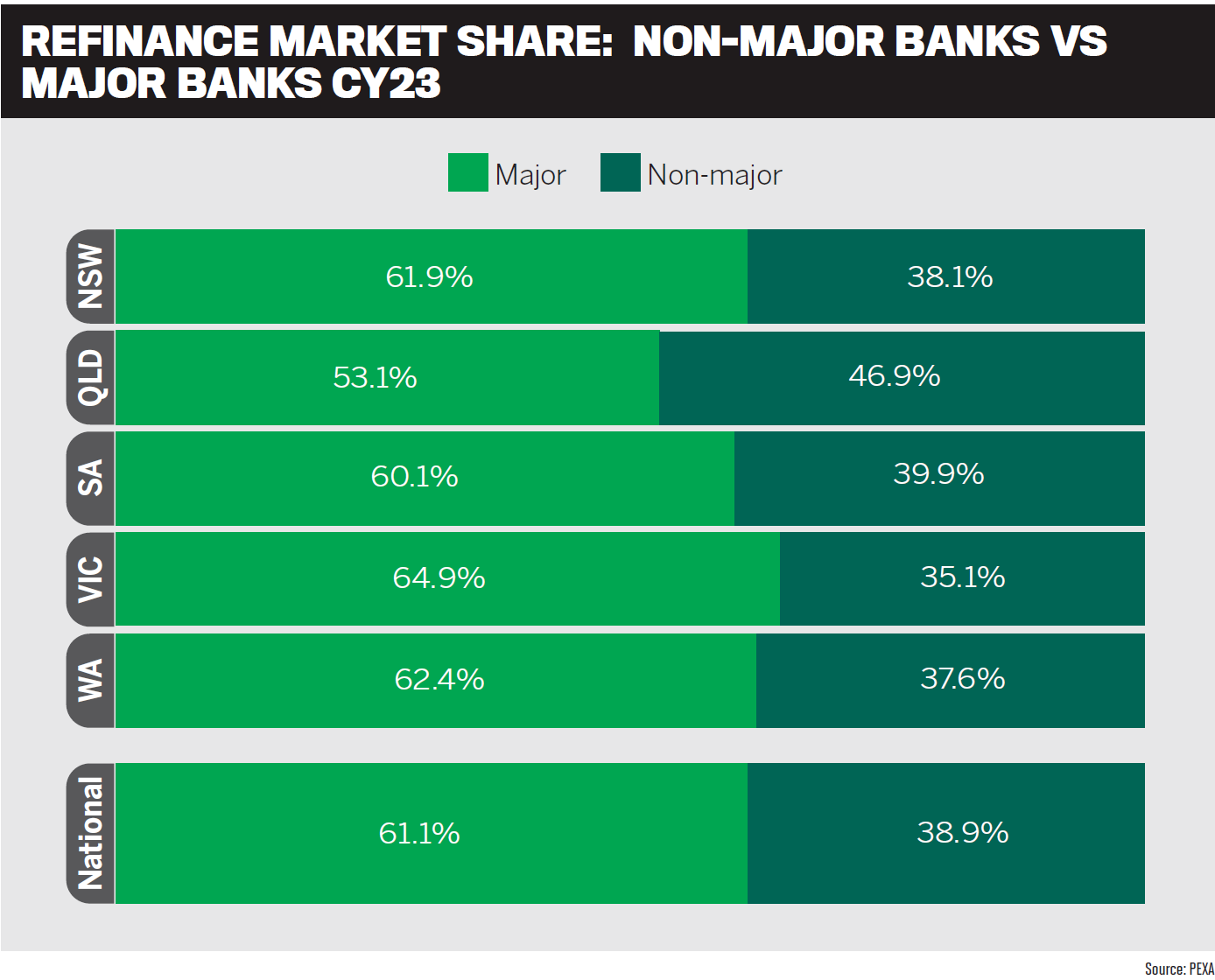

“Part of the benefit is that some of those brokers have moved towards non-majors, increasing our flow.”

Fedder said he believed home loan system growth would slowly improve this year, thereby further boosting broker market share.

Q: How did non-major banks protect market share in the face of a highly competitive market? How important is the broker channel to your business?

Herbert said market share was interesting, but “not always the main game”.

He said banks needed to continue to achieve the right margin between the cost of raising capital and lending.

“If you don’t have profitable and successful banks, it affects stability and confidence in the banking system.”

Last year, AMP Bank made some deliberate changes about how it priced for new and existing customers to get the balance right in managing margins.

“To listen, learn and act on the feedback from brokers has always been a central tenant to the experiences we deliver,” said Herbert.

“In 2023, we knew the need to continue to lift service experience was important, supporting brokers as they navigated a challenging year for their customers.”

The bank spent more time working with key brokers to streamline the lending process and assist them and their customers to save time and effort.

“At the start of 2023, we decided to really enhance broker experience and boost the number of people supporting brokers.”

Instead of having a dedicated contact centre, AMP Bank had broker experience staff attached to BDMs, responding to broker’s emails and answering the phone and building up that “repetitive knowledge and relationship”.

“We find that our broker experience team get as many scenarios as our BDMs do, because they’re accessible and have been able to help solve a problem or improve an experience for a broker or a customer.”

“Maintaining broker flows in our business is really important – more than 90% of our business comes from brokers. We’re a broker first business. Every time you do a top up for a broker loan, it might be $10,000 or $20,000, the commission continues to keep rolling through, we don’t intervene or stop that.”

Herbert said every communication or decision focused on delivering for brokers.

“I think the consistency and service we delivered in 2023, even with some really wild fluctuations in volume, was never more than four days to file. That’s how you preserve trust and reputation to consistently deliver over the long term.”

Lockwood agreed, saying it was about getting the right balance between pursuing growth and appropriately delivering “on our commitment to customer (and staff) experience, while also managing a competitive market dynamic and stakeholder expectations”.

“Balance is probably the key term for a lot of non-majors. It’s about being focused as well – we aren’t a major, we can’t do everything.”

Lockwood said BOQ Group was priced competitively as a second-tier bank”.

“We’re going through quite a large transformation on platforms… ME Bank [during this period] is the primary platform for us in achieving great customer service and broker service.

“We nail simple lending. If you’re coming through PAYG, low LVRs, the loan’s going to go through in a few days. We’re consistently rated by the aggregators as being at the top in terms of turnaround times, experience and service.”

As a multi-brand organisation, the group also operates ME Bank, BOQ and Virgin Money.

While ME Bank focused on simple, low LVR lending, BOQ had experience in handling more complex lending, such as the self-employed, construction and SME sectors.

“With confidence we can say to our brokers, ‘what type of lending are you looking to do’ – we’ve got some great options for you,” said Lockwood.

Rakhit said 90% of Bankwest’s lending now came via brokers, up from 75% about 10 years ago.

Bankwest announced the closure of its WA branch network recently. It closed its east coast network between 2018 and 2022 and was focusing mainly on the broker sector.

“We preserved and grew market share by focusing on retention. We couldn’t compete price-wise on new business but we could do it on retention because we don’t have the same costs of acquisition.”

Rakhit said Bankwest performed strongly on retention through the broker portal it had built and by allowing brokers to price as they conducted their customer reviews.

He said 2024 would be different – the branch closures meant the bank could price differently and compete more strongly.

Fedder said Suncorp Bank’s journey had been an exciting one, and it continued to grow sustainably.

“We continue to focus on growing with more brokers, and brokers that are aligned to our customer segments.”

Suncorp Bank’s approach was to ask how its value proposition could be aligned under best interests duty.

“How do we position the brand so that Suncorp Bank, for the right customer, elevates towards the top of the menu?” said Fedder.

Suncorp Bank had moved back in line with the market in the last three years, focusing on three things.

The first was Suncorp Bank’s SunLight proposition, which sees lower risk home loans approved within 48 hours, and often much faster.

The second factor was competing on price.

Thirdly and most importantly, said Fedder, was taking friction out of the loan process, especially between application and loan approval. “How do we work on being one of the more consistent lenders in the market for speed to approval?”

Feedback from brokers had been important to ensure Suncorp Bank remained competitive as a non-major. Fedder said the bank wanted to ensure that when brokers chose Suncorp Bank, they would get the right speed to approval.

Rakhit asked the brokers at the roundtable whether they had driven more business to non-majors in the last five years.

Brincat said this was definitely the case, as she found the major banks “difficult in the service that they provide”.

She said she had only written one loan with one of the major banks in the last two years because the service from the credit team was inconsistent.

“They [the bank] don’t come back to you in a timely manner, you talk to one person, they’ll ask for this and then the file went to somebody else,” Brincat said. “There are some challenges when dealing with overseas operations teams. The experience for me became frustrating because I couldn’t commit to my customer, as SLAs kept changing.”

Brincat said for a period of time, much of her business had gone to Macquarie Bank because they were consistent and easy to deal with.

“As their pricing increased we had to look at other options for our clients and you could get the same level of service from non-majors such as Bankwest and ING – so they came into play for me.”

Rakhit said everybody was talking about lifting their service proposition to brokers, because non-majors didn’t have the same brand impact as the majors.

“We’ve all focused on our service proposition to allow us to bridge that gap between ourselves and the majors.”

Michaels said his brokerage had quite an even spread between the big four banks, second-tier banks and non-bank lenders.

“But if I had to call out a difference between the majors and non-major lenders, the BDM support is miles and miles ahead with the non-majors.”

Michaels said Catalyst Advisors had a good relationship with the major bank BDMs but the care factor with non-major BDMs really shone through, acknowledging the great work of Winston Trinh at AMP Bank and Jude Schofield at Bankwest.

Brincat agreed with Michaels. She said it wasn’t that major bank BDMs didn’t care about helping brokers, it was the lack of resourcing and inability to escalate.

“We really hero our BDMs and allow them that ability to win business, defend their reputation. I wonder whether that is true for bigger organisations,” Rakhit said.

Michaels said when talking to referral partners or customers, he told them brokers were in control when it came to assessing customers and preparing the application, but once it went to the bank it was no longer in their control.

“Our closest control within a bank is via our BDMs or relationship managers. I genuinely can say that with non-big four bank NDMs, there’s more love and attention and care.”

Thompson said throughout 2023 ING increased its mortgage lending book above the rate of system growth.

“We did this by simplifying credit lending policies, providing customers and brokers with more options. We also introduced new LVR bands for investors and launched a new online serviceability calculator that was easy to use.”

Q: Broker question from Deborah Brincat: What investment can we expect for brokers to be able to have data rich information about their clients, specifically rates, term expiry and balance? Some lender portals do not provide this information for current and historical clients

Brincat said excluding Bankwest and a few others which already provided this information, she had zero visibility when it came to her clients’ current loan rates and no ability to price some existing clients.

She said this lack of information was infuriating and affected retention, especially when doing anniversary calls with customers and having to ask them what their rate was.

The non-major banks’ credit teams had really lifted, providing more consistency and communication, but when it came to broker-facing teams and managing customers, improvement was needed.

Herbert said he had heard these concerns from brokers many times and AMP Bank’s first priority was to be able to provide this information to brokers.

“You’ve got to look at your platforms, your software, the integrations you have with your core banking systems first, and what’s the pathway to get to that? Providing real-time pricing, a real-time view of your customer portfolio, it should be done.”

Herbert said in December 2023, AMP Bank had created an online reprice form which just required brokers to provide their account details. Bots could provide a response in minutes, which saved brokers time on repricing.

A retention specialist could also get in contact with the broker to discuss the loan scenario if needed.

Referring to Michaels’ earlier comment about brokers controlling the experience for the customer up until loan submission, Herbert said AMP Bank had been working hard to remove this concern from brokers and customers by creating the right platform and improving the front-end experience.

It wanted to assess loans using the data brokers had already validated through screen scraping and digital IDs and provide certainty to brokers that they would get an answer based on the information they supplied.

When the broker portal was completed, brokers would be able to look at their application pipeline in real time, including notes on the process and any conversations and interactions with customers.

Herbert said it was important that AMP Bank worked collaboratively with brokers to provide information that would help them with their customers.

Rakhit said brokers could access their existing customers’ loan information in the Bankwest Broker Portal. He said the portal was the result of time, money and investment.

Closing its east coast bank branches in 2018 had freed up money for investment in brokers.

“I think the biggest opportunity we have as leaders of third party businesses is influencing those conversations about where do our banks invest? It’s really pleasing that we are investing more and more in broker solutions,” Rakhit said.

Lockwood said ME Bank, BOQ and Virgin Money all had broker portals, including a broker pricing tool which sometimes provided an instant decision for online submissions; in other situations it might have to be escalated.

“We recognise the importance of trying to help you manage your time. There’s no point you sitting on the phone for something that can be done immediately,” he said.

Lockwood said including customer data in the broker portal would make the process simpler and BOQ Group was currently working on the security aspects. “Stay tuned.”

Fedder said Suncorp Bank had already built its broker portal, adding in the data of all customers from May 2023 onwards. Like other non-majors, the bank would look at how to best pursue the ongoing retention of customers.

“The fact that brokers see this as a crucial area where they add value to customers means that we need to continue to look at it,” said Fedder.

Lockwood said, “It’s much cheaper for us to keep an existing customer than it is to acquire a new customer. We’d love all customers to stay and for all brokers to be happy.”

Q: Broker question from Stephen Michaels. What are your thoughts on the big four banks and instances where they receive “special treatment” in comparison to non-major banks? Example – the ability to offer streamlined refinance assessment (i.e. 1% buffer on top of actual rate). Is this fair? Are non-majors at a disadvantage when it comes to implementing credit policy changes?

Rakhit said the 3% buffer was a requirement set by APRA to support responsible lending.

Some major banks offered streamline loans with lower levels of documentation such as dollar-for-dollar refinances.

Bankwest had offered a 1% buffer on dollar-for-dollar refinances, but only for single owner-occupier or one investment property.

“We needed to inform APRA that we would put certain controls in place to ensure that we weren’t taking on business or risk that would be detrimental to our standards,” Rakhit said.

Bankwest also had to agree with APRA that it would only allow a certain number of these refinances, with the limit reached very quickly.

Rakhit said the non-majors should look at first home buyers. ‘Mortgage prisoners’ was a common term but there were a lot of ‘rental prisoners’ – potential first-time buyers who due to large rents were unable to save enough for a deposit.

“In terms of serviceability, the first-time buyers are probably paying the highest rate in the market and then you put 3% on top. That’s not necessarily helping us bring more people into homeownership.”

Lockwood said one of the frustrations for non-major banks on 1% buffer loans was that they were policy exceptions and often didn’t stack up due to scale.

“When you’ve got much lower flow than a major and a much smaller balance sheet, because you might have a very small allocation, then how do you manage that? Is that the kind of risk you want?”

It was an unlevel playing field for the non-majors compared to the majors because scale did count, said Lockwood.

MPA asked Michaels if he believed the 1% buffer loans were driving broker business to the majors.

Michaels said this was absolutely the case. He gave an example of a customer with three properties in Sydney’s eastern suburbs, totalling $3.5 million in loans in the portfolio.

“His borrowing capacity going to a non 1% buffer bank was a maximum borrowing for the household of $2.2 million,” he said. “It was a $1.3 million difference in borrowing.”

Brincat said that it was mainly investors who were missing out on the 1% buffer opportunities, due to policy criteria.

“They’re already getting hamstrung around rate. They’ve got multiple properties and are clearly able to service their debt – what is the risk? Particularly when LVRs are sub-80%.”

Rakhit said all non-majors would be pleased with the low level of arrears, given two years of COVID and 13 rate rises.

“Our level of arrears is very, very low. Now this could be due to the 3% buffer.”

Lockwood said this was a good point.

“The Australian economy and banking environment is probably one of the most stable and reliable in the world – it’s the partnership between banks and the regulators and the commitments that we have.”

Q: What are your plans to upgrade technology in 2024 and how will they improve systems and processes for brokers and their customers? What part does AI have to play?

Fedder said Suncorp Bank has a strategic partnership with NextGen and they would continue to work together, investing in speed from application through to unconditional approval.

“For me, it’s that consistent approach – how you get faster and faster and take the friction out of the model. We’re reflecting on what we have done in the past and we’re continuing to ask for broker feedback around how we can make that even better.”

Herbert said speed was an interesting point. “You can be fast, but looking back at the value chain, how do we reduce effort? Effort for the broker, effort for the customer. How do we remove duplication of effort?”

AMP Bank was keen to improve brokers’ confidence in a lending outcome.

“Brokers regularly tell us they value the ability to control and have visibility of the experience for their customers throughout the home loan journey, however this often breaks down once a loan is submitted,” Herbert said.

“Providing greater confidence in outcomes before a loan is submitted is an important step change we see important to help address this, and delivering a leading application experience for our brokers and their customers that gives great confidence in the outcome upfront is a priority.”

Herbert said there were a lot of tools including propensity modelling and AI that could help. More important were the digital tools brokers used to provide information that could be used by the lenders rather than duplicating the effort already undertaken.

Brincat said a lot of this came back to banks working with aggregators which offered great technology. She gave the example of Lendi Group, which was working on an approval confidence feature.

“So this means that we can put the data in the system, and once the data is accurate, the system will be able to tell us what’s the likelihood of that approval happening. The work being done with aggregators is helping us as brokers, especially if that can be the one-stop shop.”

Brincat said many brokers also used Quickli due to its accuracy before going to a lender.

Michaels said he also used Quickli to streamline the process and get to the right outcome.

Rakhit said in the future loans could be approved at time of lodgement. This would involve revalidating information brokers provided using data points instead of documents.

Bankwest was excited to introduce its first AI tool, which helped brokers when using the bank’s library of credit policy.

“You put in certain search information, and AI will bring that information to the fore rather than you having to go and find it.”

Rakhit said AI was ideal for repeatable tasks and the plan was to expand its use.

Bankwest had also spoken to Quickli, which could provide “an amazing level of information on competitors, how they price, how they service, what they put into their serviceability catalogue”.

Rakhit said there were also other great tech companies such as CoreLogic, illion and Equifax that the industry could invest in and the next few years would be exciting.

ING was digitising and automating the customer journey and assessment process to create faster more streamlined customer experiences, Thompson said. “Digital validation of application documents is an example. AI is seen increasingly as a core capability and opportunity.”

Lockwood said 2024 would be a massive year for BOQ Group in terms of technology transformation.

“One of the largest investments that the bank has made ever is in a new home loan program,” he said.

BOQ group had launched a greenfield digital bank a few years ago featuring all three brands, Virgin Money, BOQ and ME Bank.

Lockwood said home loans would be added to the digital bank this year. “It’s not just home loans, core banking and the mobile. We’ve got a brand new origination platform for home loans, which is a digital end-to-end mortgage, but it’s purpose-built for a broker.”

Lockwood said these were significant investments – digitising and automating a new home loan origination process that was based on data points and made things easier for brokers.

“We want to take people out of the process, not because we don’t like our people, but because we want them focused on the complex things.”

After a pause in 2023, home loans would return to Virgin Money by the end of 2024.

Lockwood also talked about BOQ Group’s strategic partnership with Microsoft and being the first company in Australasia to be part of Microsoft’s cloud financial services.

“Our Teams, Outlook, our sales CRM, our broker portal, are all Microsoft and the beauty with that is they all talk to one another.”

Microsoft is also investing heavily in AI. “We are investigating how and when we turn on the AI solutions that Microsoft has built into these platforms.”

BOQ Group is looking to use AI in the first instance to improve employee capacity. Lockwood said this would mean a BDM could go into Teams and ask it to summarise the last six months of interactions with a specific broker.

“It’ll go through all their Outlook, their emails, their calendar, their CPD activities, and come back and provide the summary of what the broker is like. It’s quite exciting.”

Q: What are your predictions for the mortgage industry around demand for lending and particular customer segments?

Thompson said it was always difficult to predict where interest rates would go.

“The Reserve Bank of Australia is still not ruling out hikes, but it has moved to a more neutral setting as far as its guidance is concerned,” he said.

“While inflation has cooled, home prices have been on an upward trajectory for some time now and there’s no indication that this will ease in the foreseeable future. This may make it difficult for first home buyers who will be looking to their brokers to find good value mortgages that best suit their needs.”

Read next: How mortgage professionals can help first time buyers get that new home

Michaels said there was a fear of missing out in the property market.

“If I don’t buy this property that I’ve just found because there’s a scarcity in supply, I don’t know when I’m going to see that property again that ticks the box. So that in itself is making the market quite buoyant.”

Lockwood asked Michaels if he was seeing pre-approvals rise.

“Absolutely – our pre-approval numbers have come up recently,” said Michaels. “Everyone is thinking when rates do start to come down, whether it’s the end of this year or next year, that property prices are going to pop off.”

Michaels said he did not believe this would happen as the property market was “very rigid”.

By this he meant, if someone had bought a $1 million property five to 10 years ago, it would now be worth $2 million.

“If you want to go and then upgrade, unless you want to keep the exact same mortgage you’re going to sell and all you can do is buy a $2 million property. People are thinking I might feel rich but what does that really get me?”

Michaels said rate cuts would allow people to borrow more and lubricate the property market, fostering more buyer inquiries and more sales transactions. Rakhit said auction rates were looking very healthy but refinances were coming down as banks looked to hold onto existing customers.

“I think first-time buyers are a key demographic for us to get into the market – they generally stimulate everything from the bottom up.”

The growth of this sector hinged on the government’s first home owner grant keeping pace with house prices.

Lockwood said the rental market was tight, and he hoped investors would return. BOQ Group had increased its support for investors by boosting LVR from 90% to 95%.

He said he would like to see the authorities and regulations improve housing supply and therefore affordability.

“It is so time-consuming and so expensive to either build a new house, or to open up land.”

Brincat said older generations were living in large houses that they did not need.

“How are we encouraging older people to downsize? If they do sell, they get whacked with stamp duty and if they have investment properties, they face capital gains tax.”

Fedder said looking at the broker market, it had continued to excel year after year.

“The alignment for non-major banks to work with brokers is brighter than ever. I think the broker share will continue to grow in the market and for customers, that’s a great outcome.”

Herbert said there had been consolidation in banking and aggregator industries over the past 10 years due to high costs. Some brokers who had been operating for 10 to 15 years were looking to sell or leverage their businesses.

“As business owners’ objectives change, retaining top talent and leveraging capital become important. Our bespoke business finance loan allows brokers to unlock their business potential without borrowing against personal equity.

“We believe in supporting small businesses and will be rolling out a small business growth series later this year, providing tools and education for growth in key business areas like talent retention and marketing.

“We’re making sure we’re truly supporting brokers in that journey.”

How do non-major banks work closely with you as a broker? Comment below