Mortgage Choice’s Aspire program empowers female brokers

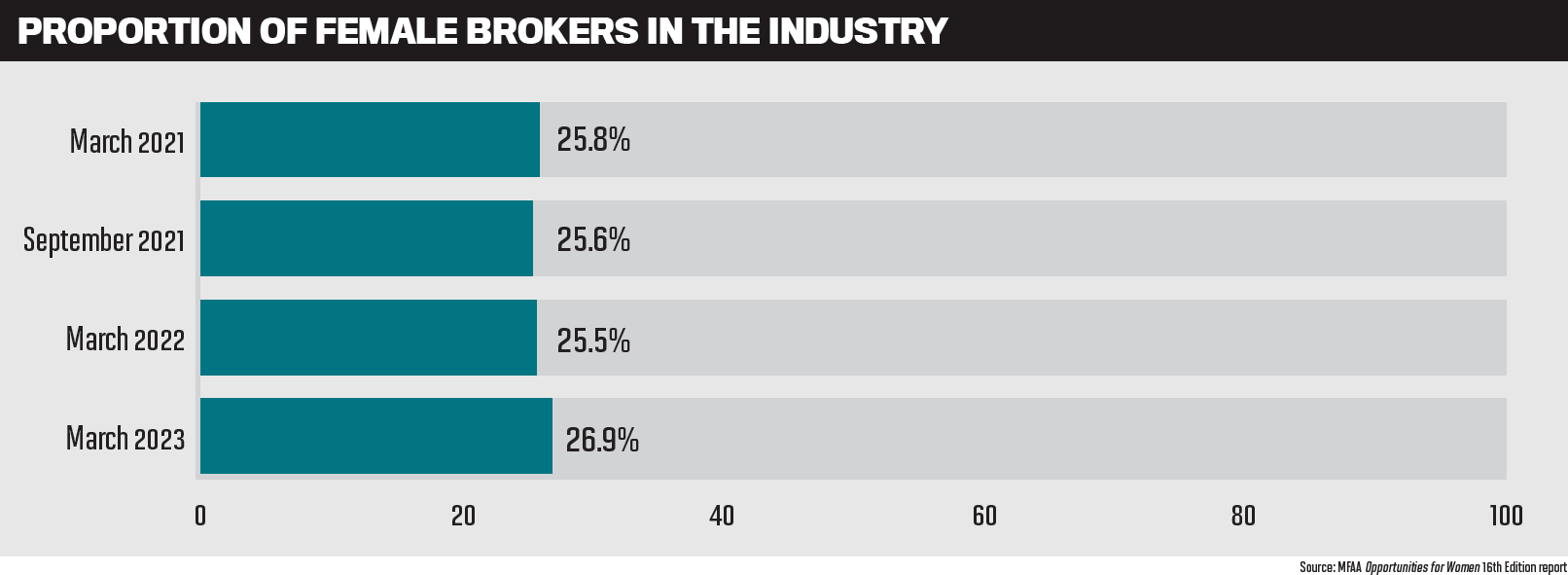

Australia’s mortgage broking industry is home to a wealth of successful female brokers and a broad variety of DEI initiatives. And yet female representation in the industry has remained stubbornly static.

The 16th edition of the MFAA’s Industry Intelligence Service report shows that even though the proportion of female brokers in the industry has risen to 26.9% (as of March 2023), the total number of female brokers has declined.

So, what are the biggest barriers preventing more women from entering the industry?

According to the MFAA, these barriers include unconscious beliefs about gender roles in the workplace; an industry culture that isn’t inclusive of women; and conscious beliefs about gender roles in the workplace, such as ‘women should not hold a position of management’.

The research also showed that while there has been growth in awareness around diversity and inclusion, 34% of female respondents cited an industry culture that isn’t inclusive to women.

Sally Chadwick (pictured below), executive manager corporate communications at Mortgage Choice, says representation is key in starting to break down these barriers. This means challenging the stereotypes around what a successful broker looks like, and putting female brokers forward for media and industry event opportunities.

“While there has certainly been positive change, the data tells us that our industry could be doing more to boost female broker recruitment and retention through initiatives that demonstrate what a great career path mortgage broking can be for women, as well as programs that support women and help them thrive once they are working as brokers,” Chadwick tells MPA.

The importance of community

For any industry that wants to increase its diversity, it all starts with sending a clear message: “You belong here”. One of the most effective ways to do this is to foster communities of like-minded people and provide support for new brokers at the start of their careers.

With these principles and the MFAA’s research in mind, Mortgage Choice launched its Aspire program in 2020. The program has since grown from a series of events to a talent development initiative for women in the Mortgage Choice network.

Spearheaded by a committee of brokers and head office staff, Aspire has received significant backing from major lenders. The program now includes masterclasses, media training, national roadshows and integrated marketing campaigns, all aimed at encouraging more women to join the broking industry and enhance their personal and professional development once they arrive.

Chadwick says, “While writing loans is a priority for all brokers, it’s important that as an industry we acknowledge that success looks different for every broker, and that we find other ways to celebrate the impact and value brokers deliver.”

Mortgage Choice franchisee Joanne Nugent says Aspire has been inspiring. “You don’t have to be the number one loan writer in the country; you can define your own success, and that’s really empowering. The Aspire program has shown me that I can be inspired by my peers who have won industry awards and built up large loan books and still feel proud of the business I’ve built.”

According to Nugent, an increasing number of women are seeking mortgage advice from brokers.

“I have seen a change in my customer base over the years, with many female customers seeking me out because they feel more comfortable discussing their finances with a female broker. Many of these customers are women who are rebuilding their lives after a separation. Working with them is so rewarding.”

For Nugent, being a broker has been personally fulfilling, and Aspire’s events and masterclasses have been pivotal to her journey.

“Being a broker is a wonderful thing, especially as a parent. It’s much more flexible than a nine-to-five job, and you can make work fit around your lifestyle,” Nugent says.

“The keynote presentations at the Aspire events and masterclasses are brilliant. While I love seeing my peers face-to-face, I also appreciate being able to tune in to a masterclass online or watch a recording at a time that suits me. The Aspire masterclass I logged into last week about conquering impostor syndrome was particularly insightful as it’s a feeling I often struggle with.”

Bojana LePoidevin, a Mortgage Choice franchise owner based in South Australia, attended an Aspire event very early in her career journey. She says the camaraderie and support she was able to access has been invaluable and has given her a strong foundation to succeed in the industry.

“My peers were all so welcoming and invited me to come to their offices and encouraged me to reach out if I needed help,” LePoidevin says. “The brokers I met were candid and open with their experiences, and it reinforced to me that I’ll be able to achieve the work-life balance I desire in this industry.”

Mortgage Choice SA/NT state manager Ben Livera (pictured below) has witnessed first-hand the success of the Aspire program and the role it’s played in boosting the careers of female brokers. He notes that when Smartline and Mortgage Choice began their journey to integrate under one brand, one of the key goals was to help brokers connect in person.

“Aspire has played a pivotal role in fostering a sense of community among the women in the Mortgage Choice network by creating opportunities for them to find common ground in a safe space,” Livera says.

“Over the last two years I’ve seen a huge change in how the women in South Australia engage with each other. I would often see attendees at Aspire events stick to the people they knew, but over the last couple of years the energy has transformed, and attendees are excitedly mingling and chatting to each other.

“Women in the Mortgage Choice network are encouraged to bring a friend who owns a business, or a referral partner, to Aspire roadshows, which has seen the events evolve beyond women in broking; they’ve become spaces for women in business too.”

Livera notes that the decision to start a business is always challenging, and so meeting peers is an invaluable source of support. Aspire has helped women form new connections that have developed over time, with many franchise owners regularly catching up for coffee or dinner.

“Women franchisees in SA/NT have even started their own group chat,” Livera says. “Franchisees tell me they often seek each other’s advice about complex lending scenarios, but, more importantly, they use the chat to stay in touch and check in with each other.”

Moving forward together

While it’s still early days in the Aspire program’s journey, the results are already impressive. In June 2024, the proportion of women brokers at Mortgage Choice was at 34% – 7% higher than the industry average. In FY24, 40% of new franchise owners and 45% of new broker recruits joining the Mortgage Choice network were women.

This reflects a gender balance that is significantly more equitable than we can see in the industry at large.

“We have seen great momentum in the number of new female franchise owners and brokers joining our network, and we’re hopeful that this trend will continue as we strive for greater diversity across the board,” Chadwick says.

“We have seen great momentum in the number of new female franchise owners and brokers joining our network, and we’re hopeful that this trend will continue as we strive for greater diversity across the board,” Chadwick says.

She adds that improving gender equality is just one way to create a more inclusive industry.

“To achieve greater diversity in the mortgage broking industry, we should look to attract brokers from all walks of life, including underrepresented groups, so that brokers better reflect the Australian community,” Chadwick says.

“Then we must ask ourselves how we’re going to retain these brokers once they have joined the industry. We need to continue to evolve and become more inclusive to ensure the long-term sustainability of the mortgage broking industry.”

Share your thoughts on what the industry needs to do encourage more women to become brokers by comment below