The First Home Guarantee scheme is helping Australians climb onto the property ladder. But there are risks

The First Home Guarantee is a first-time home buyer scheme designed to help Australians climb onto the property ladder. It lowers the home buyers deposit to 5% (and in some cases 2%) while helping them avoid lenders’ mortgage insurance (LMI).

While there are benefits, there are also risks, both for the individual home buyer and for the broader housing market.

In this article, we will explore the First Home Guarantee scheme, how it works, and whether it is worth it. Here is everything you need to know about the first home buyer guarantee.

How does the First Home Guarantee scheme work?

Under the First Home Guarantee (FHBG) scheme, eligible home buyers in Australia can buy or build a new home with a deposit of as little as 5%. For eligible single parents, that number can be as little as 2%. In either case, the home buyer does not need lenders’ mortgage insurance.

The FHBG scheme is a part of the Home Guarantee Scheme (HGS). It is an Australian Government initiative to support eligible home buyers purchase a property sooner than later. On behalf of the Australian Government, the FHBG is administered by Housing Australia.

Under the FHBG, a portion of an eligible home buyer’s loan (from a participating lender) is guaranteed by Housing Australia. That is how eligible home buyers can purchase a property with as little as a 5% deposit and avoid paying lenders’ mortgage insurance.

Participating lenders

There are 32 participating lenders in this First Home Guarantee scheme. These include the biggest mortgage lenders in Australia and non-bank lenders as well. They include the following:

- Two major bank lenders: the Commonwealth Bank of Australia and the National Australia Bank

- 30 non-major lenders: including Indigenous Business Australia; Bendigo Bank; People’s Choice Credit Union; Regional Australian Bank and Teachers Mutual Bank Limited, including Health Professionals Bank, Firefighters Mutual Bank, UniBank, and Teachers Mutual Bank

Dwelling types

Under the First Home Guarantee scheme, first-time home buyers can purchase one of these dwelling types:

- an existing house, apartment, or townhouse

- a house and land package

- an off-the-plan townhouse or apartment

- land and a separate contract to build a property

Property price threshold

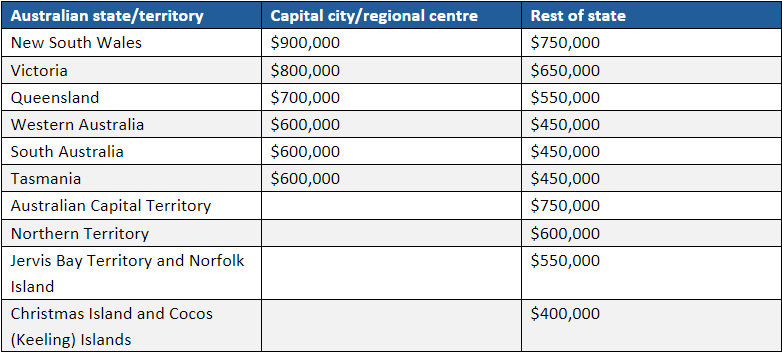

Below is a chart of property price caps for the First Home Guarantee scheme in Australia. This will help home buyers buy properties that can be covered by the scheme. Note: the property price threshold is not applicable for some capital cities and regional centres.

Property price threshold for First Home Buyer Guarantee scheme by Australian state and territory.

Who is eligible for First Home Guarantee in Australia?

Before you apply for the First Home Guarantee scheme, there are certain eligibility requirements that must be met. As of July 1, 2023, these criteria include the following:

- You must apply as an individual or as two joint applicants

- You must be an Australian citizen or permanent resident at the time you enter the loan

- You must be at least 18 years old

- You must earn up to $125,000 for individuals or $200,000 for joint applicants (as indicated on the Notice of Assessment issued by the Australian Taxation Office)

- You intend for the home to be owner-occupied. Note: the First Home Guarantee scheme cannot be used to purchase investment properties

- You are a first-time buyer or previous homeowner who has not owned a home in Australia within the last 10 years

Since July 1, 2023, the Australian Government has broadened eligibility requirements to previous homeowners and permanent residents. The government also allowed home buyers to apply for the First Home Guarantee scheme with family members or friends.

How does the 5% deposit scheme work?

The 5% deposit scheme is also called the First Home Loan Deposit Scheme (FHLDS). Launched in 2020, the FHLDS is a scheme designed by the Australian Government to encourage first-time home buyers to enter the housing market.

The 5% deposit scheme works like this. First-time home buyers with a minimum 5% deposit are not required to pay lenders’ mortgage insurance. Instead, the Australian Government acts as a guarantor for the remainder of the deposit.

Keep in mind, however, that the money does not go to the borrower. Instead, it is a guarantee that the government will pay what is owed to the lender if the borrower defaults on the loan.

Is the first home guarantee worth it?

If you are eligible for the First Home Guarantee scheme, it is important that you weigh the pros and cons before applying. In this section, we will help eligible home buyers determine whether this scheme is worth it.

First home buyer guarantee: pros

First, let’s look at the pros of the First Home Guarantee scheme.

Avoid paying Lenders’ Mortgage Insurance (LMI)

There are fees and charges that first-time home buyers should know before securing a mortgage to buy a home. One of the largest is Lenders’ Mortgage Insurance (LMI). This insurance can cost tens of thousands of dollars.

If you qualify for the First Home Guarantee scheme, you can eliminate this cost. That way, you can purchase the property sooner and pay less in fees of the lifetime of the loan.

Become a home buyer faster

One of the major benefits of the First Home Guarantee scheme is that it enables you quicker access to the property market. How? By allowing you to buy a home with a lower deposit.

Avoiding paying LMI can be incredibly helpful. Most first-time home buyers in Australia find themselves caught in an endless cycle of saving up for the 20% deposit only to learn the price has increased. This means having to go back to saving up for the new amount.

In other words, if you can avoid paying LMI, you can put that money toward a deposit.

Choose from a variety of properties

This scheme is different from the First Home Owner’s Grant, which applies only to newly built homes. The First Home Guarantee scheme can be used to buy existing homes, vacant land, an off-the-plan home, or a land and house package.

Property data and analytics company CoreLogic estimated that roughly 35.4% of Australian properties qualify for the First Home Guarantee scheme. This was based on the scheme’s current property price cap list. If home prices drop, this may mean that more properties will be available to eligible applicants.

First home buyer guarantee: cons

Now, let’s look at the cons of the First Home Guarantee scheme.

Use all your savings on 5% minimum deposit

One main issue with the First Home Guarantee scheme is that you must use all your savings on the 5% deposit. The reason is to prevent home buyers from taking advantage of the government scheme.

Pay more in interest

Buying a home with a smaller deposit means you will pay more in interest over the life of your loan. You would have to pay interest on a 95% loan, rather than typically saving for a 20% deposit and taking out a mortgage for the remaining 80%.

Face additional risks

Buying a home with a larger loan also comes with additional risks. For instance, an increase in interest rates can impact the cost of a monthly repayment. Additionally, a higher loan-to-value ratio (LVR) may also limit the mortgage lenders that are available to you in the future.

The First Home Guarantee scheme can lower your deposit to 5% and help you avoid paying LMI. But there are risks to consider.

What are the risks of the First Home Guarantee scheme?

Aside from the cons mentioned above, there is another risk involved in the First Home Guarantee scheme. That is a commercial risk factor due to the low deposit loan. That means that a buyer’s loan size is considerably larger than if they had purchased the property with a higher percentage deposit. Ultimately, they owe more.

A lower deposit also increases the amount of interest payable on the mortgage. For instance, a dwelling value of about $728,000 means the buyer will end up paying $37,000 more in interest if they have a 5% deposit compared to a 20% deposit.

And because there is a limited number of financial institutions involved in the scheme, the lenders can set higher interest rates. This is due to the lack of competition among other lenders.

Negative equity is a risk that results from the objective of the scheme: to reduce affordability issues. It’s possible that the scheme would add negative pressure to housing prices, reducing their expense.

This can pose a risk to first-time home buyers because there is the potential for the value of their home to drop below the amount they have borrowed. This situation would force them into negative equity.

First home buyer guarantee: eligibility, benefits, risks

The First Home Guarantee scheme offers Australians an opportunity to climb onto the property ladder. Through the scheme, you can pay as little as a 5% deposit (compared to 20%) and avoid LMI. Before you apply, however, it is important to learn if you are eligible. You must also weigh the benefits and the risks against your financial situation and goals.

For questions on the first home buyer guarantee scheme, talk to one of the best mortgage lenders in your area.

Do you think that the First Home Guarantee scheme is a good option for you? Let us know in the comment section below.