Major banks roundtable discusses third party partnerships

Now that the cashback battles are truly in the rearview mirror, major banks are not so narrowly focused on winning new customers – it’s keeping existing customers that remains vital in the current market.

While the figures fluctuate, it’s clear the refinancing boom is over. The latest data from PEXA’s Refinance Index for the week ending 15 September shows a 17.5% year-on-year drop in mortgage refinancing volumes.

This doesn’t mean mortgage holders aren’t refinancing, just that activity has slowed. ABS lending indicators for July 2024 show the value of external refinancing for total housing (both owner-occupier and investor) rose 4.3% to $16.6 billion but was down 21.4% year-on-year. External refinances are new loans obtained to replace existing loans provided by different lenders.

The KPMG major Australian banks half-year 2024 report shows that net interest margins continue to decline, and it’s always more cost-effective to retain borrowers on the books than to acquire new ones.

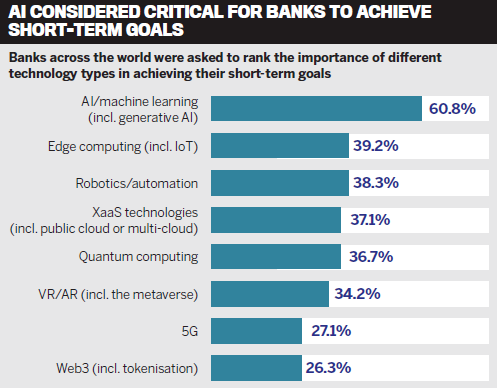

Mortgage brokers are a vital piece of the puzzle in any major bank retention strategy. The trust and confidence Australians place in brokers is at an alltime high: brokers wrote 73.7% of all new home loans in the June 2024 quarter, according to the MFAA.

With this in mind, the major banks are working hard to foster strong relationships with brokers and their clients. This includes providing support for customers undergoing financial difficulties and assisting brokers when it comes to retention conversations. But it’s also about upgrading technology, including the use of AI, to streamline and speed up loan processes and decisions, and giving customers a better life-of-loan experience.

To discuss these and other issues, MPA hosted the 2024 Major Banks Roundtable at Café Sydney. Representing the major banks were Adam Brown, executive, broker distribution, NAB; Wendy Brown, head of broker distribution, Macquarie Bank; Razia Khan, general manager third party banking, CommBank; and Sarah Willsallen, state general manager NSW/ACT – mortgage broker distribution, Westpac Group.

Broker participants included Fabio De Castro, director, Simplify Finance, and Melanie Cunliffe, managing director Indigo Finance.

Natalie Smith, general manager third party at ANZ, was unable to attend in person but provided written responses.

The home loan market remains highly competitive. Major banks face declining net interest margins, competition from non-bank lenders, and borrowers who are struggling with higher interest rates and inflation. How are you meeting these challenges and working closely with brokers who now have a market share of 73.7%?

Innovation and exceptional service, superior technology, listening to broker feedback and partnering closely with brokers to support their clients for the life of the loan – these are some of the main factors driving major banks in a competitive sector.

The major banks have adjusted to customers’ changing economic circumstances during a cost of living crisis that’s been hitting people hard.

After 13 increases to the official cash rate since May 2022, some clients’ mortgage buffers were running low or had depleted altogether. This meant both the banks and brokers had a greater focus on clients’ finances and spending habits and on helping them determine the right time to borrow rather than ‘how much can I borrow?’.

Willsallen said it was great to see so many lenders wanting to support customers into homeownership.

“That competition drives innovation, and it drives service excellence, which is good for all of us,” she said. “We do need to ensure that we manage mortgage returns to build a sustainable business, and we’ll continue to focus on the right balance of risk, margin and volume.”

Willsallen said Westpac was pleased that the investments it had made over last three years to improve broker technology, systems and tools had driven such strong improvements in time to decision and in its Net Promoter Score from brokers in the last 12 months.

Westpac has been listening to broker feedback about what it should focus on to make further improvements. “We’re committed to doing all we can to make it easier, simpler and faster for our brokers and customers,” Willsallen said.

Khan emphasised CommBank’s strong partnership with brokers. “CommBank has been supporting brokers for over 30 years now to help grow their businesses,” she said. “We understand that brokers play a crucial part in a stable economy.”

The bank has invested heavily in broker technology, such as its CommBank broker portal (Your Loans, Your Applications). It focuses on listening to brokers to understand “what they want and need”.

“We want to ensure their experiences with CommBank remain seamless,” Khan (pictured below) said. Looking at how to diversify support for brokers was also important; using data insights and analytics to help brokers understand and grow their businesses.

“We’re also doing a lot of work around diversity and inclusion, such as for women in business, and providing additional support from our sales team.”

Smith said that in a highly competitive home loan market, ANZ was committed to standing out through innovation and exceptional service.

“As broker market share reaches close to 74%, we are dedicated to enhancing our support for this important channel,” she said.

“Our focus remains on delivering differentiated propositions across all channels during these changing economic times. With significant developments like our recent Suncorp Bank acquisition and the expansion of ANZ Plus, we are positioning ourselves to better serve both brokers and their customers.”

Adam Brown (pictured below) said brokers were working in a very different economic environment than they were 12 months ago and 12 months prior to that. Despite the challenging economic conditions, about two thirds of NAB customers were ahead on their home loan payments by an average of three and a half years.

“You hear a lot about people paying ahead and building up buffers, but it actually masks those customers that are a bit more challenged,” Brown said.

Four in 10 Australians had experienced some sort of hardship. In NAB’s past conversations with brokers, customers had been focused on the maximum amount they could borrow, but this had now switched to ‘how much can I really afford?’, Brown said.

“So the conversation that you then have with brokers is really how do you support these customers through getting a home loan? And when’s the right time to get a home loan? Once they’ve actually got the home loan, how do you best support that customer for the life of the loan?”

Brown said brokers were doing a good job of providing customer support beyond the transaction. NAB is also focused on helping customers for the life of the loan, acknowledging the difficult economy and cost of living challenges.

Wendy Brown from Macquarie Bank said it was clear that the right conversations were taking place between brokers and their customers, particularly around understanding their financial situations. “We’ve noticed that in the quality of that book. Great conversations have happened – what they [customers] need versus what they want and what they can afford.”

More than 90% of Macquarie Bank’s loan flow comes from brokers, Brown said. In terms of technology, the bank focuses on providing platforms and functionality that will help brokers do business whenever and wherever it works for them.

Macquarie Bank works with brokers to provide them and their support staff with seamless access to the information they need to help them be more efficient. It has rolled out Macquarie Authenticator, a market-leading multi-factor authentication security app, to brokers and their support staff so they can feel confident that they are assisting their customers in the most secure way possible.

“For us it’s about scale and technology but for the best outcomes for the customer and broker,” said Brown. “The more control we can put in a broker and customer’s hands the better.” The information supplied in the broker portal, or that customers could see across mobile and internet banking, “helped to give confidence throughout the home loan process”.

“They can clearly see revert rates – both the broker and the customer. That element of control is really important, especially when you’re coming into a higher interest rate and inflation environment.”

Adam Brown added that the advisory role banks play with brokers and customers was very important. Over time, NAB has built up its premium access proposition, providing a team member who will work with a broker on a loan scenario before it goes to credit assessment and lodgement.

“We know brokers hate that long ‘maybe’ answer versus a really quick no or a quick yes,” he said. “Having that certainty up front, and not wasting time when there’s increased costs and increased regulation, has been really important.”

Wendy Brown agreed that it was important for lenders to provide clear credit guidance for brokers and their customers to ensure a better and more efficient experience in the application stage.

On the topic of spending and financial capacity, De Castro said roundtable participants would be surprised to know how many owner-occupiers did not have a budget or know much they could afford to borrow.

“When you ask that question, you’d be surprised how people just implode,” he said. Some clients’ redraw [facilities] were running low, and some had run out of savings. “I think the real effects of the rate rise we’re starting to see now [are] eating into buffers.”

A recent NAB consumer sentiment survey showed that almost 60% of people had cut back on eating out; 50% had reduced their ‘micro-treats’, such as buying coffee and snacks; and around 50% had scaled back on entertainment, such as streaming services.

“Twenty per cent of people have cut back on what they’re spending on their pets, such as insurance … all this money is going into loan buffers,” said Adam Brown.

Melanie Cunliffe said customers were now very cautious about their spending and the amount they could borrow for a home loan. “It’s almost like they think the credit environment is going to be so tough that they’re not going to be able to borrow,” she said. “It’s about coaching them through to the other side and reassuring them ‘we’ll be alright, let’s see what we can borrow, let’s work through it together’.

“I think people are very nervous because of interest rates that they’re going to lose that possibility of homeownership.”

What AI-driven tools or data platforms are you using, or planning to introduce, that improve the broker and customer experience? How will AI change the banking industry?

Artificial intelligence is a hot topic at present. News stories and advertising provide constant updates on the latest AI-supported products and platforms that are set to make everyone’s lives easier.

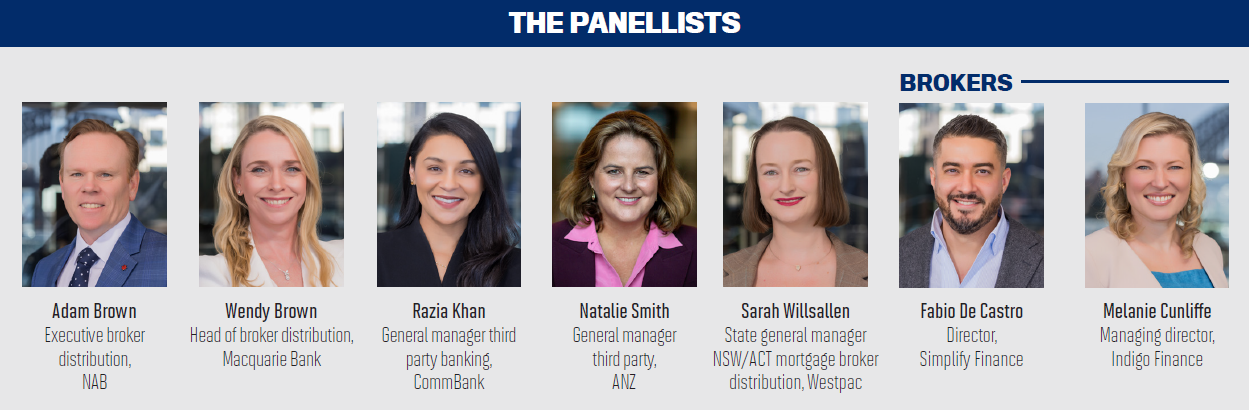

AI is also making huge inroads into the worlds of banking and mortgage broking. A September 2023 KPMG Global Tech Report found that 60.8% of banking technology leaders believed generative AI, AI and machine learning would be critical to achieving short-term ambitions.

Wendy Brown (pictured below) said it was often underestimated just how long AI had been in use. Macquarie had been investing in AI for several years in a number of different ways, alongside a range of other data science technologies, including machine learning.

“We’ve been using it for some time across different use cases; historically, for example, we would use it on the risk of a street or a postcode, or property or valuation.”

Brown said a key benefit of AI was that it freed up time to enable the bank’s teams to focus on higher-value engagements. Instead of manually reviewing documents, they could focus on engaging with and providing insights to brokers.

Macquarie Bank uses AI in the loan and documentation review processes, which helps to deliver even faster turnaround times for customers and more efficient experiences for brokers engaging with the bank. It also uses AI to detect instances of fraud and scams.

Macquarie Bank takes a copilot approach with AI, “with a human overlay, and we have found that to be very successful”, said Brown. “We work in a highly regulated environment, so it’s vital that there is the right level of oversight and governance on AI and other data science processes.”

Willsallen said she has a favourite quote when it came to AI: “I don’t want AI to paint the next Picasso for me – I want it to clean my kitchen so I have time to learn how to paint.”

She agreed with Wendy Brown that AI had been part of banking infrastructure for a long time. “We want to see where it adds value to make things faster and simpler,” Willsallen said. This includes use in document identification and verification and ensuring these are aligned with policy.

“Where it can make it faster for humans and know their cash flow because they then don’t need to check something, that’s gold,” said Willsallen. “It makes it faster and easier for our team members, for our brokers, but also means we get outcomes for customers faster.”

Adam Brown said AI is critical to driving efficiency internally at NAB but also to speeding up lending outcomes for brokers and customers. AI also detects trends in large data sets, which is valuable for combating fraud and scams and boosting security.

“We are seeing more instances of application fraud,” Brown said. “It’s an industry challenge. Some of the automation and checking is critical in identifying that and seeing some

of the patterns across our portfolio.”

At CommBank, Khan said AI and other technology is being used for fraud detection but also to help customers predict their bills and know their cash flow, often through the CommBank app.

The bank has also introduced Benefits Finder, which has put $1.2 billion in government benefits and grants back into the pockets of customers.

CommBank also generates data insights that are particularly aimed at growing broker businesses. “It can highlight different triggers that your customer may be about to refinance.

Have a conversation with them if you haven’t already,” said Khan.

Smith (pictured below) said ANZ’s commitment to leveraging technology is transforming how the bank serves its customers and supports brokers.

“Our recent partnership with Microsoft to establish an AI Immersion Centre signifies a major step forward in accelerating AI adoption across the bank.

“We’re empowering our leaders to drive innovation and enhance services. AI is integral to improving customer experiences, protecting clients and streamlining processes, all while adhering to our core principles of risk, privacy and ethics.”

Smith said that while technology evolved, it would never replace the essential human touch in banking. “Instead, AI will complement and enhance the personal relationships that brokers and lenders provide, creating opportunities for a more seamless and insightful customer experience.”

Broker question from Melanie Cunliffe: What are your plans around investing in and using AI in enhancing the ‘broker channel’ model in comparison to ‘direct to consumer’, and how are they different?

Willsallen (pictured below) said Westpac doesn’t see a difference in the way it approaches AI and technology for brokers and their clients.

“We want to make it faster for every customer, regardless of whether it’s through a broker or directly,” she said. “Our lending origination capability that manages this for us manages it agnostically across our channels.”

But there are some specific differences, Willsallen said. For example, when broker applications come through ApplyOnline it involves an assessor rather than a lender. “If the technology makes an assessor’s job faster, it’s also going to make a lender’s job faster and vice versa.”

Westpac focuses on how to make processes work faster for customers, providing quick, correct and valid answers.

Khan said introducing AI policies and processes is occurring faster with brokers than consumers. “Because we’re dealing directly with brokers, we can be faster with the right compliance overlay … with direct to consumer, there’s a few more checks and balances that we need to be confident of.”

The digitisation quality in CommBank’s loan application processes remains the same for both broker and direct-to-consumer channels. “Our goal is to try and digitise a big part of the back end so brokers and lenders get a faster time to yes,” Khan said.

Adam Brown said NAB continues to work on its new origination platform. “We’ve got one in three of our unconditional approvals going through the new platform. We started with the broker channel because we’ve got 60 to 65% of our [loan] flow coming through the channel,” he said.

Brown said that when it comes to digitisation and AI automation, it makes sense to start where the volume of business is the greatest – the broker channel. “In the face of increasingly sophisticated scams, it’s imperative that brokers and banks alike invest in robust processes and cuttingedge technology to enhance our prevention and detection capabilities.”

NAB’s proprietary channel and commercial broker business will also be included in the one origination platform, providing a similar experience for customers no matter the channel.

“It’s build once and apply to all, as opposed to the past, where many of us looked at channel-by-channel decisions,” Brown said. “That’s not efficient; it’s costly, and it’s hard to maintain.”

Wendy Brown said that at Macquarie Bank the approach used to be to trial technology tools in the direct-to-consumer channel first and then “iron out any kinks” before rolling the functionality out to brokers. But the bank has evolved that process to pilot new technology with a group of brokers first before launching more broadly, and this has worked successfully.

“Broker feedback is so important to us, and we know that our perception of what they want and need, and what takes time in a broker business, may be different to their perspective, so this process is important to get a deeper understanding.”

Transparency is key, Brown said, and Macquarie has a consistent approach, reinforcing the broker’s brand in market.

De Castro (pictured below) said everyone seemed to agree that AI was not being used to replace people’s jobs but to boost efficiency.

“I love AI because if it makes you [banks] more efficient, it makes me more efficient, and that leads to retention.”

He said it also meant that banks could allocate resources to make sure that RMs and BDMs were meeting brokers, uncovering their needs and helping them grow their businesses.

De Castro said he loved the fact that broker market share had almost reached 74%, but he believed some brokers had the attitude that this meant ‘banks need brokers’.

“We need each other,” he said. “We need to remember we’re all on the same path. We’ve got to evolve together as an industry.”

He hoped the “old-school mentality of brokers that played golf and lived on trail” was gone. “It’s a bad image for people like me who are trying to build actual businesses,” De Castro said. He said he hated rewriting loans because doing that meant his books size wasn’t growing.

“It’s about that partnership [with banks]. What can we do to empower customers to stay where they are?”

Broker question from Fabio De Castro: What tools and processes are being implemented to empower brokers in retaining our mutual customers?

Leading into to his question for the major banks, De Castro said they all did an amazing job, but retention was challenging. He gave the example of going to a client’s bank, trying to get a better loan deal, and being given an offer that did not meet the customer’s expectations.

He would do all the work to find a better rate at another lender and gain approval for that loan, only for the original bank to say at the last minute that it would match the rate.

“This makes me look bad because I’m the introducer, and the client will think next time I will go to NAB or CBA directly because I can get a better rate … I’m a small business owner, so earning and keeping trust, it’s one of the hardest things to do.”

The second issue was all the paperwork and time he had spent going to another lender to get the loan approved when the original lender could have provided the broker with a better rate initially.

De Castro said brokers that didn’t churn their books and retained clients with the same lender should be empowered.

Regardless of whether a broker reached out through the portal or their customer contacted Macquarie directly, Wendy Brown said there was a consistent rate that remained in place for 90 days, which was a fair and transparent approach that provided everyone with confidence.

De Castro said that if all banks could agree to prices remaining in place for 90 days, that would be best practice.

Khan said there were always opportunities to improve bank processes for brokers. About two years ago, CommBank had stopped making outbound calls once the discharge process was in place.

“We offer a discharge form at the time the customer made the call,” she said. “At that point we give you your pricing. If you don’t want to accept the pricing, we give you a discharge form. That will be the last interaction.”

Willsallen added that Westpac had invested significantly in its pricing tool to provide the best possible pricing for customers through the Broker Hub.

“That now matches what historically the customer might have needed to ring our retention team to be able to get, which really supports the broker,” she said.

“The other thing we’ve been piloting is that when we do get a discharge request for a broker-managed customer, we actually ring the broker.”

Cunliffe said she had received a call from Westpac Group under this process. “The call wasn’t, ‘hey, we’ve received a discharge request’,” she said. “It was, ‘one of your clients has talked to us about if I do want to discharge the loan, what does that look like?’ They haven’t actually requested the form, but we were really surprised and pleased to get the call.”

Willsallen said an almost 74% broker market share across the industry was really strong, but it also meant one of the challenges was customers dealing with multiple brokers at once.

“That’s a change in customer behaviour that we didn’t see five or 10 years ago. We want to help support our partners and set up long-term partnerships. It’s about making sure brokers have that visibility.”

Wendy Brown agreed that a new dynamic was in place. “It used to be branch to broker; it’s now broker to broker.”

What strategies and programs have major banks implemented to support customers struggling to meet their mortgage payments, and how can brokers assist in connecting these customers with the assistance they need?

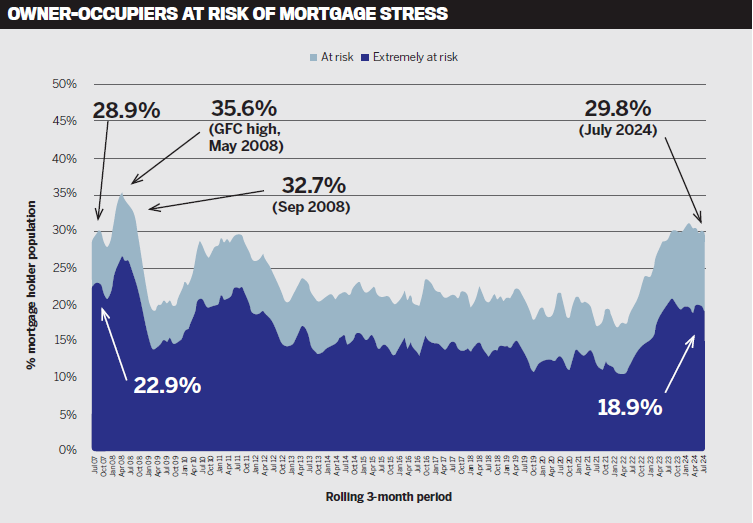

According to the latest Roy Morgan research,29.8% of all mortgage holders (equivalent to 1.6 million people) were ‘at risk’ of mortgage stress in the three months to July 2024. This represented a drop of 0.5% points on the June figures after the introduction of the Stage 3 tax cuts in July increased household income for millions of Australians.

Since May 2022, when the Reserve Bank began lifting interest rates, the number of Australians ‘at risk’ of mortgage stress has increased by 797,000.

So, how are the major banks helping those who are struggling?

Wendy Brown said it was all about providing transparency and giving customers the ability to check their revert rates and review their own pricing with the support of a broker. “I say this every year: when a customer feels like they are struggling, engage with us early,” she said. “The earlier we know, the earlier we can support, and often the outcome is much better.”

Many Australians are feeling cost of living pressures, Willsallen said. “We encourage any customer doing it tough to get in touch with us sooner rather than later to discuss options. There are so many options available that we’ve got dedicated teams standing by ready to assist, and we can offer them a really tailored, individualised hardship approach.”

Adam Brown said he was very proud of the NAB Assist team, which helps customers with restructures, repayment holidays, long-term extensions and payment breaks.

NAB has set up an internal counselling service for people who are doing it tough. It’s run by a third party and available to bank staff as well as brokers.

“Brokers are Australian customers as well, and they’ve got small businesses, and they’re feeling the same pressures, and sometimes they need someone to talk to,” Brown said.

He added that NAB’s role in the community is important – extending beyond supporting those with cost of living pressures to helping people who have suffered from bushfires and flooding by providing grants “to help them get back on their feet”.

Smith said, “ANZ remains steadfast in our commitment to provide support to those customers facing financial difficulties. With home loan hardship rates increasing across the sector – although still at a relatively low base historically – our strategy involves proactive engagement and a range of tailored assistance options.”

The bank has also enhanced its outreach with initiatives such as proactive hardship offerings and simple payment reminders. ANZ’s dedicated teams, including Customer Connect and the Extra Care Hub, are focused on delivering personalised support that takes an individual customer’s circumstances into account.

“Brokers play a vital role in this ecosystem by connecting customers with these resources, ensuring they receive timely assistance to help navigate their financial challenges,” Smith said.

Khan said she highlights to brokers that if they believe their customers are experiencing any form of financial stress, they should reach out early to CommBank’s hardship team and encourage the customers to contact the team.

“We’ve just introduced a whole new range of offers which are bespoke to what that customer needs at that point in time.”

CommBank also operates a cost of living hub, money management tools and financial support. “We’re doing quite a lot to really help

educate customers.”

Wendy Brown said it was the banks’ role to assist customers suffering hardship. “It’s important that customers recognise the options available to them, such as reduced payments or financial hardship support measures. We want to ensure that people don’t go into arrears, and we are trying to set up our customers for success.”

Cunliffe (pictured below) said sometimes when clients raised their financial hardship with their bank, it had affected them negatively down the track, with loan increase rejections, for example.

“Sometimes they’ll say, ‘why did the lender offer it to me if it was going to potentially impact me in the future?’. ”

In these cases, Cunliffe said it was valuable for brokers to have conversations with their clients to make them aware of the potential impacts if they tell the bank about their financial difficulties.

Considering underlying inflation, unemployment and other economic factors, where do you see the lending landscape heading in the next 12 months, and what are you doing to prepare for these market changes?

Khan said the economy is still absorbing the shocks of the past few years, but CommBank remains focused on supporting brokers.

“Higher rates have had the intended effect of lowering household demand. Inflation is falling, but the pace has slowed.

“Households are finding it more challenging to respond to the higher price environment. We’re also anticipating some relief this year, with disposable income set to rebound, but it will be important to keep demand constrained across the economy so that inflation returns to the target band.”

Khan said domestic challenges remain, including productivity growth and housing affordability, but Australia’s economy is still fundamentally sound and stronger than many international markets.

“Unemployment remains low, business investment high, and exports are strong.”

Willsallen said that as Australia’s first bank, Westpac has a long history of helping customers navigate various economic cycles, each with their own mix of challenges and

opportunities.

“Homeownership will continue to be a very important part as customers seek to secure their own slice of the Australian dream – whether it’s first homes, upgraders, downsizers, investors or sea changers,” Willsallen said.

Westpac is proud of being a Home Guarantee Scheme partner. The bank’s own family guarantee policies also enable different pathways to homeownership.

“Our focus is on continuing to make improvements to our systems, tools and processes so we can be faster and easier to do business with,” Willsallen said.

NAB economists have predicted a cash rate reduction in May 2025, said Adam Brown. “We’re still expecting growth in our economy, and that’s the message. It’s slowing but still growing,” he said.

“We’ve still got strong employment, and while we continue to have a robust workforce and low unemployment, then we’re weathering the storm better than most. We see unemployment increasing a bit, but still below pre-COVID levels.”

Wendy Brown said Macquarie Bank economists believe the first RBA cash cut will happen in February 2025. “However, we are mindful of the current uncertainties with respect to the global economic outlook. If there was to be weaker than expected global economic growth in that period, the RBA would take that into account.”

As Australia faces a landscape of intense competition and economic pressures, Smith said ANZ is committed to standing out through exceptional service and innovation.

“Looking ahead, we’re preparing for the future by seeking to help more customers following the Suncorp Bank acquisition and expanding our ANZ Plus platform.

“We are dedicated to refining our home loan processes by listening to broker feedback, investing in team upskilling and enhancing broker tools. Our goal is to lead with a streamlined, superior service that meets the evolving needs of both brokers and customers.”