Communication vital for tapping into refinancing market

The refinancing boom is well and truly in the rear-view mirror, and activity has dwindled since the peak in mid-2023. It will be no surprise to mortgage brokers as the data backs up what many will have experienced – fewer clients are refinancing their mortgages.

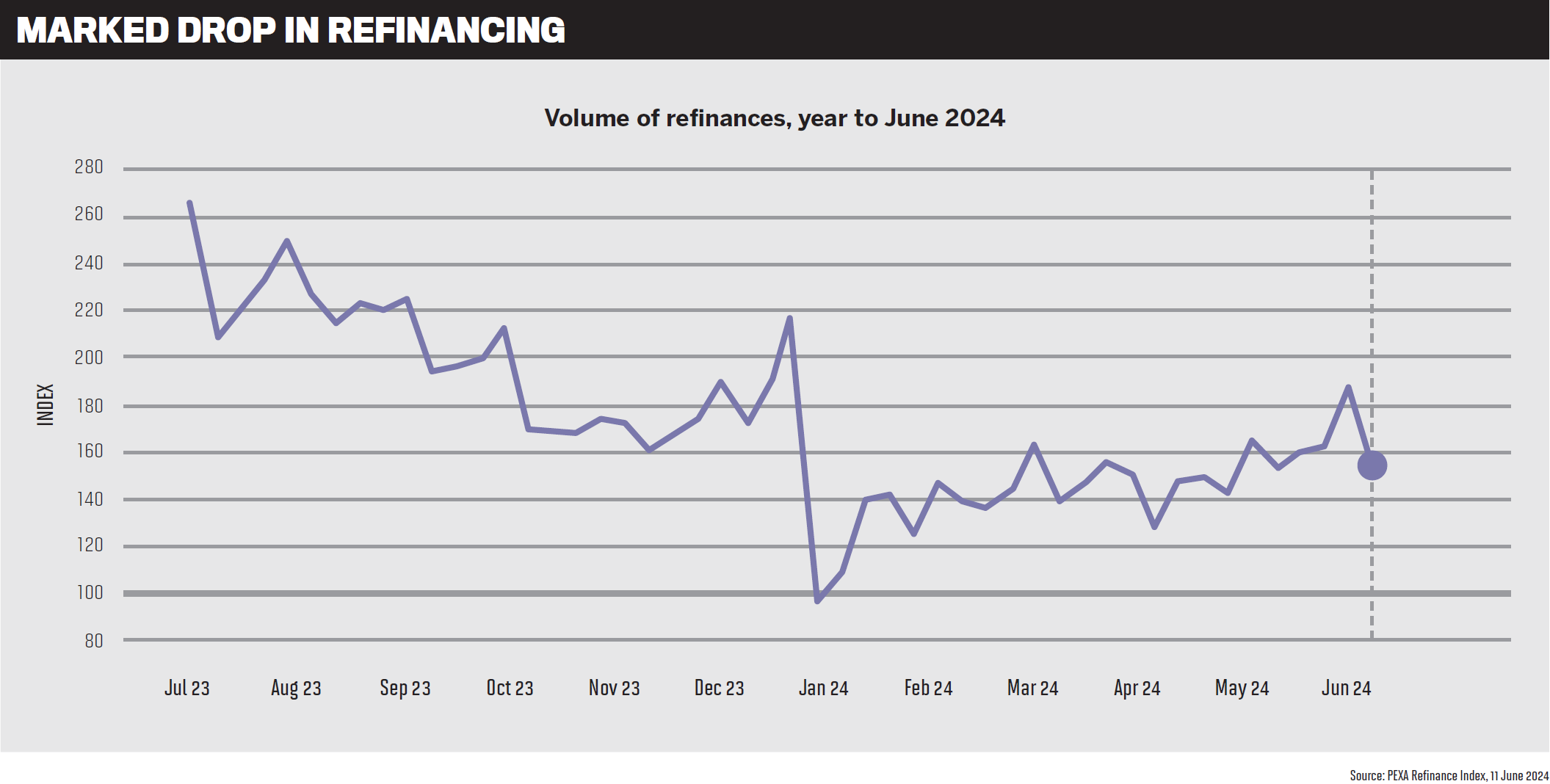

The PEXA Refinance Index, which measures the volume of refinances, shows that as of 9 June 2024, the level of refinances was down 28.8% compared to the previous year, although it had risen almost 12% quarterly.

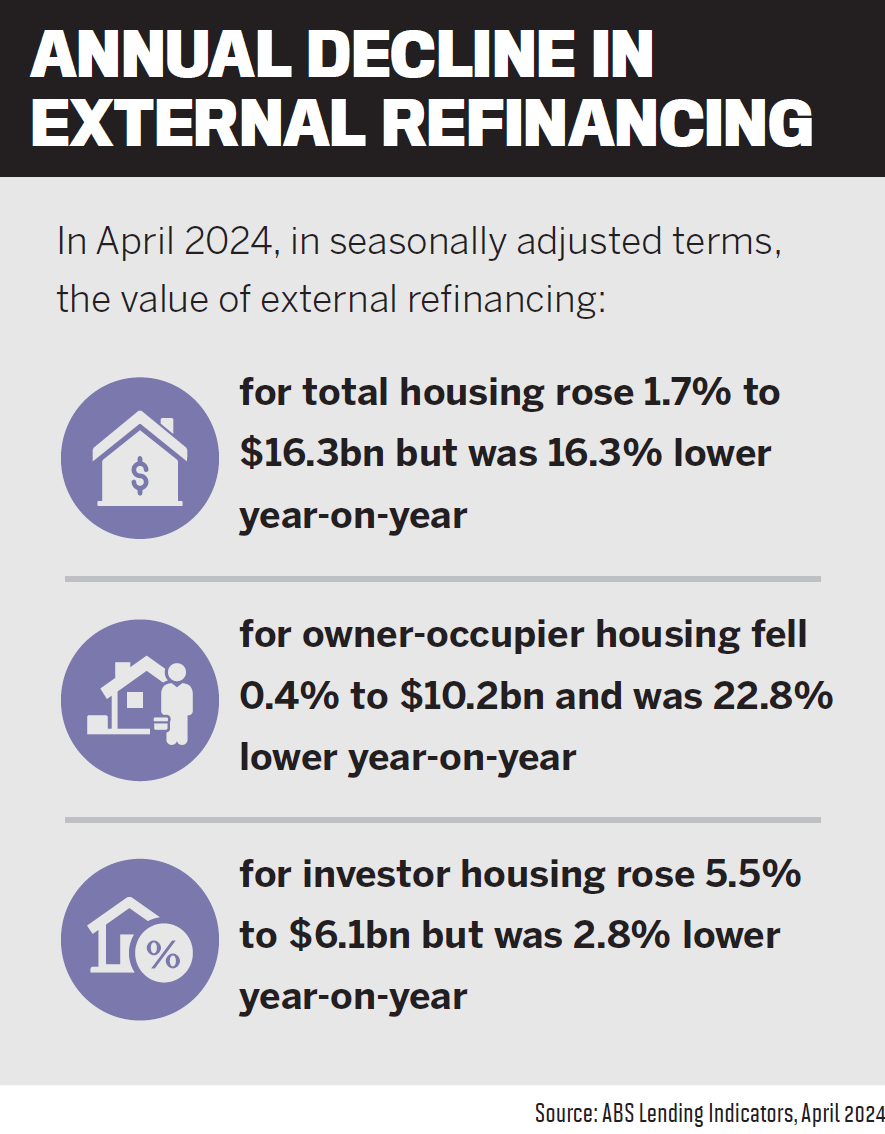

ABS lending indicators for April show that the value of external refinancing for total housing was 16.3% lower than a year prior. For owner-occupier housing it was down 22.8% and for investor housing it fell 2.8%.

There are a number of factors behind the drop-off in refinancing activity. Cashback offers from lenders have declined considerably; the Reserve Bank hasn’t changed the official cash rate since October 2023; borrowing capacity has eroded; and due to serviceability constraints, some mortgage holders are unable to refinance.

On the flip side, brokers are in a strong position to help borrowers, enjoying record home loan market share of 74.1%, with more and more Australians relying on their exper-tise to get them a better loan deal.

There are still opportunities for brokers to assist customers wanting to refinance, especially those who are only now coming off their fixed rate loan terms.

To understand what’s happening in the refinancing market, MPA sought expert insights from Natalie Smith, general manager at ANZ Retail Broker, and Johnny Lockwood, general manager broker and strategic partnerships at BOQ Group, which includes ME Bank.

Refinancing trends

Refinancing volumes peaked around June 2023, following the cycle of RBA interest rate increases that led to customers seeking better rates.

“External refinancing has declined notably since peaking in 2023,” Smith says. “It’s likely that there are less borrowers seeking to refinance to a loan with lower rates, with most rates not changing over the last six months.”

There are also fewer borrowers rolling off fixed-term loans and looking for the lowest available variable rate loan, with expiring fixed rate loans having peaked in 2023.

Lockwood says there was a surge in home-owners refinancing their home loans early last year. “As borrowers moved from lower fixed rates to higher variable interest rates, they sought more competitive loan options and attractive cashback offers, resulting in record levels of refinancing activity,” he says.

Momentum began to taper off in the second half of 2023 as lenders, who were facing increased funding costs, started to scale back their acquisition strategies. Some lenders reduced or removed cashback offers that had previously enticed borrowers to refinance, leading to a decline in loan volumes, Lockwood says.

“With interest rates likely at peak levels, borrowing capacity has weakened … coupled with the challenges of higher borrowing costs, ongoing cost of living pressures and economic uncertainty, the demand for home loans is expected to remain subdued until there is some relief in interest rates.”

For brokers, it’s important to understand which customer segments are seeking to refinance now. At ANZ, Smith says most current ‘refinance’ customers are owner-occupiers. They equate to about 70% of the refinance book, with investors at 30%.

“No matter their circumstances, customers want to deal with brokers who understand their needs, provide accurate information and explain their loan options clearly,” she says. “Whilst borrowers are reviewing their loans more regularly, they still value the support, choice and convenience that brokers have to offer.”

Smith says brokers can find ANZ product information, rates and offers on the ANZ Broker Portal and anz.com.

The bank has also introduced the ANZ Home Loan Offer Selection tool, a digital process available through the ANZ Broker Portal. Smith says it’s a time-saving and convenient way for brokers to request available home loan offers for their eligible customers.

“Now is a great time to consider ANZ for your home loan customers eligible for a great refinance offer. Refinance your customer’s eligible home loan of $250,000 plus and 80% or less LVR to ANZ and they could get $2,000 cashback*.”

ANZ is aware that some brokers are working with self-employed customers, Smith says, and “where these customers have a home lending need, we have a range of income verification options for self-employed applicants”.

Lockwood says, “ME continues to see predominantly low-LVR owner-occupied refinancers in the market. However, there is an emerging upward trend in the higher-LVR segment, specifically for owner-occupied loans exceeding 80% LVR.”

He advises brokers to take the time to thoroughly understand their clients’ unique situation before presenting them with loan options.

“There is no one-size-fits-all approach when it comes to choosing between fixed and variable rates; in fact, splitting between the two could be a beneficial strategy for certain clients, balancing stability and flexibility in times of uncertainty,” Lockwood says.

“Keep an eye out for customers who have built up equity in their home, as you might be able to secure them more competitive loan terms.”

Fixed rate roll-offs

Lockwood says in late 2023 the number of ME customers transitioning off fixed rates reached its peak. “While most of our customers who were on lower fixed rates have now reached maturity, there are still some customers in this category who are yet to transition.”

To support these customers, he says ME maintains a close partnership with its broker network. Fixed rate expiry notifications via email serve as a proactive tool for brokers, alerting them when a shared customer is nearing the end of their fixed rate.

To support these customers, he says ME maintains a close partnership with its broker network. Fixed rate expiry notifications via email serve as a proactive tool for brokers, alerting them when a shared customer is nearing the end of their fixed rate.

“This prompts timely outreach from brokers, enabling them to check in with clients and facilitate pricing requests for retention.”

ME has developed a robust engagement plan tailored for customers approaching fixed rate maturity. It uses multiple touchpoints, including email, phone, mail and SMS, over a 12-month period, to empower customers with knowledge and options well in advance.

Lockwood says new procedures also help the contact centre team identify potential triggers for home loan retention. And rate rise navigation hubs have been launched, offering calculators, tips and tools to educate customers about rate changes and the options available.

Smith says about 5,100 customers who were refinanced to ANZ and introduced via a broker are yet to roll off low-rate fixed term loans.

“It’s important that we continue to provide a compelling proposition for our existing customers as well as for those looking to refinance through a broker. Our existing customers want confidence that they’re receiving a good deal, so ANZ proactively contacts broker-introduced customers with expiring fixed rates at di erent points of their journey.”

Smith says eligible customers can opt to receive a discount on the applicable variable rate once their fixed rate expires, or to take advantage of ANZ’s current fixed rate offers.

Customers who seek to increase their loan or apply for further lending are referred back to their broker in the first instance. For new customers exploring a better home loan deal through their broker, a streamlined OFI refinance process is available when certain eligibility criteria is met.

Streamlining the refi process

Brokers are busy people dealing with multiple clients, so fast turnaround times and efficient loan processes are important.

Smith says ANZ has several streamlined processes for brokers to ensure refinancing is fast and efficient. These include ANZ’s Simpler Switch policy enabling brokers to provide a convenient refinance process for eligible customers, with less paperwork.

It’s available to eligible PAYG borrowers, and self-employed customers who meet ANZ’s company wage policy, who are switching between similar term loans or to a lower-cost ANZ home loan, where the minimum repayments on the new ANZ home loan are equal to or less than the current repayments on their OFI loan. Certain other eligibility criteria also apply.

Smith says because Simpler Switch uses comprehensive credit reporting to verify a customer’s ability to meet their existing commitments, there’s no need to supply any income documents as part of an eligible application.

Lockwood says ME plays a crucial role in BOQ Group’s multi-brand business strategy. Focused on simple, low-LVR lending, the bank offers brokers and customers competitive rates and impressive turnaround times. Broker partners also benefit from the dedicated support of their BDMs.

“We are committed to investing in and expanding our ME broker channel,” says Lockwood. “One of the most exciting advancements is the ongoing development of our new digital end-to-end home loan offering, designed with the broker experience as top of mind.”

ME is dedicated to enhancing service efficiency and satisfaction for brokers and shared customers, Lockwood says.

*Offer can be withdrawn at any time. Limit of one cashback within any 12-month period. O er is $2,000 cashback with 80.00% LVR or less; loans with LVR above 80% are not eligible for cashback. Paid within 60 days to an eligible ANZ account. You must draw down the Eligible ANZ Home Loan(s) within 120 days from applying. Fees, charges, eligibility criteria apply