A group of aggregator leaders and brokers met up at MPA's annual roundtable to discuss the lessons they have learnt and what the future holds

From adjusting to new technology and work patterns through the COVID-19 pandemic to lobbying the federal government to protect broker remuneration, aggregators have had a lot on their plates over the past two years. As the property market boomed and there was a huge increase in loan volumes, they worked hard to assist their broker members in getting the best finance deals for their clients.

MPA’s annual Aggregators Roundtable recently brought together aggregator leaders and brokers at Café Sydney to discuss the pandemic, technology, streamlining applications and turnaround times, channel conflict, the broker remuneration review and female broker numbers.

In attendance were Tanya Sale, CEO, outsource Financial; Brad Cramb, CEO distribution, Lendi Group; Blake Buchanan, manager of aggregation, Specialist Finance Group; Theo Chambers, CEO of brokerage Shore Financial, and brokers Mhairi MacLeod, managing director, Astute Ability Group, and Mario Reyad, lending specialist, Expert Mortgages.

Brendan O’Donnell (pictured immediately above), managing director, Liberty Network Services, was unable to attend in person but provided his views in writing.

Q: The COVID-19 pandemic seems to be firmly behind us. What are the biggest lessons learnt, and how do you operate differently now?

Tanya Sale said a lot of people in the industry had learned how to operate differently during the pandemic.

“Virtual was the new buzzword back then, and it’s probably still the buzzword today,” she said.

“We also see the flexibility in the working environment. For all of us who were working at home for such a long time, and I know for outsource, the productivity went through the roof.”

Sale said outsource Financial soon found that the team was working at all hours.

“Whilst it was a good thing for the business, it wasn’t such a great thing for one’s mental health or your morale.”

Coming out of COVID, she said staff had maintained a balance, splitting time between home and the office.

“We have two to three days that our team must be around face-to-face or on the road; the other days we allow the team to work from home, allowing more flexibility.”

MacLeod (pictured immediately above) said it was clear that lenders had the technology pre-COVID, but some weren’t giving it to brokers.

“You have to ask the question, ‘Why did it take an event such as COVID for many to release digital solutions that were already available and have been asked for by brokers for quite some time?’

“Potentially, lenders were going to lose huge market share if they couldn’t wet-sign [borrowers] on glass and they couldn’t do face-to-face interviews,” she said. “So again, why did they put us through that pain for years prior when they had the technology already available? Perhaps they have been protecting their market share against the best interests of the customer?”

MacLeod said it begged the question as to what other technology is coming that lenders are going to push back on.

“I think we as brokers or aggregators probably need to ask those questions: Who’s not signing on glass? Who’s not giving us the flexibility? And if you guys aren’t doing that, how can we work together to solve the problem and get on with helping our customers more efficiently?”

Necessity is the mother of all innovation, Cramb (pictured immediately above) said, so there was a period when everyone was forced to change.

“I agree, Tanya, that the learnings from our point of view – agility and speed were the differentiator. Number one: those that moved quickly obviously took market share, and that hopefully will echo through the future.”

Cramb said the second point was that the workplace had changed forever. Brokers held virtual meetings, and Aussie and Lendi team members had a hybrid work model: the Lendi Group’s Flex First policy enables a balanced approach with some time working from home.

“The third key point was that technology should enable human interaction and can’t replace it,” he said. “So how do we find the hybrid between the two? And we saw some great technological innovations.”

The great news was that customers’ expectations had totally changed and not just in the mortgage industry, he added, so brokers and lenders were judged on customers’ tech experiences in other industries.

Buchanan said, “Technology advancements have built a better way for us to transact. Human interaction and what we learned throughout COVID have brought us closer than ever to our members. It’s become abundantly clear that empathy, compassion and high engagement with our group are paramount to a great business relationship.”

He agreed that technology couldn’t replace humans. “You can’t replace that validation – that structuring and that comfort you get from an expert who knows what they’re doing by validating the structure and solution to your need.”

Buchanan said SFG brokers working from home went from doing eight- or nine-hour days to 12 to 15 hours a day. For those who were finding it hard to balance this change in arrangements, SFG needed to ensure they were supported.

“It’s really [about] engaging with our members to make sure that they’re taking care of themselves and knowing that we’re available should they need us,” he said.

Chambers said technological advancements, efficiencies with online documents, and being able to VOI via FaceTime had all saved time. “However, I don’t 100% agree on some brokers, some staff working better from home. It’s a very case-by-case situation. We’ve got maybe 60 people on our team; half the team are able and still efficient whilst working from home, the other half not so much – some unable and some decreasing in efficiency.

“Some people might have kids and a partner in the background running around, and it’s distracting,” he said. “Some people who are young might be room sharing, and they’ve got flatmates that they’re having to try and work around as well.”

Chambers said Shore Financial’s culture and camaraderie were affected by COVID, and he tried to maintain it with, for example, virtual drinks on a Friday afternoon through FaceTime or Zoom, but “it didn’t quite work”.

So he took the opportunity to find a bigger office space during COVID that was “more new-age” and featured private rooms for Zoom meetings, a podcast room, hot-desking and a breakout room to encourage people to come into the office, share ideas and collaborate.

“We found the new office did drastically improve the culture and camaraderie again, bringing the team back together to collaborate and work as one,” he said. “The team was partly fragmented prior to this.”

Sale said she had never been a fan of people working from home. “But in COVID it changed my mind because we have a great team, and they’re as passionate about outsource as I am. But what I didn’t change my mind on is wanting balance. Connectedness is imperative and something I never want outsource to lack; I want the team out and about seeing the members.”

At Liberty Network Services, O’Donnell said one of the key learnings was the value of flexibility.

“While Liberty Advisers have always prioritised customer convenience, the pandemic required us to rethink our standard business practices and introduce greater online support options,” he said.

O’Donnell said these accommodations had proved particularly vital for those in Melbourne and Sydney who endured multiple lockdowns, but the benefits extended much further than initially expected.

“For many customers, flexibility truly is paramount – not just in terms of their loan options but in the way they engage with their mortgage broker and other professional services,” he said.

Reyad (pictured immediately above), who has been a mortgage broker for four years, said there had been a lot happening since he started in the industry, with the royal commission and then COVID.

“I see that as a blessing and a bit of a curse. The blessing was definitely the fact that this was it for me,” he said. “I came in and I deep dived and understood the lay of the land, whereas I think for some other brokers, it was a big shift.

“My wife and I had a baby during COVID, which all parents will know is a massive shift in your normal routine. Add lockdown to that, and I found myself working more than I normally did, and I was putting in extra hours.”

Reyad said he really focused on having conversations with his clients, emphasising to them that after COVID “anything can happen”, and they needed financial buffers in place.

Q: Technology is changing rapidly. How is technology helping improve aggregator operations and broker businesses?

Buchanan said SFG was blessed as it already had a great system with VOI and video conferencing systems built into it.

“So with COVID, we didn’t have to make any changes to our system and technology, which was a fantastic thing.”

Some lenders enforced new ID and other metrics, but SFG brokers were already doing that anyway through a digital process.

“We’re always looking to the future of broking and to deploy new technologies, partnerships and processes today so that our businesses are future-proofed and tomorrow-ready,” Buchanan said. “Having COVID-ready systems and processes available pre-COVID is great evidence of this.”

He said technology hadn’t stopped shifting: SFG saw more innovation coming, including direct access through CRMs to lender gateways and decisioning tools.

Now a broker would go out with loan options they might recommend for a client or they might choose, but in the next three to five years you would see them coming back as conditionally eligible loan options for their customers.

“That’s only going to happen through digitisation and the ability for a broker to

pick up a loan application and put that into the decisioning system of a lender that talks straight back in real time,” Buchanan said.

CDR (the Consumer Data Right, or open banking) would also come into play, and Buchanan said this would place downward pressure on SLAs and provide a better service to brokers and their customers.

At present brokers were looking at data, compiling an application and giving it to a lender to validate. “When CDR comes into play, the data that the broker looks at is exactly the same as what the lender looks at, and it can’t be compromised. It’s going to speed up those efficiencies as well,” Buchanan said.

Sale (pictured immediately above) said the lenders and aggregators now had more advanced systems in place, which allowed them to identify circumstances much more efficiently that involved fraud.

“At the moment, we’re seeing a big thing in the industry on salary staging, but the aggregators and the lenders are able to jump on that quite quickly because of all recent technological advances that have enabled us as business partners to be more connected and to stamp out this kind of behaviour within our industry,” she said.

Chambers said fraud had increased during the pandemic because more people went online and seized information. However, Sale added, technology meant the industry was able to deal with it a lot quicker.

Buchanan said that when one-touch payroll systems and validation by a broker were eventually introduced, a broker would not only be able to see clients’ credit history through CDR but would also be able to vali-date that income through the payroll system.

“We’re providing a more holistic digital solution for every area of the finance application: cost of living, validation of income, validation of other debts, and credit history.”

Cramb said Lendi Group was in a fortuitous position because its platform, especially the proprietary knowledge, was fit for purpose.

“This industry is famously disjointed, overly complex, stressful; it’s hard. It’s hard for customers, and therefore it’s hard for brokers.”

Cramb said the average loan was 600 pages long and took 18 hours to reach settlement, which were long times and led to big costs for broker businesses. He said Lendi obsessed about these things every day and tried to remove the costs and minute processes and automate them as much as possible through ID verification and validation of income and expenses.

Lendi has five lenders already using its Approval Confidence tool, which hardcodes the lenders’ pricings and policies into its systems. Cramb said there were moves afoot for this to be included in the lenders’ decision engines. “So we can give brokers and customers confidence that that loan is going to be approved … we want to create that seamless environment for our customers and of course for our brokers as well.”

Sale said outsource, along with SFG, was using the Salestrekker CRM, and as an aggregator it met regularly with Salestrekker to predict things in advance.

She said some outsource members were concerned about the impact of fintechs and digitalisation of the industry. “So in conjunction with Salestrekker, a system was developed called a WebLoanQ.” This gives outsource Financial’s brokers who choose to implement WebLoanQ an advantage because it links into the broker’s website and allows them to be “a little bit of a fintech, in accompaniment with being a mortgage broker”.

“They diversified into a generational demographic that they were previously missing out on,” Sale said.

Q: How do you work closely with lenders to streamline loan applications and reduce turnaround times?

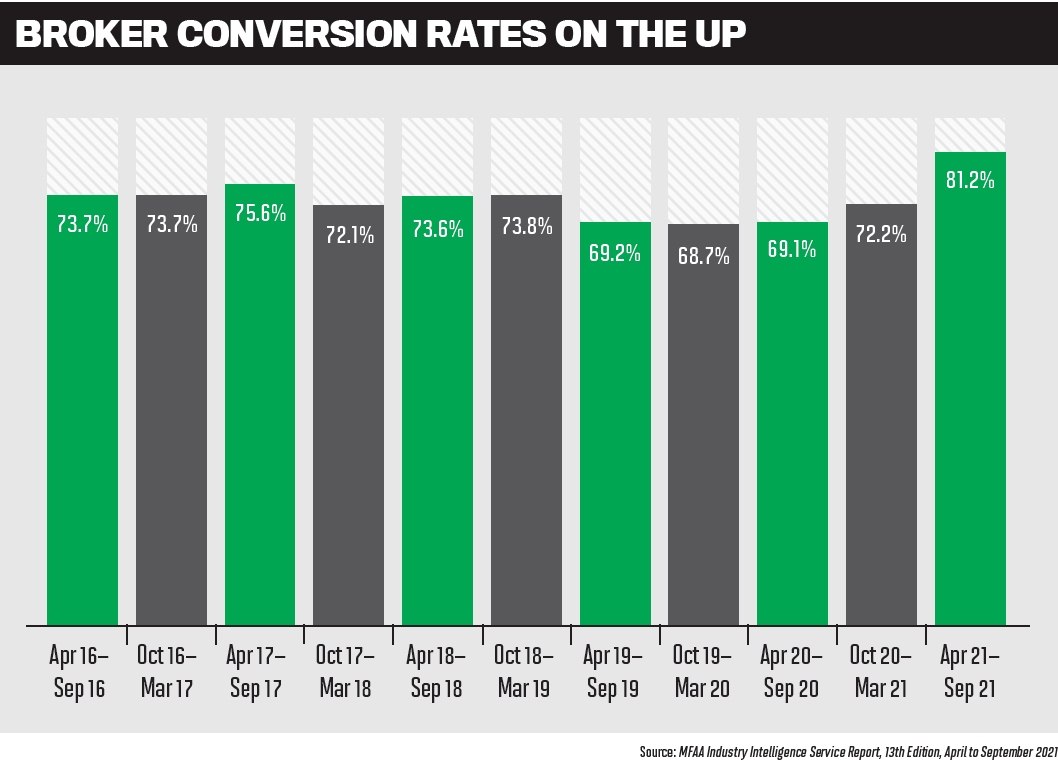

Buchanan said that out of 10 loans submitted, fewer than seven were settled. “That means that three loans are worked on, and that time is wasted looking at those three loans; they’re never going to go anywhere. It’s never going to be perfect, it’s never going to be 100%, but can we increase that rate to eight out of 10? Absolutely.”

Those loans that were never going to succeed contributed to the delays in SLAs for lender assessments.

Buchanan said brokers needed to get better at handling those loans, and this could happen through training and education but also with access to digital technologies and crucial areas of data that helped a loan go through to the right lender the first time.

“One of those areas of data would be credit checking,” he said. “So 10% of the time, files fail simply because of adverse credit scoring, unknown discrepancies, whether it be judgments, defaults or bankruptcies.”

Brokers could improve processes, turnaround times and the customer experience by running soft-touch credit checks on those clients so that information was known before supplying the loan.

Buchanan said brokers were also relying on the lenders getting better too, and the only way to do this was through improved transparency of lender reporting – informing brokers about things “they couldn’t see”, such as disclosures on living expenses.

“We can take that information to train and educate our brokers so those instances are reduced.”

Sale added that in the future it was likely to become compulsory for all brokers to have either Equifax or illion or bankstatements.com to ensure that they were contributing to streamlining applications and not lodging deals with a lender where they were never going to be a good fit.

It would also be important to ensure that brokers did their due diligence on applications, as this would in turn limit reworks and further reduce turnaround times.

Cramb agreed, saying technology played a massive role.

“All loans processed through the Lendi platform today have a credit check – it’s auto-mated,” he said. “We have automated all of the verification of identity; we’re looking at automation internally for verification of income, etc., so those brokers are benefiting from that.”

Cramb explained that Lendi would carry out specialisation checks on each of those files to make sure they weren’t going to the wrong lender. “So we have a technology plat-form that has a hardwired process to ensure that we’re identifying the customers going to the right lender.”

Lendi Group also calculates across all of the panels in real time against serviceability as well as policy. “Approval Confidence is a fantastic tool to go through all of that,” Cramb said, “because we’ve not only worked with the lender to understand their policy; the lender is giving us specialised cues for our deals.”

He said Lendi had a depth versus breadth strategy for its lender panel, with 28 lenders on its panel, fewer than a lot of other aggregators had. “We believe that’s enough – that’s 99% of customer types that we can deal with, but it allows us to have deep integrations with the lenders.”

MacLeod said that lately there had been a lot of movement among BDMs.

“We’ve had a few issues with BDMs not being up to speed on their own product, and requests for more information or assistance are often not to a standard that you would expect,” she said.

‘Yes, yes, yes, yes, yes’ is the answer. I hate the yeses when I know there’s something behind the scenes that’s telling me this is too easy for a yes, and this means it needs to have a discussion. By transacting on a yes that should have been a no, we waste the lender’s time, our time, the client’s time, and often do reputational damage through no fault of our own.”

MacLeod said BDMs who had moved around a lot needed more training. She had experienced a few loan deals where a BDM had said yes, it was on track, and then she was still chasing conditional approval 19 days later.

“I think the velocity of change that we’ve had across lenders, across portals, across product, the BDMs unfortunately have been given bigger patches and more information to absorb but with less time to be able to get on top of it. The pressure on BDMs is enormous at the moment.”

Reyad said it was clear from the discussion that everyone was trying to bridge the gap between broker and lender.

“There’s clearly a gap there,” he said. “Generally speaking, I have found the lenders that allow brokers to have direct access to assessors typically allow things to move much faster. To give an example, when I’m dealing with complex deals that require more communication with the lender, having direct access to the assessors enables us all to work together towards an efficient and positive outcome for my client. This is something that I would love to see implemented more broadly by the lenders.”

When it came to quality BDMs, Chambers (pictured immediately above) said it all depended on the individuals. He said his brokers would call some BDMs several times and never receive a callback.

“The only time we hear from some BDMs is when they’re doing their review for their bonuses and then all of sudden they’re calling us every day. Sometimes our brokers refuse to give the review, and this person says, ‘Why won’t you give me a review?’ Well, you don’t pick up my calls whenever I call you about anything else, so why would I give you a good review?”

Reyad said he agreed with Chambers about BDMs, but he had seen models that some lenders used in which BDM calls were answered within a team, not just by particular individuals, and this worked well.

“But [being a BDM] it’s a tough job – there’s so much policy,” Reyad said. “I’ve made it a priority to focus more on understanding lender policy particularly, because in some instances it’s not black and white. I think this is crucial for brokers to do, as educating ourselves more on this will not only help ensure our clients are getting a more optimum and relevant solution to suit their financial needs but also ensure that we [brokers] are doing our part in submitting quality and streamlined loan applications.”

Buchanan agreed that policy wasn’t always black and white; it was sometimes grey.

“This is a tip for brokers that I’ve been speaking about for 20 years: if you have a conversation with a BDM and they say, ‘we can make that work’, put it in writing to them so at least you’ve got it in a memorandum that’s what the BDM has offered you. So when it comes to challenging it with the credit officer, you’ve got it in writing that they’ve already said yes.”

Cramb said Reyad was spot on when it came to the interface with lenders. “For a broker, I can’t imagine how you can keep up with all the policies and all of the different permutations and taking the notes and all the rest of it.”

At Lendi Group, brokers don’t do loan packaging on their own. The file is handed to a team that specialise in HSBC or ANZ or whatever lender is involved, so those teams get to know the lender’s specific policies and credit processes. These processes are also being rolled out to Aussie brokers so loan applications come through one central point.

“Reworks currently in the industry are anything north of 40%,” Cramb said. “We currently run it at less than half the industry average. The reason we can do that is because we have both digital and human operational processes that are specialised to create that high efficiency. It’s a different support model. Into the future the industry sees these challenges; I’m not saying it’s the only answer, but it’s one solution.”

Chambers said what Cramb was suggesting was that no matter the size of the aggregator, the applications should land in one spot. “It should be a standardised process that’s scalable, right? So even if you have five people in an office and two of you are processing, it should be the same standardised process. You might not have that fancy tech that does the credit checks on your behalf, but it should be that same due diligence.”

He said there were different aspects to streamlining: BDMs supporting brokers, the upfront credit work, and the back-end processing of applications.

“We’ve got two different teams to do that, some of it onshore, some of it offshore.”

Chambers said his biggest frustration over the past year was being unable to get feedback from lenders about who in his processing and packaging teams was doing a great job. “I can’t get visibility from most lenders on any of that rework and application quality data.”

Buchanan agreed that aggregators needed data back from lenders. Of the 60 lenders on the SFG panel, only a minority provided those reports.

“We can see conversion statistics; we can see the good brokers that are converting well. At a broker level, you’re not getting that data back,” he said.

Chambers said CBA and Macquarie Bank were the better lenders when it came to data – identifying how many times applications were touched and how many one-touch approvals occurred, which enabled Shore Financial to provide good feedback to its brokers.

“But that needs to be more of an expectation of all lenders to give us that on a quarterly basis where we can actually utilise that and implement it in our business.”

Sale pointed out that ASIC had said the banks had a responsibility to give aggregators that data. It was a hot topic about a year ago, with ASIC asking aggregators, “where’s the data?”

“Well, we don’t have that data because we rely on the banks to provide it,” she said. “There was a big push for the lenders to get their systems right to provide the aggregators the data. We’re still waiting.”

Buchanan said it was vitally important to remember that the broking industry was only 30 years old, and a lot of progress had been made in the last 10 years. “We’re imperfect, and there’s a lot of changes and innovations still to come.”

He said banks and lenders should be providing better data sooner, but they had just gone through COVID, with thousands of people working offshore that they’ve had to bring onshore. “So I admire that they’re moving in the right direction. Do we want it sooner? Yes. But I’ll caveat that by saying we are only 30 years old as an industry, and we’re getting better every single day.”

Q: How are you lobbying banks to remove channel conflict for brokers?

Chambers said there was some conflict with the banks that didn’t want to support aggregators in improving their processes because they wanted to take back market share. “They don’t want you to become too good at your job.”

Sale’s view was that in the past channel conflict was a big deal, but not now.

“Whilst you have branches and brokers and the third party, you’re always going to have some sort of channel conflict, but I think it’s improved out of sight,” she said.

Buchanan advised brokers to have “as many facts written down as possible”.

“We’ve had great success when brokers present channel conflict to us and we’ve got it in writing. We present it to the bank; they honour the commissions,” he said. “[Channel conflict] is a rarity now.”

Buchanan said banks had got better at stopping channel conflict, and it came from the banks’ leadership telling staff at the branches not to take customers off brokers.

“When these matters arise, we lobby; we take it to the tops of our lending partners and make sure they know that it’s not on, you can’t steal people’s customers, and largely they’ve been honouring it.”

Reyad said there was less channel conflict now. “Personally, when it has happened with me, I write it off and say, ‘well, like every business, if you open up a burger shop and McDonald’s opens next to you, you’re going to lose a little market share’.”

Cramb said there were areas that the industry should focus on and lobby on – not the front end of channel conflict but loan discharges.

“[Discharges] have gone north of 40 days last year to probably 15 to 20 days now on average,” he said. “It needs to be a lot better than that – the ACCC said 10 days was the standard that the lenders need to work to.”

He saw retention as another big issue that was connected to discharges.

“We’d obviously like to make sure that there’s parity in the channels, and that should be the overall push from our point of view … discharge should be two days.”

Chambers said he would be the outlier on channel conflict. “I don’t think it’s dissipated at all. I’ve had some serious issues in the last year or so with channel conflict. Last year, so many people would go into a branch, and we’d be told our SLAs were two or three weeks before they pick up the application; they go into the branch, and they say, ‘we’ll do it in two days’, and we lost a lot of business that way.”

Chambers said he was dealing with two cases of channel conflict right now – one in which he got the major bank to pay the commission. “They had told our clients we can do this deal, but we can’t do it through the broker – they don’t even hide it.”

Q: What does the decision to drop the broker remuneration review mean for the industry?

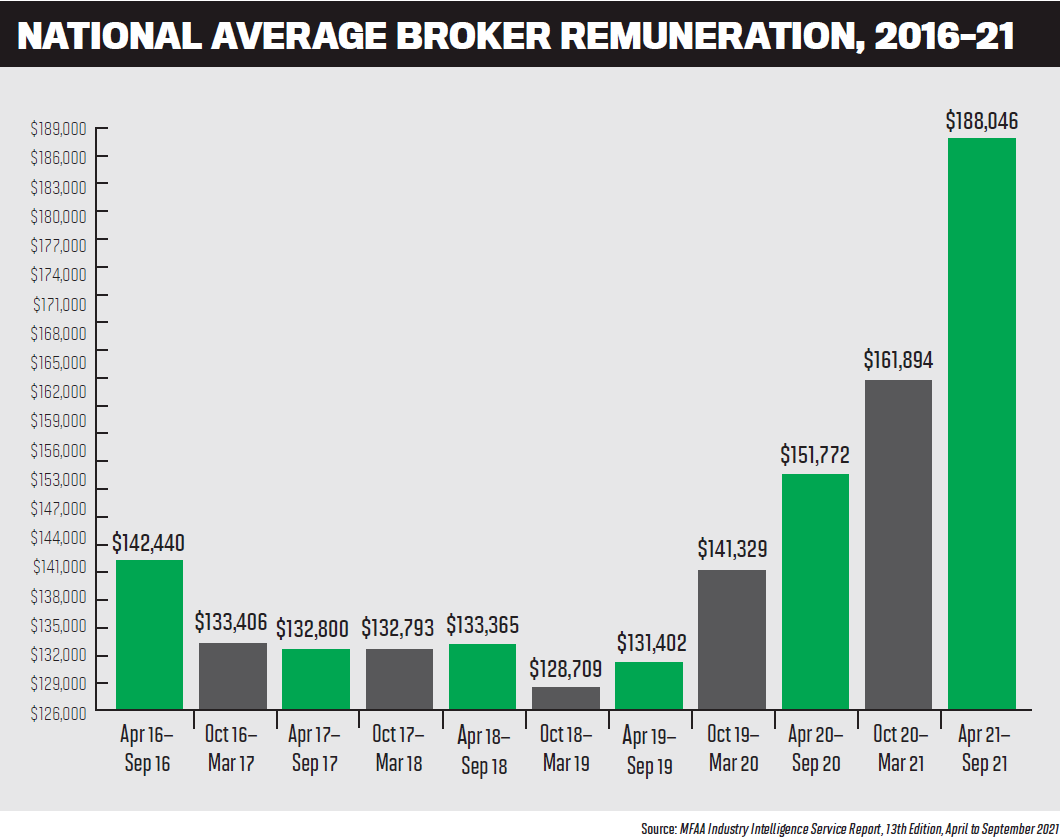

O’Donnell said the government’s move to discontinue the review was fantastic news for the industry. “We know that brokers play an essential role in helping Australians to secure competitive loan options, and it’s terrific to see our government leaders recognise this.”

He said brokers had embraced the changes introduced after the royal commission and continued to increase their professionalism and improve their services. “This is clearly reflected in the most recent industry survey, with the broker Net Promoter Score far exceeding the service the banks have provided.”

Buchanan (pictured immediately below) said broker behaviours had been validated by the decision to drop the review. “We’ve implemented BID; we were largely already doing BID anyway. Everything else has met the checks and balances – our distribution market share has grown to 60% and above, and it’s well on track to 70%.”

He thought it was great that the government had dropped the remuneration review, but it meant that brokers didn’t get the rubber stamp, and a review could be revived by a future government. “It just means there’s nothing to see here; we’re happy to let it lie – whereas if we did go through a review, I’m extraordinarily confident that they would have given us the seal of approval. And once they’ve done that remuneration review and stamped, they can’t take that away from us.”

Sale said it was imperative for Labor to say it would not pursue a remuneration review – “like Blake says, we need a rubber stamp”.

For Cramb, self-regulation in the industry had validated that there was no need for a review. “We need to continue that – it’d be great to formalise that. I just don’t think there’s any ongoing into-perpetuity sort of guarantees.

“What you’ve seen in the last five and eight years has been a remarkable effort by the industry to do that self-regulation. That type of validation is there, but we need to continue it.”

Sale said the aggregators were working together to ensure that the broking industry was protected. “The royal commission changed the whole dynamics of our industry – we banded together and said we’re not going to cop this at all … to this day there’s still a group of us aggregators through the FBAA really ensuring that we keep these politicians honest.”

MacLeod added that aggregators had come a long way, proving to brokers that they weren’t just clearing houses. “I can validate with 24 years in the industry, I think aggregators have actually come a really long way from being recognised as a clearing house to actually [being] a service provider [that’s a] valued partner to a broker.”

MacLeod explained that she had changed aggregator groups because she wanted a service provider, and she believed there would be a lot more movement in that space in the next 18 months as brokers sought out aggregators that offered better systems and support.

Buchanan said aggregator leaders had spent a lot of money out of their own pockets, lobbying politicians on behalf of brokers.

“I spent countless hours in Canberra in Parliament House lobbying politicians, as did a number of people in this room, and brokers don’t always see that. Like then, and into the future as matters need addressing, we will continue to go into battle on behalf of our great industry and members to achieve the best possible outcomes for the future of the broker offer and their clients.”

Q: The latest MFAA report shows that the proportion of female brokers has fallen to 25.6% – the lowest figure yet. What are you doing to encourage more women to become brokers?

“Being a woman and co-founder of a female-owned aggregator, this question gets asked over and over, year upon year,” Sale said.

“I can’t see the stats shifting too much from this; they haven’t for years, so I think this question should stop. I really do. What I’d like to see us focusing on is the women in our industry that are doing amazing things now, because that is a component that will motivate more women to join our industry.”

O’Donnell said 25.6% was a disappointing statistic and one that the industry needed to work together collectively to change.

“At Liberty and LNS, we have several programs dedicated to fostering diversity within our business, and for LNS, recruiting more women into broking is a key strategic focus,” he said. “Over the past year, we have made some good progress in this area through several important initiatives, including our partnership with Work180’s female recruitment platform. We have also launched our Adviser Assistance Program to support advisers with the challenges and demands of their work and personal lives. And we run comprehensive diversity and inclusion training for all members of our business.”

MacLeod said the issue was not about losing female brokers; it was about retention.

“Where we lost most of these women was in the last two years. COVID is going to be a natural cull, because who is predominantly in the household looking after children? My husband’s a fly-in, fly-out [miner]. I’ve got two teenage boys, but does he stop his job to come home because of COVID? No. I’m home, I’m female.”

She said it was just an expectation that women would remain at home, which she labelled “an unconscious bias that none of us can avoid, yet with continued awareness can change over time”.

“Being female, whether you have children or not, your responsibility is obviously clearly in the home, according to most people. So I think there was going to be a natural fallout anyway during COVID,” MacLeod said.

Chambers agreed that female participation in the workforce was not an industry issue but a society issue.

“I don’t think women have a disadvantage in our industry,” he said. “I think they have an advantage over my male brokers because society, especially in financial services, will trust a woman more than a man.”

Cramb said, “I see broking as a viable opportunity for women. The relative flexibility broking affords can make it somewhat easier to find balance and schedule work around life’s other commitments.

“Of our new recruits last year, 43% were women, well above industry average. We’re committed to fostering diversity and inclusion in our network and removing barriers of entry for women into the industry.”