Majority of changes in the past week seen in investor fixed rates

The federal budget announcement last week has had minimal impact on the mortgage market, with only five lenders on the RateCity.com.au database adjusting at least one fixed or variable rate.

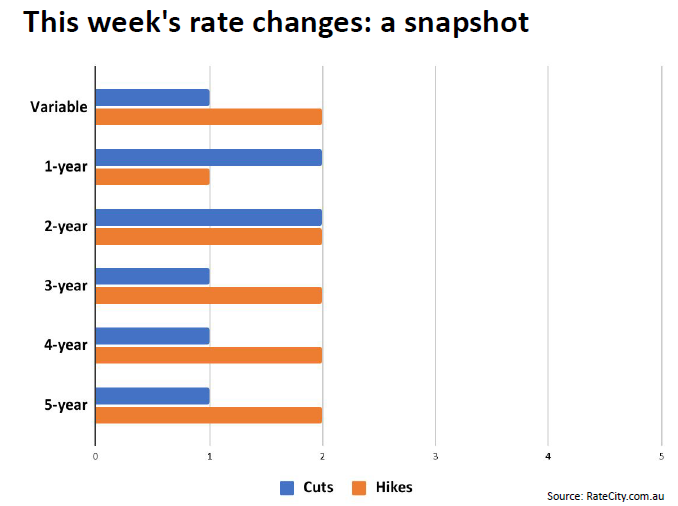

The latest RateCity interest rates weekly wrap-up showed that most changes over the past week were seen in investor fixed rates, with a mix of increases and decreases.

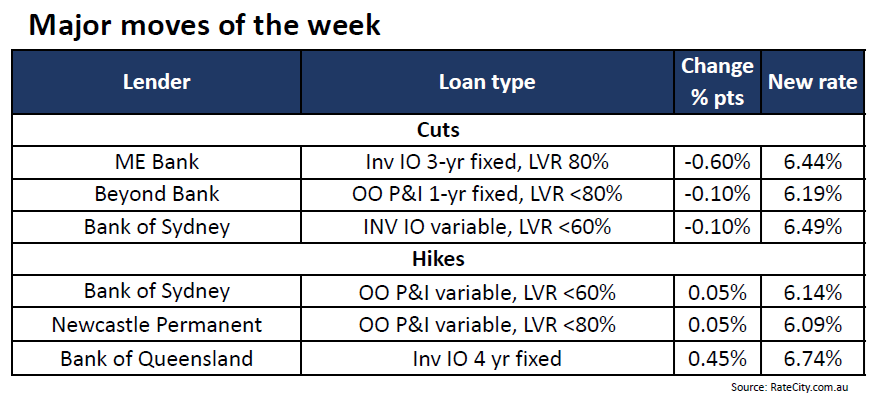

ME Bank reduced its investor interest-only three-year fixed rate by 0.60 percentage points, bringing it to 6.44%. Beyond Bank cut its owner-occupier principal and interest one-year fixed rate by 0.10 percentage points to 6.19%, and Bank of Sydney also decreased its investor interest-only variable rate for loans with a loan-to-value ratio (LVR) below 60% by 0.10 percentage points to 6.49%.

On the other hand, Bank of Sydney raised its owner-occupier principal and interest variable rate for LVR below 60% by 0.05 percentage points to 6.14%. Newcastle Permanent increased its owner-occupier principal and interest variable rate for LVR below 80% by 0.05 percentage points to 6.09%. Bank of Queensland made a significant hike in its investor interest-only four-year fixed rate by 0.45 percentage points to 6.74%.

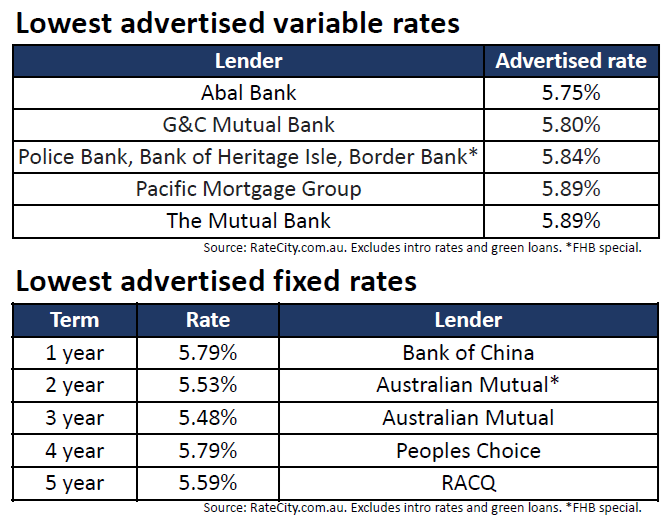

Among the lowest advertised fixed rates, Bank of China offers the most competitive one-year fixed rate at 5.79%. Australian Mutual provides the lowest two- and three-year fixed rates at 5.53% and 5.48%, respectively. Peoples Choice leads in the four-year fixed rate category at 5.79%, while RACQ offers the best five-year fixed rate at 5.59%.

For variable rates, Abal Bank presents the lowest rate at 5.75%, followed by G&C Mutual Bank at 5.8%. Police Bank, Bank of Heritage Isle, and Border Bank all offer a rate of 5.84%, while Pacific Mortgage Group and The Mutual Bank provide rates of 5.89%.

“The announcement of the federal budget last week has caused almost no ripples on the mortgage front so far,” said Sally Tindall (pictured), research director at RateCity.com.au.

“Looking at the week ahead, the next round of CPI figures come out next Wednesday and will be under close scrutiny to see if progress in inflation picked up in the month of April, or whether it has continued at its current sluggish pace.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.