Rate cuts and hikes split the market as lenders respond to shifting borrowing conditions

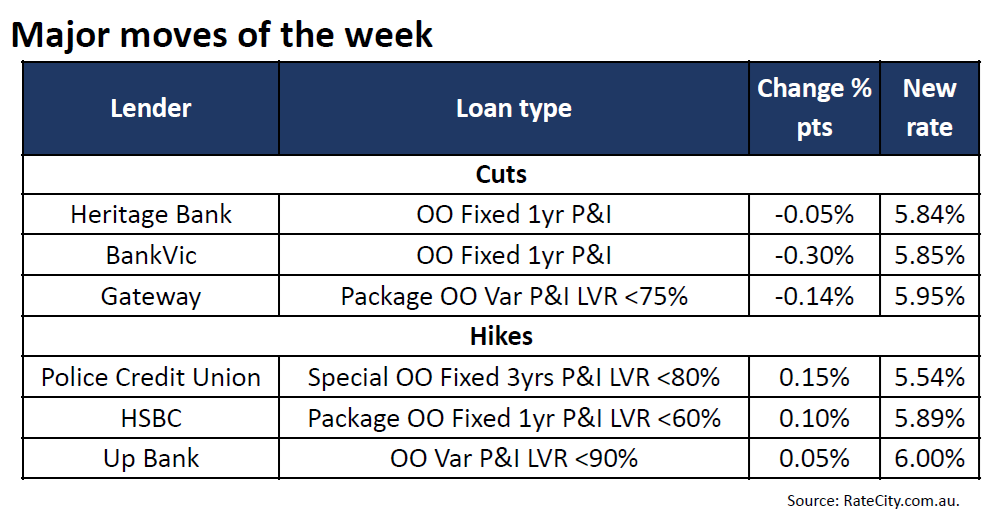

Over the past week, six lenders in Australia slashed home loan rates, while five raised borrowing costs, financial comparison website RateCity.com.au has reported.

Gateway Bank lowered its variable home loan rates by up to 0.14 percentage points. Its lowest variable rate now stands at 5.95% for borrowers with a 25% deposit, while its green loan rate dropped to 5.85%.

BankVic made more significant cuts, reducing some fixed rates by up to 0.94 percentage points. The lender’s one-, three-, and 5-year fixed rates have all fallen below 6%.

Heritage Bank trimmed its one-year fixed rate by 0.05 percentage points, bringing its lowest offering to 5.84%. However, the bank also raised several fixed rates by up to 0.20 percentage points, including its three- and five-year fixed rates, which now sit at 5.69%.

HSBC increased its fixed rates across all one- to five-year terms by up to 0.50 percentage points. Its one-year package rate, available to borrowers with a 40% deposit, rose 0.10 percentage points to 5.89%.

Police Credit Union raised its three-year fixed rates by up to 0.15 percentage points for investors and 0.30 percentage points for owner-occupiers. This adjustment pushes its lowest three-year fixed rate to 5.79%. Up Bank also raised its variable rate by 0.05 percentage points, bringing it to 6%.

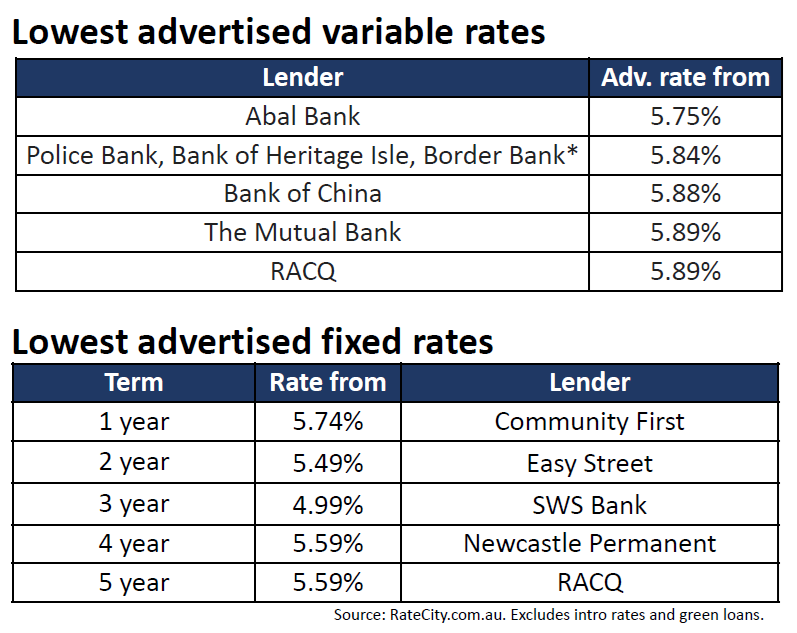

The lowest variable rate is still 5.75%, offered by Abal Bank. Other lenders close to this benchmark include Police Bank, Bank of Heritage Isle, and Border Bank, which advertise rates at 5.84%, followed by Bank of China at 5.88%, and The Mutual Bank and RACQ, both at 5.89%.

In the fixed rate segment, the most affordable offers vary by term. The standout one-year fixed rate comes from Community First at 5.74%. For two-year terms, Easy Street leads with a rate of 5.49%, while SWS Bank sets the pace for three-year fixed rates at 4.99%. Longer fixed terms such as four and five years are available at 5.59%, with Newcastle Permanent and RACQ among the key players.

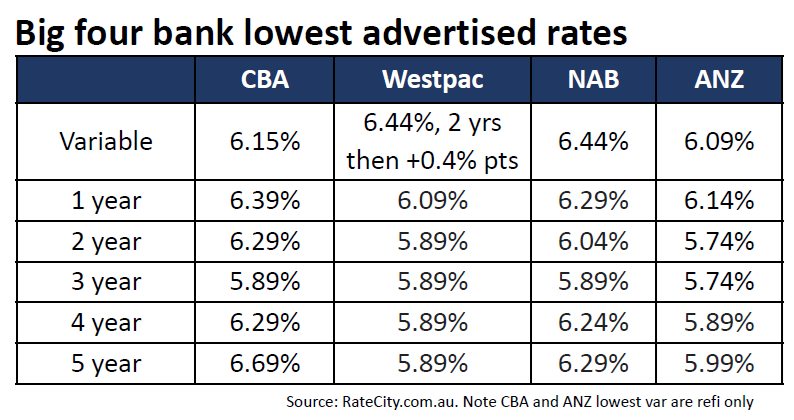

The RateCity interest rates weekly wrap-up also showed the lowest advertised rates among Australia’s big four banks.

For variable rates, Commonwealth Bank (CBA) offers 6.15%, while Westpac has 6.44% with a two-year initial rate before increasing by 0.4 percentage points. National Australia Bank (NAB) matches Westpac’s rate at 6.44%, and ANZ provides the lowest variable rate at 6.09%, though it is available for refinancing only.

In fixed rates, CBA’s one-year fix stands at 6.39%, while Westpac leads with 6.09%, NAB follows at 6.29%, and ANZ offers 6.14%. For two-year terms, CBA offers 6.29%, Westpac and ANZ lead with 5.89% and 5.74% respectively, while NAB’s rate is 6.04%. Across three-year fixed rates, CBA, Westpac, and NAB each advertise 5.89%, while ANZ’s is again lower at 5.74%.

For four-year fixed rates, CBA lists 6.29%, while Westpac and ANZ share a rate of 5.89%, and NAB advertises 6.24%. In five-year fixed terms, CBA is highest at 6.69%, Westpac maintains 5.89%, NAB offers 6.29%, and ANZ sets its rate at 5.99%.

“All eyes will be on the Reserve Bank when it meets next Tuesday for the last cash rate meeting of 2024, although it’s unlikely to hand borrowers any rate relief until at least May next year,” said Laine Gordon (pictured above), money editor at RateCity.com.au.

Any thoughts on the latest RateCity interest rates weekly wrap-up? Share them with us by leaving a comment in the discussion box at the bottom of the page.