Which lenders adjusted rates during this quiet week?

In a relatively calm week for mortgage rate movements, only two banks adjusted their home loan rates, according to RateCity’s latest interest rates wrap-up.

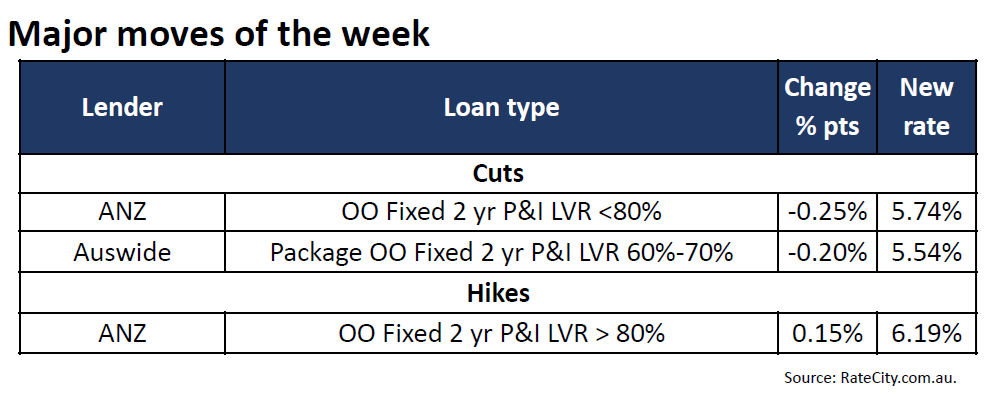

On Tuesday, ANZ, Australia’s fourth largest lender, reduced fixed rates by 0.25 percentage points for both owner-occupiers and investors with deposits of 20% or more. This marks ANZ’s second rate cut on fixed home loans in less than three weeks, following reductions of up to 0.70 percentage points on Oct. 11.

However, ANZ raised rates for borrowers with deposits below 20%, increasing fixed rates by 0.15 percentage points for these customers.

Auswide Bank also adjusted its rates, cutting its two-year fixed rate and variable rates by 0.20 percentage points. With this change, Auswide’s two-year fixed rate now stands at 5.54%.

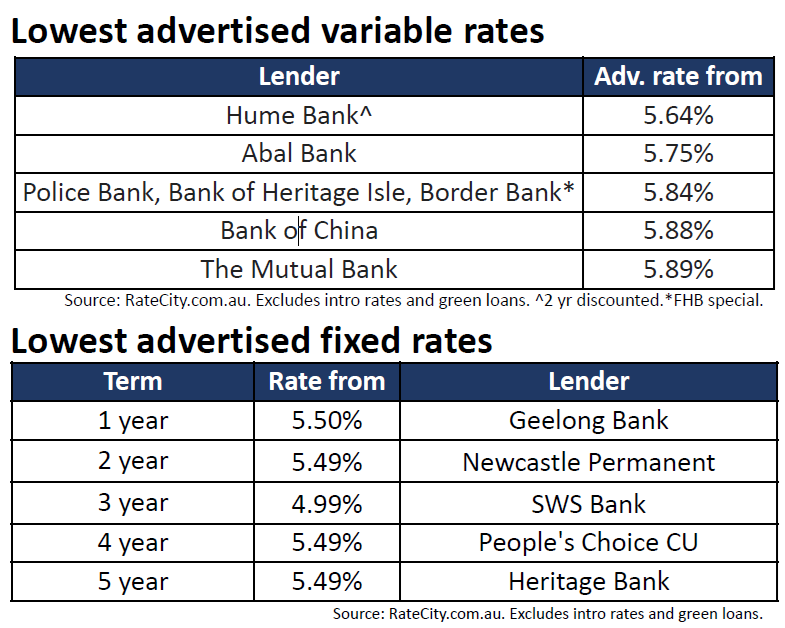

The lowest variable rate among lenders is currently offered by Hume Bank at 5.64%, followed closely by Abal Bank at 5.75%. Other competitive rates include Police Bank, Bank of Heritage Isle, and Border Bank, each advertising a variable rate of 5.84%. Bank of China follows at 5.88%, with The Mutual Bank offering a rate of 5.89%.

For fixed rate loans, Geelong Bank leads with a one-year fixed rate starting at 5.50%. Newcastle Permanent offers a competitive two-year fixed rate of 5.49%, while SWS Bank advertises a three-year rate at 4.99%, the lowest in the fixed category. People’s Choice Credit Union and Heritage Bank also present competitive fixed rates of 5.49% for four- and five-year terms, respectively.

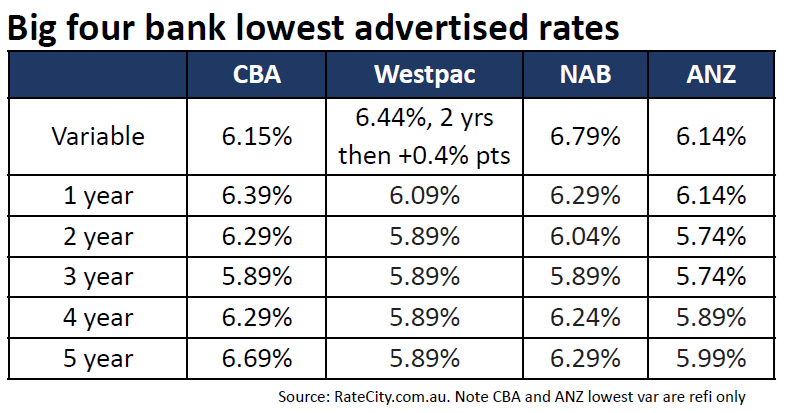

Among the big four banks, ANZ leads with the lowest variable rate at 6.14%, followed closely by Commonwealth Bank at 6.15%. NAB’s and Westpac’s are slightly higher, with variable rates of 6.79% and 6.44%, respectively, after initial promotional periods.

Fixed rates show more variation across terms. ANZ offers the lowest advertised two- and three-year fixed rates at 5.74%, positioning it as the most competitive in this category. Commonwealth Bank’s lowest fixed rates for one- and three-year terms are 6.39% and 5.89%, respectively, aligning with Westpac’s and NAB’s three-year rates. Five-year terms range higher, with Westpac advertising 5.89%, while Commonwealth Bank offers the highest at 6.69%.

“New CPI figures for the September quarter showed Australia’s annual inflation rate dropped to 2.8% from 3.8% in the June quarter,” said Laine Gordon (pictured above), money editor at RateCity.com.au. “It’s now at the lowest level since the March quarter of 2021 and well below the peak of 7.8% at the end of 2022, according to the ABS.

“While the CPI result was broadly as expected, it won’t be enough for the RBA to pull the trigger on a cash rate cut in 2024. Largely this is because the significant drop in CPI was due to temporary measures, such as energy rebates kicking in.

“On the back of this, CBA updated its cash rate forecast, pushing the first projected cash rate cut out from December 2024 to February 2025, followed by three more rate cuts by the end of next year. All four big bank economic teams now believe the next move from the RBA will be a 0.25-percentage-point cut in February 2025.”

Any thoughts on the latest RateCity interest rates weekly wrap-up? Share them with us by leaving a comment in the discussion box at the bottom of the page.