Are there new lenders offering the lowest rates?

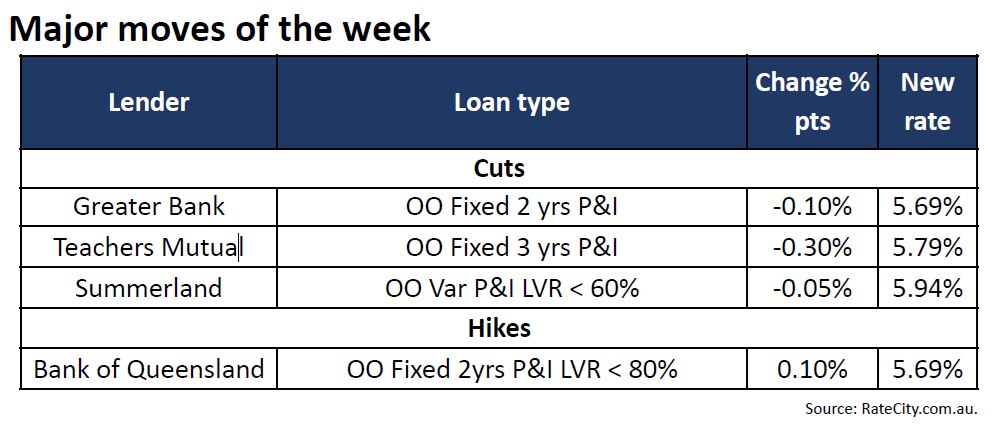

Seven Australian lenders adjusted their home loan rates this week, with five cutting rates and two opting for increases.

“Greater Bank lowered its fixed rates, notably, dropping its lowest two- and three-year rates down to a competitive 5.69%, but only for borrowers in NSW, ACT and Queensland,” said Laine Gordon (pictured above), money editor at RateCity.com.au.

Teachers Mutual Bank also reduced rates, slashing its fixed rates by up to 0.30 percentage points and some variable rates by as much as 0.35 percentage points. Following these cuts, the bank’s lowest three-year fixed rate now sits at 5.79%, while its lowest variable rate has dipped into the 5 per cent range.

“As for the rate hikes, Bank of Queensland increased its two- to five-year fixed rates by up to 0.30 percentage points,” Gordon said. “The move from BoQ sees its two-year rate increase by 0.10 percentage points, which at 5.69% remains competitive at just 0.20 percentage points above the lowest rates in the market.”

ME Bank, a BoQ subsidiary, also implemented rate hikes, increasing its two-year fixed rate by 0.10 percentage points, from 5.59% to 5.69%.

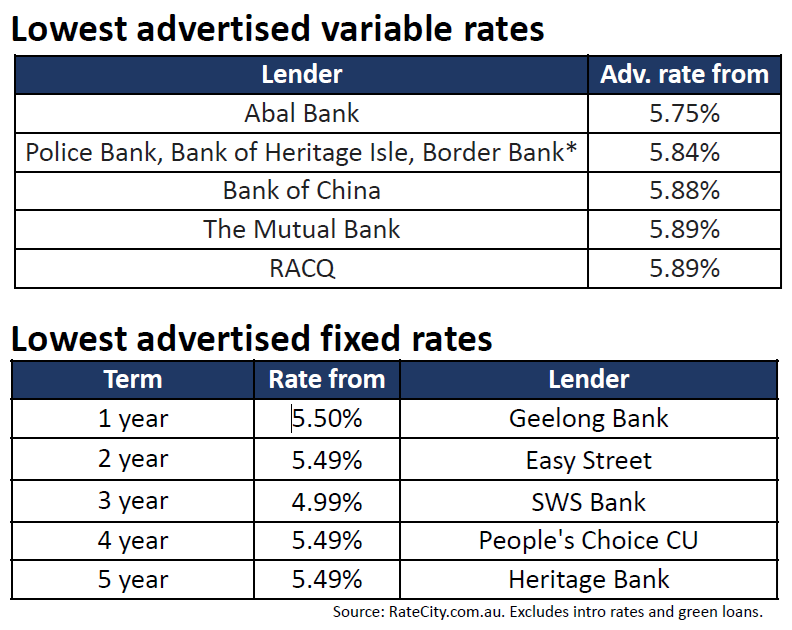

Abal Bank currently offers the lowest variable rate, starting at 5.75%. Police Bank, Bank of Heritage Isle, and Border Bank follow closely, with rates starting at 5.84%. Bank of China offers a variable rate from 5.88%, while The Mutual Bank and RACQ have rates beginning at 5.89%.

For fixed rate loans, competitive offers are available across various terms. Geelong Bank offers the lowest one-year fixed rate at 5.50%. Easy Street holds the leading two-year fixed rate at 5.49%. The lowest three-year fixed rate, at 4.99%, is available from SWS Bank. For four- and five-year terms, People’s Choice Credit Union and Heritage Bank both offer rates starting from 5.49%.

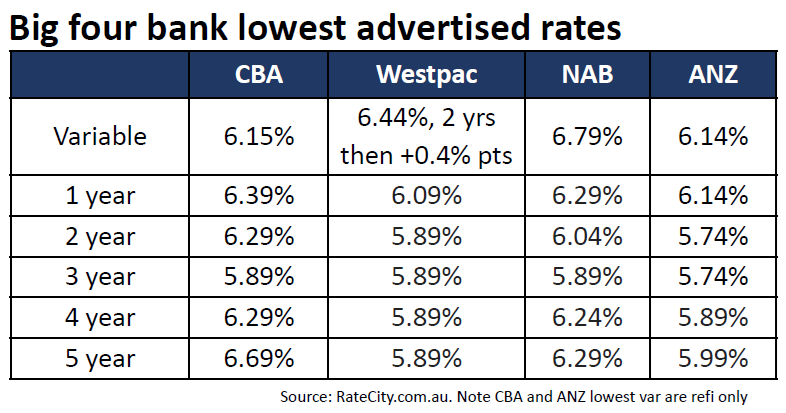

Among the big four banks, ANZ is currently offering the lowest variable rate at 6.14%, slightly edging out CBA at 6.15%, NAB at 6.79%, and Westpac’s entry point at 6.44%, which includes a two-year period followed by an additional 0.4 percentage point increase.

Fixed rates show more substantial variances across terms. For a one-year term, Westpac leads with a 6.09% offer, followed by ANZ at 6.14%, NAB at 6.29%, and CBA at 6.39%. In two-year fixed rates, ANZ’s 5.74% is the lowest, compared to Westpac’s and CBA’s 5.89% and NAB’s 6.04%. Three-year rates see a convergence with CBA, Westpac, and NAB all offering 5.89%, while ANZ undercuts at 5.74%.

Longer fixed terms also vary, with four-year options set at 5.89% from CBA and Westpac, while NAB’s stands at 6.24%, and ANZ’s remains at 5.89%. For five-year terms, Westpac offers the lowest rate among the big four at 5.89%, while CBA’s offering rises to 6.69%.

Any thoughts on the latest RateCity interest rates weekly wrap-up? Share them with us by leaving a comment in the discussion box at the bottom of the page.