Find out which lenders are offering the lowest fixed and variable rates

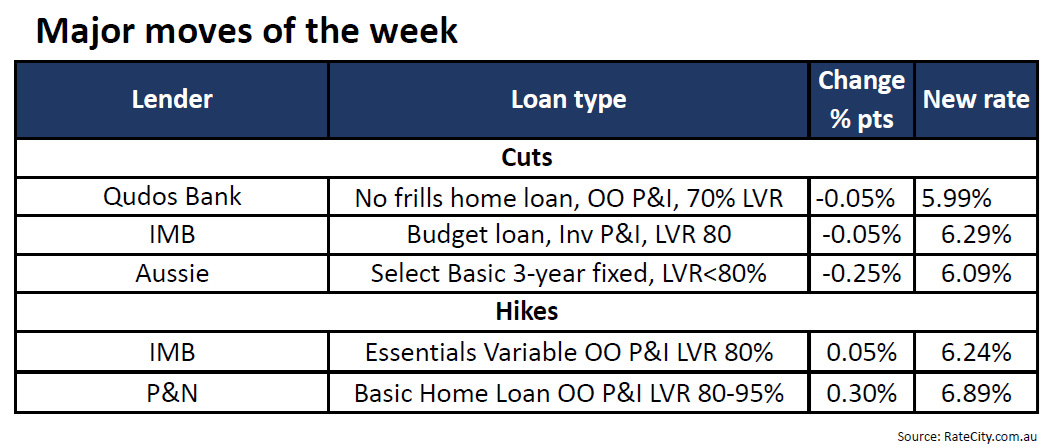

The fixed rate mortgage market saw minimal activity this week, with no hikes and only a few reductions from Qudos Bank, IMB, and Aussie, financial comparison website RateCity.com.au has reported.

The latest RateCity interest rates weekly wrap-up also showed just six lenders adjusting their variable rates for new customers, with Qudos Bank dropping its lowest variable rate to under 6%. Aussie Select cut its basic three-year fixed loan rate by 0.25 percentage points to 6.09%

IMB lowered its budget loan rate by 0.05 percentage points to 6.29%, but increased its Essentials variable rate by 0.05 percentage points to 6.24%. P&N raised its Basic Home Loan rate by 0.30 percentage points to 6.89%.

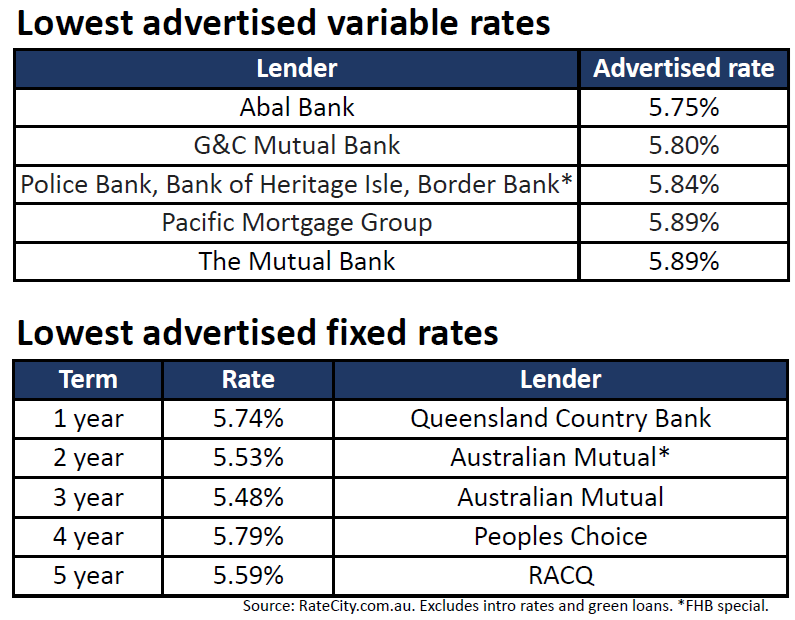

Queensland Country Bank leads with the lowest one-year fixed rate at 5.74%, while Australian Mutual offers the lowest two- and three-year fixed rates at 5.53% and 5.48%, respectively. Peoples Choice and RACQ provide competitive lower four- and five-year fixed rates at 5.79% and 5.59%.

For the lowest variable rates, Abal Bank offers 5.75%, G&C Mutual Bank 5.80%, and Police Bank, Bank of Heritage Isle, and Border Bank all at 5.84%.

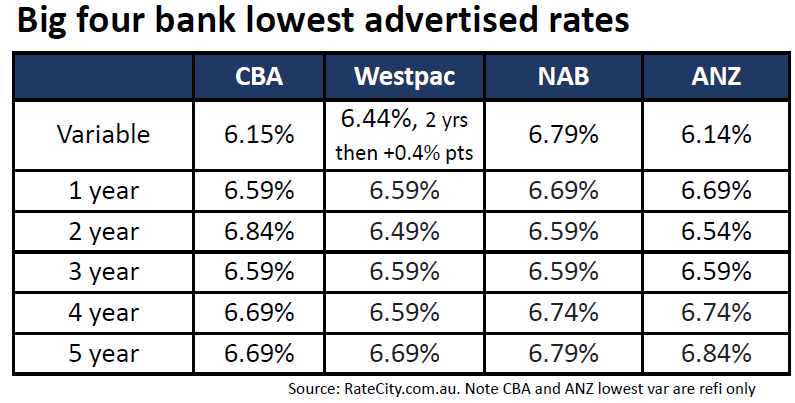

Among the big four banks, the Commonwealth Bank (CBA) offers the lowest variable rate at 6.15%, followed by ANZ at 6.14%, NAB at 6.79%, and Westpac at 6.44%. ANZ and Westpac both advertise the lowest one-year fixed rate at 6.59%, while NAB’s three-year rate is set at 6.59%.

“The latest APRA data released last Friday for the month of April shows Westpac lead the way in terms of growth in residential home lending out of the big four banks, with the group increasing its loan book by an impressive $3 billion in just one month,” said Sally Tindall (pictured above), director of research at RateCity.

“It will be interesting to see what impact, if any, the removal of the Westpac Group’s cashback incentive has on its loan book in the second half the year, with St George, BankSA and RAMS all wrapping up their refinancing sweetener on June 30.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.