Recovery sets the stage for 2024 records

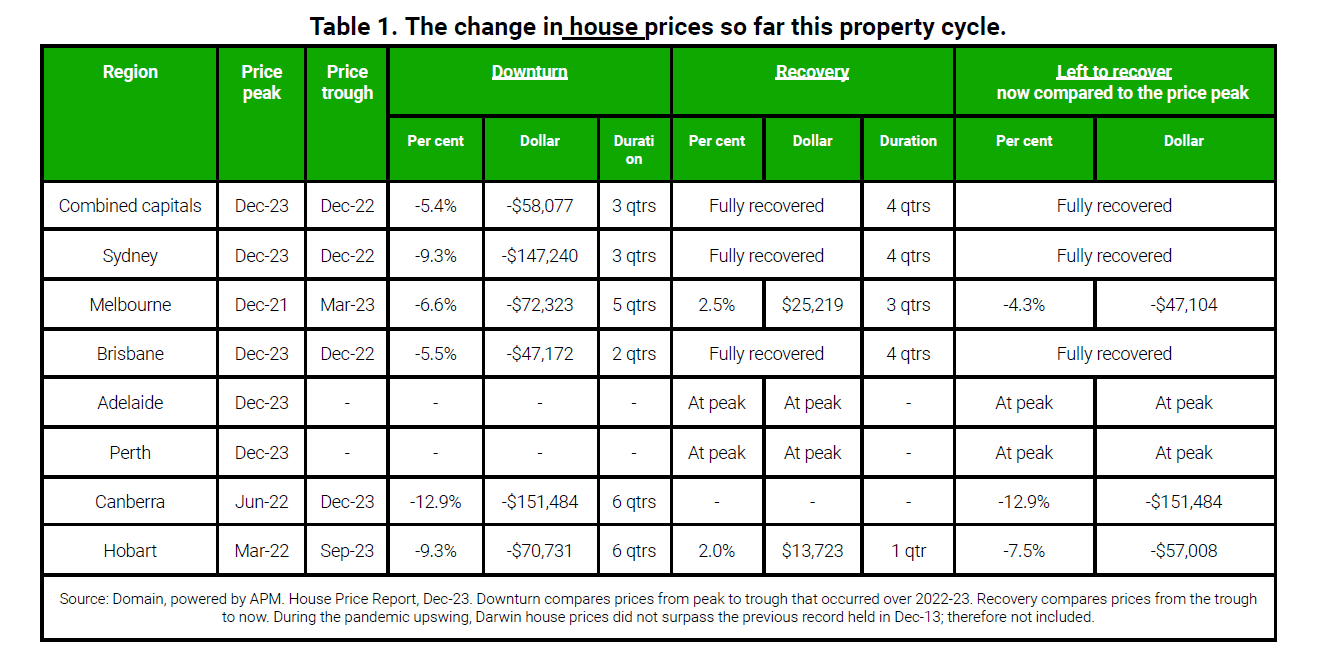

Australia’s property market has made a remarkable recovery, surpassing the 2022 downturn, according to Domain's latest House Price Report for the December quarter.

The combined capital house and unit prices closed 2023 at an all-time high, setting the stage for new price peaks in 2024, considering a potential interest rate cut expected later in the year.

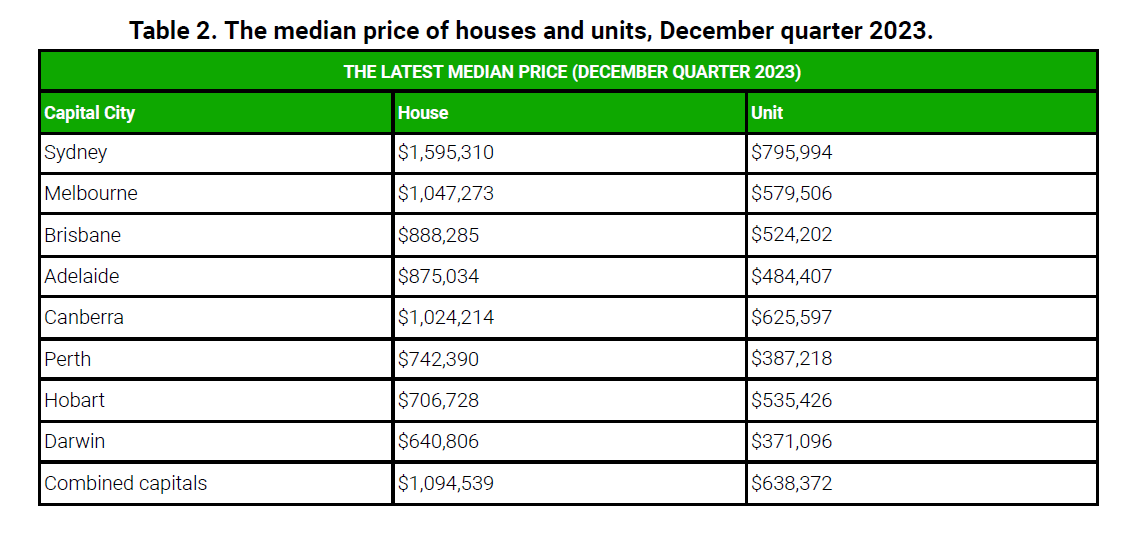

During the December quarter, most capital cities witnessed a resurgence in their housing markets, with Adelaide taking the lead in median house price growth in 2023, boasting a substantial 12.7% increase, followed closely by Perth (11.9%) and Sydney (10.6%). Conversely, Canberra, Hobart, and Darwin experienced modest declines of 4.6%, 2.5%, and 1.2%, respectively.

Record-breaking median prices were recorded in major cities, with Sydney ($1,595,310), Brisbane ($888,285), Adelaide ($875,034) and Perth ($742,390) reaching new highs for houses, and Canberra ($625,597), Brisbane ($524,202) and Adelaide ($484,407) setting records for units.

In the case of Melbourne, the market’s recovery process is expected to finalise this year.

House prices steadily recovered over four quarters after a three-quarter decline, while unit prices rebounded swiftly in just three quarters following a five-quarter fall. This shows a quicker recovery for units compared to houses.

Nicola Powell (pictured above), Domain's chief of research and economics, said that despite concerns about affordability, cost of living, and high-interest rates in 2023, a combination of factors, including housing undersupply and population growth, led to new record prices for both houses and units by the end of the year, breaking previous records from March 2022 and December 2021, respectively.

Property market outlook

Domain's forecast suggested the potential for further growth in 2024, driven by a looming interest rate cut anticipated to ignite demand and propel housing prices to unprecedented levels.

Powell noted that while prices are still ascending, the pace has slowed compared to the early stages of recovery. The influx of new properties into the market has eased competition but hasn't halted overall price growth.

“In the shorter term, high-interest rates will continue to exert stress on mortgage affordability and limit borrowing capacity,” Powell said. “With an interest rate cut tipped to happen in the latter half of the year, we are expecting to see an increasing demand that will likely drive upward price pressures on the housing market.

“On a more positive note, the tax cuts in July may alleviate some of the cost-of-living pressures and inflation is easing, which may help improve mortgage affordability.”

Powell advised prospective buyers to set realistic expectations and remain flexible with their area preferences. For sellers, collaboration with agents to determine an optimal pricing strategy is crucial to leveraging higher demand without discouraging potential buyers.

For the full Domain House Price Report, please see here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.