They are projected to reach an all-time high this year

Insolvencies in the Australian building and construction sector have not yet stabilised, according to business recovery and personal insolvency specialist firm Jirsch Sutherland.

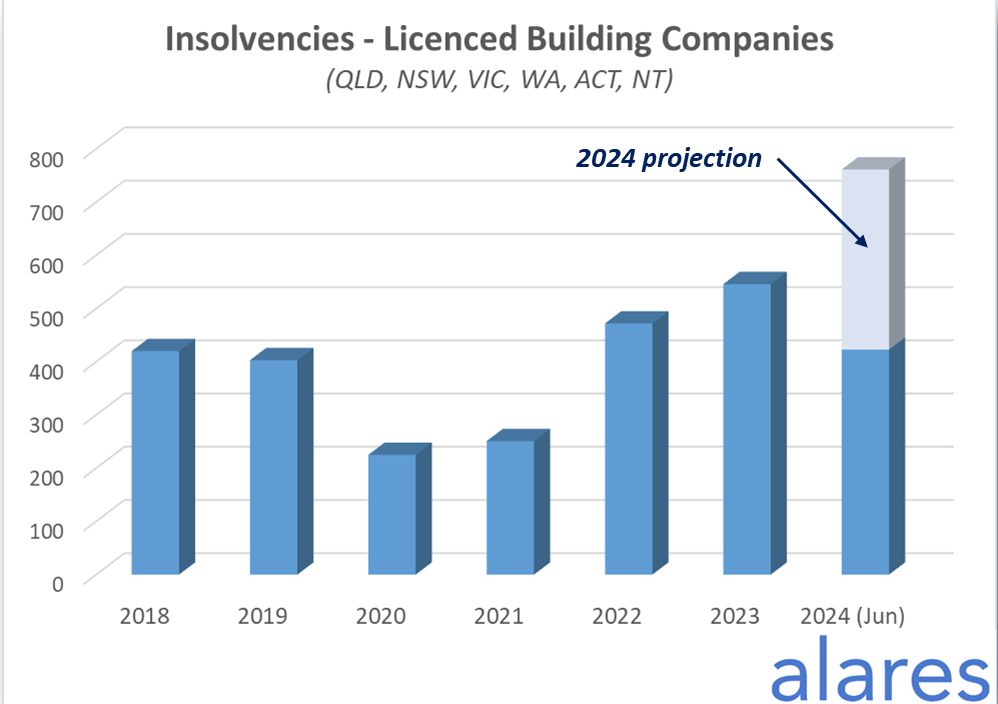

The forecast follows the latest Alares Credit Insights report, which indicates that insolvencies among licensed building companies by the end of June were already on par with full-year totals in 2018 and 2019.

“These statistics align with what we are observing in the sector,” said Malcolm Howell (pictured above) of Jirsch Sutherland. “Between January and July this year, Jirsch Sutherland has handled 60 cases in the building and construction sector, compared with 44 during the same period in 2023 and 78 in total over the last 12 months.

“There’s a significant domino effect occurring, with an increase in smaller subcontractors being impacted by the financial difficulties of head contractors.”

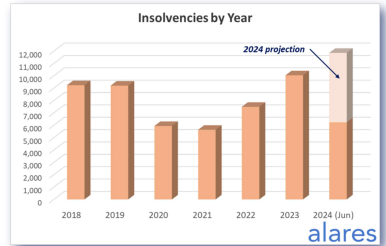

In June, overall insolvencies remained around 50% above historical levels, and according to the Alares report, insolvencies in 2024 are projected to reach an all-time high. Over 27,000 businesses currently have reportable tax debts exceeding £100,000 overdue by more than 90 days without significant engagement with Australian Taxation Office (ATO).

“The building and construction industry has been particularly hard hit in 2024,” said Patrick Schweizer, director of Alares. “The full-year projection for 2024 is expected to well exceed historical highs.

“There’s clearly a catch-up happening from the COVID years (2020-2022). During those years, we saw about 8,000 fewer insolvencies than the historical run rate. This suggests the current increase in insolvencies will continue through the remainder of 2024 and potentially into next year. The key question is, what will happen once the catch-up is complete?”

Howell cautioned that ignoring the issue is not an option.

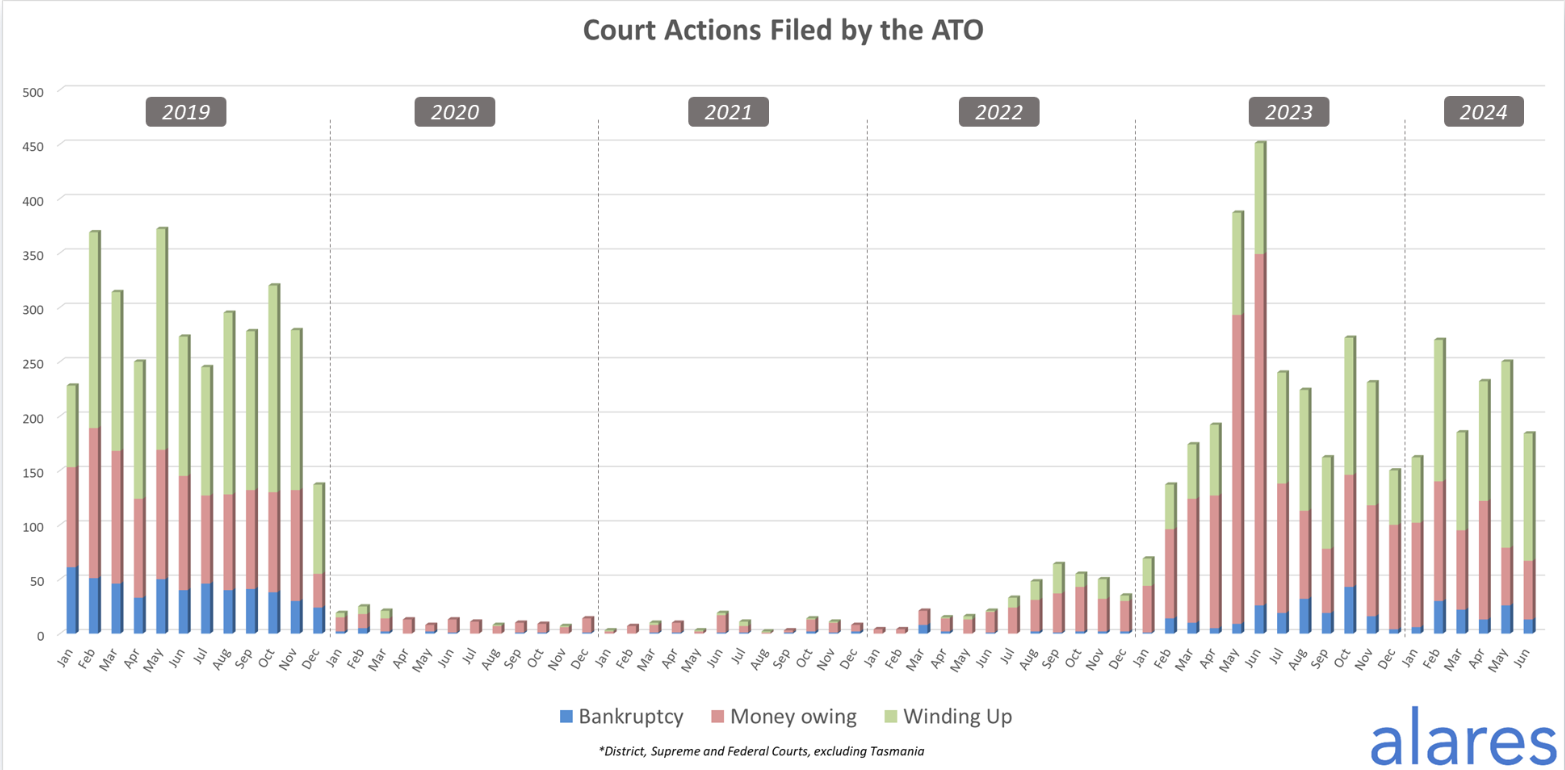

“Director Penalty Notices (DPNs), warning notices, and garnishee notices are reaching record levels, pushing more businesses into insolvency or forcing them to seek refinancing or restructuring,” he said. “In June, one in five insolvency appointments were small business restructurings, which underscores its value as a way to get a business back on track while addressing legacy debt.

“It’s not just ATO tightening controls; credit providers are becoming more stringent with recoveries, and major banks are increasingly seeking winding-up orders through the courts. Insolvency inquiries will continue to rise as ATO intensifies efforts, the economic environment pressures sales, and landlords and businesses start collecting debts.

“According to the Reserve Bank, housing loan arrears have increased steadily since late 2022, alongside rising household budget pressures from higher inflation and interest rates. It is truly a perfect storm.”

Additionally, Howell said that it is not just current directors under ATO scrutiny.

“Recent reports indicate that even former directors of now-liquidated companies are receiving DPNs for unpaid taxes or superannuation contributions,” he said. “We have seen many older cases resurface years later, with directors experiencing a major ‘DPN shock’.

“This underscores the need to act swiftly: with a non-lockdown DPN, there’s a 21-day window to comply, while with a lockdown DPN, directors are instantly liable. Engaging with an insolvency specialist immediately is crucial.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.