SMEs saw little improvement in cost pressures in the March 2023 quarter

SME business confidence has remained negative in the first quarter despite conditions remaining resilient, the latest NAB quarterly SME survey for the March 2023 quarter has revealed.

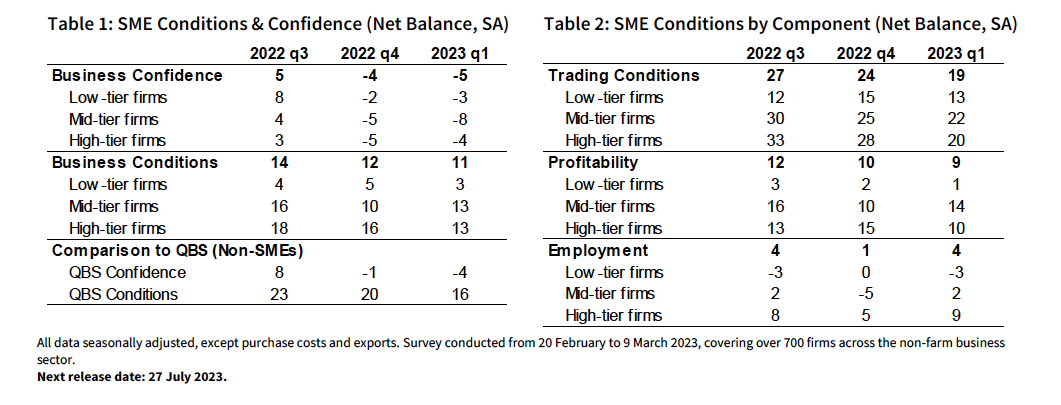

The NAB business survey found business confidence fell by one point from the previous quarter, remaining into negative territory at -5 index points. Confidence was negative across SMEs of all sizes but fell most for mid-tier firms. Forward orders reduced by 1pt to +1 index points while capacity utilisation edged higher, to 82.8%. Capex, meanwhile, dropped 5pts to +6 index points.

“Confidence remained negative for SMES in Q1, with larger firms reporting similarly low levels of confidence in the NAB Quarterly Business Survey,” said Alan Oster (pictured above), NAB chief economist. “Higher interest rates, elevated inflation and a clouded global economic outlook all likely weighed on firms’ confidence in the quarter.”

By industry, confidence in property jumped by a huge 9pts but remained negative at -14 index points, while finance, retail, and health posted deeply negative confidence levels. SME confidence fell in Queensland but rose in SA and WA, to be negative everywhere except SA and WA.

SME business conditions, meanwhile, slipped 1pt to +11 index points, which was still above the long-run average of +6. For mid-tier firms, conditions climbed 3pts, while larger and smaller SMEs saw their edging lower. Trading conditions and profitability eased but employment lifted 3pts to +4 index points.

“Business conditions continue to ease gradually across both larger firms and SMEs, but remained resilient through Q1,” Oster said. “In terms of SMEs, the smallest firms report very soft conditions, but mid-tier and larger SMEs are at robust levels.

“SMEs in property reported a pickup in conditions, to be back in positive territory,” Oster said. “Retail SMEs reported the next weakest conditions at +3 index points with other sectors at robust levels. Across the states, SMEs in WA, Qld, and SA reported the strongest conditions.”

There was little change in cost pressures in the first quarter. Purchase cost grew 2% in quarterly terms, down 0.2ppts from the previous quarter, with 50% of SMEs still reporting availability of materials as a constraint. Labour cost growth was steady at 1.6%, with 73% of firms pointing to labour as a constraint, down from 78% in the prior quarter. Final prices grew at 1.4% overall (down from 1.5%) although the sales margin index improved 7pts to -7 index points.

“There were some signs of easing in cost pressures reported by larger firms in the NAB Quarterly Business Survey in Q1,” Oster said. “However, that doesn’t appear to have been the case so much for SMEs which reported similar cost pressures to those experienced in late 2022.”

Use the comment section below to tell us how you felt about this.