The gateway to commercial

The gateway to commercial

If a mortgage borrower has already trusted a broker with the biggest purchase of their life – their home – then it makes sense that they would trust that same broker with their second-biggest purchase.

That’s the message from those in the space, but it seems that brokers are already waking up to this fact.

According to a 2017 report by the Commercial and Asset Finance Brokers Association of Australia, 67% of commercial equipment finance is sourced through brokers.

It also makes sense for brokers to help with this type of purchase because, typically, most homebuyers will also buy a new car within 12 months of moving into their home.

Not only has the broker built that trust and relationship but they also already have all the financial information.

Cars are deemed the ‘gateway’ to equipment finance from mortgage broking, but equipment is not just about cars. Once you’re through

Less lavish but perhaps more crucial to many businesses, asset and equipment finance can also include machinery, IT equipment and medical equipment.

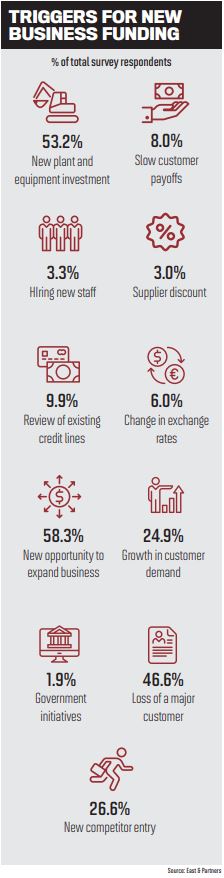

With research by East & Partners showing that one in five businesses found it harder in 2018 to get access to funding, the opportunity for brokers to help is clear.

The same research also showed that 53% of small and mediumsized businesses were looking for funding to invest in new plant and equipment.

Brent Starrenburg, head of Connective Asset Finance, says changing lender policies and risk appetite over the past 12 months have made it harder for businesses.

The aggregator has therefore found brokers looking for alternative lenders to make sure they can service their customers, “rather than trying to put a square peg into a round hole”.

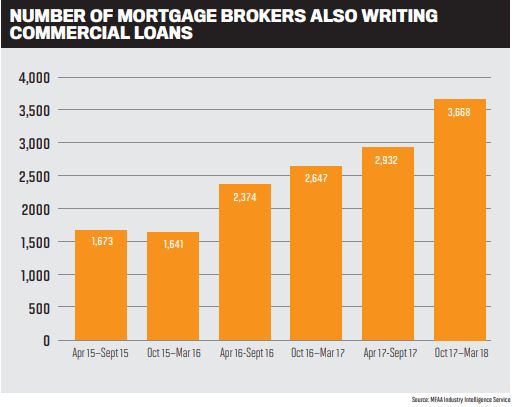

Connective has been educating brokers to move into the asset space for more than five years now, but over the last year it has seen a particular increase in the number of mortgage brokers diversifying.

Not only that but it is also seeing more brokers wanting to join an aggregator in order to work with them in asset finance. “With the mortgage broker side, this was probably spurred on by the royal commission, where they were concerned about loss of income,” Starrenburg says.

The ban on flex commission last year in the motor industry has also “opened up competition” for brokers, he says.

In the past, the interest rate on a car loan was set by the dealer, and the higher the interest rate, the higher their commission.

ASIC banned this, and interest rates are now determined by the customer’s financial position and credit score.

With less time spent on negotiating interest rates and more transparent, standardised pricing, brokers can spend time finding the right deal for the customer.

While a car dealer might have just one or two lenders to offer a consumer, brokers will have a panel of lenders they can turn to. .

“I think the opportunity is definitely there; they have just got to work out how to grab it,” Starrenburg says.

To help brokers with moving across, Connective has provided educational programs and workshops, being mindful of the particular nuances the asset finance space might have, like company structures. Businesses are increasingly turning to brokers for their finance needs, but there is still a way to go in making sure businesses know they can use brokers.

The MFAA recently launched its online campaign to raise the profile of asset and equipment finance brokers and help businesses connect with them.

Starrenburg agrees there is a lack of awareness and says it is incumbent on the broker network to make it clear to their customers what they can offer.

“If I’m a mortgage broker and I’m telling a client that I’m a mortgage broker, I’m pigeon-holing myself. In their mind, that’s all I do” Brent Starrenburg, Connective

For him, it’s about being a finance broker.

At Connective workshops he asks for those in the room who think of themselves as ‘mortgage brokers’ to raise their hands, and many of them do.

He says there is also nothing stopping asset brokers from moving in the opposite direction and offering mortgage products – in fact Connective has seen more of that happening in recent times.

“The problem is that if I’m a mortgage broker and I’m telling a client that I’m a mortgage broker, I’m pigeon-holing myself. In their mind, that’s all I do.

But if I tell them I’m a finance broker, I’m changing their perception of what I do,” he says.

With the idea that mortgage brokers might refer their customers to commercial brokers for their business needs and then find that those brokers can help with all areas of their finance, Connective went the extra step.

The aggregator teamed up with business lender Valiant last year.

Starrenburg says to help brokers with moving across, Connective has provided educational programs and workshops, being mindful of the particular nuances the asset finance space might have, like company structures.

Businesses are increasingly turning to brokers for their finance needs, but there is still a way to go in making sure businesses know they can use brokers.

The MFAA recently launched its online campaign to there are asset finance brokers who do not want to do commercial property, but the partnership allows these brokers to pass their customer on to someone else without the fear of losing them.

“The broker will have the comfort of knowing the client is going to get looked after, and they’ll be kept in the loop with what’s happening and still get a commission split,” Starrenburg says.

While the consensus is that across the board the major banks have pulled back in commercial lending, the options are still there, and for those brokers using the majors they provide education and tools for an easy transition.

ANZ has offerings for vehicle and equipment finance.

This includes cars, trucks, motorbikes and buses, forklifts, dental chairs and ultrasound machines.

Angelo Manos, head of commercial broker at ANZ, says the major bank sees core business assets like trucks and trailers or agricultural machinery making up the majority of business it writes.

“We are also seeing an increase in specialist equipment used for medical and manufacturing purposes,” he says.

Manos says the slowing market conditions have provided brokers with the opportunity to diversify into asset finance.

He also agrees that the trust brokers have already built with their clients when searching for a home loan is invaluable.

“If clients know that their broker can also assist with their vehicle and equipment fi nance needs, it’s likely they will return to their broker for this” Angelo Manos, ANZ

“Brokers are building relationships and establishing trust with their clients mostly for the purpose of assisting them with a home loan,” he says.

“If clients know that their broker can also assist with their vehicle and equipment finance needs, it’s likely they will return to their broker for this because they value that relationship and the guidance provided in the past.”

Equipment finance is a great introduction to commercial lending and is a “natural progression for residential brokers”, Manos says, but it is important to have clear and consistent messaging so that the broker is top of their customer’s mind when they think about asset finance.

ANZ is focusing on education and training to give brokers a seamless experience, Manos says. It is working on producing webinars for ANZ-accredited brokers and looking at ways to partner with aggregators to upskill brokers.

Additionally, the major has committed to a three-month campaign to highlight the ways in which vehicle and equipment finance can help business owners get access to the equipment their businesses need without pressure on their cash flow.

“Asset finance can help brokers diversify their product offering, create an opportunity to contact their customers more often to talk about their needs, and ultimately continue to grow,” he says.

.JPG)