Brokers, industry associations and regulators are scrambling to ‘educate’ borrowers – with varying degrees of commercial self-interest.

On the 14th March 2016, brokers nationwide joined the MFAA in this year’s Global Money Week, an international initiative across 100 countries to educate parents and children about money.

MFAA brokers ran community workshops on this year’s theme of ‘Take Part, Save Smart’ along with an online forum, games and competitions to help build financial literacy.

Whether or not you’re an MFAA member, you’re going to be hearing the word ‘education’ endlessly repeated over the coming year. In November, the National Financial Literacy Stakeholder Forum, hosted by ASIC, reignited the debate over how to improve consumer understanding of financial concepts from school onwards, with the release of ASIC’s studies into consumer awareness.

Attention was focused on improving female financial literacy. FBAA CEO Peter White noted this was particularly important as 70% of women manage the family budget, and are likely to outlive their husbands. This echoed ING Direct’s Women & Finance report, released last year, which predicted women will be beneficiaries of “a massive intergenerational transfer of wealth”.

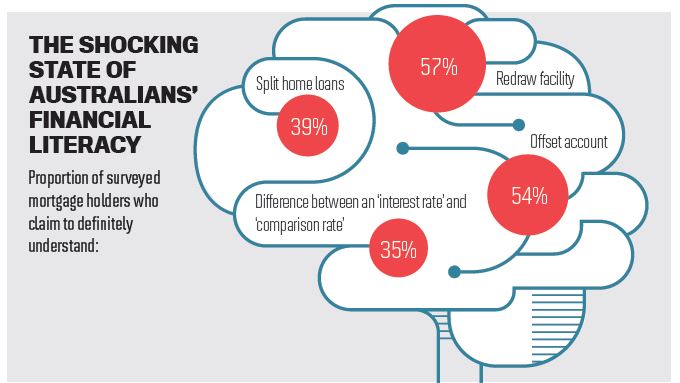

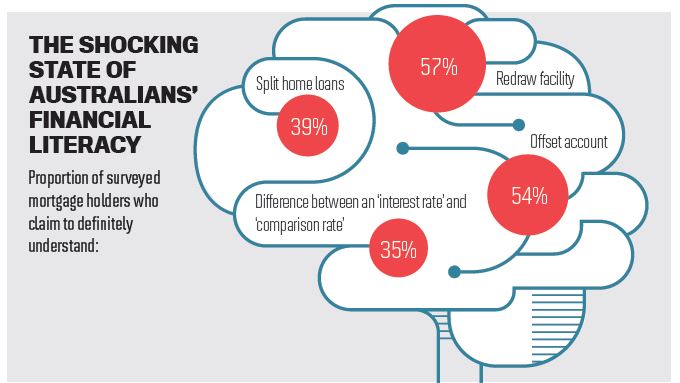

Educating consumers presents numerous opportunities, but is also a response to continuing financial illiteracy among Australian consumers. In December, credit union Gateway released a study indicating even mortgage holders often struggled to understand key features of mortgage products (see the results in our sidebar). Consumer ignorance ‘cements’ brokers’ role in the mortgage value chain, Gateway’s CEO Paul Thomas told MPA’s sister title Australian Broker. “The reality is that on the one hand we say that today’s consumers are financially literate and savvy and I understand that, but this survey clearly shows there is a critical mass of the populace that really need help and guidance when it comes to selecting a cre dit provider for a home loan,” said Thomas.

dit provider for a home loan,” said Thomas.

Brokers have been guiding clients for years. A broker’s website is now likely to feature a blog, downloadable white papers, and newsletters, many of which are distributed on-mass by aggregators and franchises. However, an increase in educational content is increasingly exposing how thin the line separating education and advice really is. Banks, for instance, would like brokers to ‘educate’ borrowers about opportunities in asset finance and insurance, which sounds suspiciously like cross-selling. Of course, taking out insurance may well be a sensible move for a new home owner, but does it really count as education? Making this brand of education a key part of broking’s proposition could fundamentally damage broking’s standing in the community – parents aren’t likely to welcome brokers selling insurance to their kids.

The solution may be for brokers to reclaim the definition of ‘education’ from banks and investment consultancies and take it back to basics. Gateway CEO Thomas provides a potential definition. “We define financial literacy as the ability to make informed judgements and effective decisions about the use and management of money.”

Therefore, the broker’s role is to add knowledge and tools to what can be an emotional decision for many buyers. “Sometimes our head rules the decision that we make and sometimes our heart rules. I believe that a broker’s role is to ensure at all times that borrowers make decisions about financial transactions with their head.” That could well start with teaching borrowers the difference between an interest and comparison rate.

MFAA brokers ran community workshops on this year’s theme of ‘Take Part, Save Smart’ along with an online forum, games and competitions to help build financial literacy.

Whether or not you’re an MFAA member, you’re going to be hearing the word ‘education’ endlessly repeated over the coming year. In November, the National Financial Literacy Stakeholder Forum, hosted by ASIC, reignited the debate over how to improve consumer understanding of financial concepts from school onwards, with the release of ASIC’s studies into consumer awareness.

Attention was focused on improving female financial literacy. FBAA CEO Peter White noted this was particularly important as 70% of women manage the family budget, and are likely to outlive their husbands. This echoed ING Direct’s Women & Finance report, released last year, which predicted women will be beneficiaries of “a massive intergenerational transfer of wealth”.

Educating consumers presents numerous opportunities, but is also a response to continuing financial illiteracy among Australian consumers. In December, credit union Gateway released a study indicating even mortgage holders often struggled to understand key features of mortgage products (see the results in our sidebar). Consumer ignorance ‘cements’ brokers’ role in the mortgage value chain, Gateway’s CEO Paul Thomas told MPA’s sister title Australian Broker. “The reality is that on the one hand we say that today’s consumers are financially literate and savvy and I understand that, but this survey clearly shows there is a critical mass of the populace that really need help and guidance when it comes to selecting a cre

dit provider for a home loan,” said Thomas.

dit provider for a home loan,” said Thomas.Brokers have been guiding clients for years. A broker’s website is now likely to feature a blog, downloadable white papers, and newsletters, many of which are distributed on-mass by aggregators and franchises. However, an increase in educational content is increasingly exposing how thin the line separating education and advice really is. Banks, for instance, would like brokers to ‘educate’ borrowers about opportunities in asset finance and insurance, which sounds suspiciously like cross-selling. Of course, taking out insurance may well be a sensible move for a new home owner, but does it really count as education? Making this brand of education a key part of broking’s proposition could fundamentally damage broking’s standing in the community – parents aren’t likely to welcome brokers selling insurance to their kids.

The solution may be for brokers to reclaim the definition of ‘education’ from banks and investment consultancies and take it back to basics. Gateway CEO Thomas provides a potential definition. “We define financial literacy as the ability to make informed judgements and effective decisions about the use and management of money.”

Therefore, the broker’s role is to add knowledge and tools to what can be an emotional decision for many buyers. “Sometimes our head rules the decision that we make and sometimes our heart rules. I believe that a broker’s role is to ensure at all times that borrowers make decisions about financial transactions with their head.” That could well start with teaching borrowers the difference between an interest and comparison rate.