Repayments now 65% higher than pre-pandemic levels

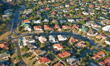

New homebuyers in Australia are taking on larger mortgages than ever before, with repayments now 65% higher than pre-pandemic levels.

As the Reserve Bank board prepares for its final meeting of the year, households are grappling with intense financial pressures. In response, Treasurer Jim Chalmers has announced that the Albanese government will only consider new cost-of-living measures ahead of the next budget in May, The Australian reported.

Chalmers acknowledged signs of a slowing economy and job market but cautioned against expecting significant new measures in the mid-year update next week. He said that the government remains open to considering additional measures closer to the May budget, provided they align with budget constraints and economic conditions at the time.

The upcoming mid-year economic and fiscal outlook is expected to reveal a much healthier state of the nation's finances. However, Chalmers clarified that a surplus for this financial year is not anticipated, despite the budget already exceeding expectations by $9 billion in the financial year leading up to October.

“We’ve already delivered a surplus and the MYEFO would show a much healthier set of books than what we saw in the May budget,” Chalmers told The Australian. “We are making welcome and encouraging progress across all these fronts, particularly in the fight against inflation, but we’re not getting carried away because there’s a long way to go.”

According to new data from the Australian Bureau of Statistics, Australians purchasing their first homes borrowed an average of $509,300 in October, surpassing the previous peak in January. These figures also indicate that new buyers are borrowing an average of $100,000 more than before the pandemic. The Reserve Bank of Australia reports that mortgage rates have also significantly increased, rising to 6% compared to 3.3% in October 2019, according to The Australian.

Consequently, the burden of mortgage repayments has skyrocketed. Prior to the pandemic, the typical Australian first-time mortgage holder paid $1,990 per month to service their loan. That burden has now surged to $3281 per month, as analysed by The Australian.

While economists and investors do not anticipate an interest rate adjustment on Tuesday, Reserve Bank of Australia Governor Michele Bullock has warned that further action may be necessary in the coming months if inflation does not come under control. The central bank has already implemented 13 rate hikes in the past 18 months. However, a resurgent property market, coupled with a surge in net migration, has complicated the RBA's efforts to tame high price growth, The Australian reported.

Recent data from the ABS indicates a resurgence in the housing market, with total new home lending in October experiencing the highest increase in almost two years. Despite being lower than the peak at the start of 2022, new lending to owner-occupiers and investors reached $26.7 billion in October, significantly higher than the $18.9 billion leading up to the COVID-19 pandemic.

The average new loan size among owner-occupiers increased to $610,300 in October, just 1% below the record set in January 2022, according to The Australian. In comparison, the average new home loan size in October 2019 was $481,600.

Have something to say about this story? Let us know in the comments below.