As the first rung on the property ladder seems to hover ever higher for first home buyers, MPA and ANZ team up to explore recent changes on that bumpy road to home ownership. Maya Breen reports

.JPG)

As the first rung on the property ladder seems to hover ever higher for first home buyers, MPA and ANZ team up to explore recent changes on that bumpy road to home ownership. Maya Breen reports

Buying your first home isn’t an easy endeavour these days. Faced with high house prices, first home buyers have to scrabble together weighty deposits while keeping track of regulatory changes and which benefits apply to the state they live in – all this before they actually get on the ladder leading them to home ownership at a later age than previous generations. When they do purchase, getting caught out by rising interest rates or overstretched budgets could lead to losing their homes if they’re not careful, so the guiding light and expertise of brokers is needed by this particular sector now more than ever.

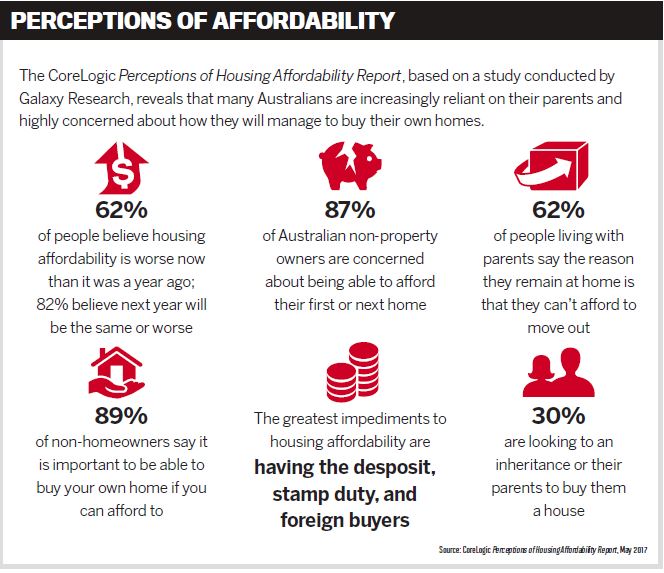

CoreLogic’s recent Perceptions of Housing Affordability Report found that almost two thirds (62%) of Australians believe housing affordability is worse than 12 months ago and

58% expect next year to be no different, if not worse.

This is a grim picture when most non-homeowners (89%) believe it’s important to own your own home but 87% have doubts that they will be able to afford to do so.

New data from aggregator Australian Finance Group, however, has found that the number of first home buyers is going up nationally. Its mortgage index for Q3 FY17 revealed that FHB lodgements had jumped to 10% of the total number of loans written, levels not hit since 2014.

But in contrast, two brokers MPA spoke to from opposite sides of the country actually saw a fall in FHB clients. Simon Kahl, general manager of Western Australian brokerage The Loan Company, leads a team of 16 brokers and has seen many changes in the more than 20 years he’s been in the finance industry.

The Loan Company is a division of BGC, one of Australia’s biggest residential building groups, and as a result about 70% of its core business is FHB construction clients. However, Kahl says in the past year they have seen a decline in these clients.

Unemployment is high in Perth and people are moving interstate to find work. “Also, our mining industry has gone from the development phase into the production phase, which generally means that you need about 10% of the workforce that you actually needed when these particular mines were being built, so that’s also caused quite a significant downturn in the market,” Kahl says. But he is optimistic that a balance will return over the next few years.

“People still love the great Australian dream of building and buying their first home, and that mentality is definitely prevalent in WA,” he says. “There’s definitely a market for the first home buyer construction client that wants to borrow beyond 95%.”

Over in Sydney, the owner manager of Mortgage Choice for both Glenwood and Kellyville, Bianca Long, says over the past 12 months they have also not seen as many FHBs as they used to.

“At the moment we are predominantly seeing mainly existing homeowners and a lot of investors in the market. As far as what we’re seeing come through, for first home owners the number has dropped significantly.

“A lot of the times it’s not so much a case of affordability at the moment; it’s purely just based on deposit.”

FHBs’ biggest worries

Buying a house brings with it many challenges, but nationally, saving for a deposit is seen as the biggest impediment to purchasing a property, according to CoreLogic’s report. Stamp duty costs come next, followed by the threat posed by foreign buyers.

From a state perspective, stamp duty was the greatest concern for respondents from NSW (48%), whereas Western Australians’ biggest fear was finding a deposit (47%).

Despite these concerns, there seems to be a lack of awareness around what options can help them become homeowners.

Only half (51%) of respondents knew there were stamp duty concessions available; 42% realised property purchase was possible with less than a 20% deposit; and just 25% were aware of restrictions on foreign buyer purchases.

Long says that among her clients only 30–40% are in a position to proceed, with most relying on parent-gifted funds. She finds their lack of knowledge in certain areas interesting as “this is a generation now that is so highly educated on everything, and when it comes to buying their first home they’re not educated on the deposits”.

Some welcome news for prospective first-time buyers, however, is the government’s recently announced First Home Super Saver Scheme, allowing FHBs to access voluntary superannuation contributions for a housing deposit.

The measures in the 2017 Federal Budget will allow FHBs access to $15,000 a year and $30,000 in total, with contributions able to be made from 1 July 2017.

“I actually believe that’s a step in the right direction,” says Kahl, but he adds that “because property prices are expensive, it is getting harder and harder for someone to save that deposit for a new home. This is a fantastic idea, but there needs to be a little bit more”.

“A 30% rebate on what they would’ve paid on their usual tax bracket, I don’t think is enough,” he adds, referring to the fact that from 1 July 2018 withdrawals for a deposit will be taxed at marginal tax rates less a 30% offset. “If it’s going into the super fund for the purpose of buying their first home, why not actually do something that’s a little bit more generous?”

But Western Australians face a more pressing hurdle after the state government recently announced a cut to its First Home Owner Grant, which gave eligible FHBs building their own homes access to $10,000 for purchases up to $750,000, plus a boost amount. It was announced in May that the closing date for the temporary $5,000 boost, which came from the former Barnett Government last December to help FHBs get into property, has been moved back six months to June 2017.

WA Treasurer Ben Wyatt said the move would contribute $20m in savings to help repair the budget. “The boost is not an effective mechanism for stimulating additional construction of homes, and given the disastrous state of the finances which we have inherited, we need to remove any ineffective spending,” he said in a statement.

But Kahl says, “I can tell you right now that is so far from the truth it’s extremely disappointing,” especially as the decision was apparently made without consulting the housing industry, according to news reports.

“What’s now going to happen is a lot of people that were considering building a home and having a conversation over the next three to six months are now going to try and be pulled into the next six weeks [at the time of writing].”

Finding safe passage

Clearly it’s a turbulent time for first home buyers, with many hoops they must jump through to become homeowners. But once they have the mortgage, it’s still not smooth sailing. CoreLogic’s report found that meeting repayments was of greatest concern in NSW (41%) and WA (40%) as a barrier to housing affordability.

Mortgage Choice’s Long says a possible strain on repayments could be down to these buyers’ lifestyle choices. “Their lifestyle is very different to what the older generations is – they spend much more within their disposable income; their entertainment lifestyle is certainly more expensive than what the older generation is.

“So even though the benchmark is saying that they can afford it, I do think that there is a real sense of urgency for first home owners to pull the reins in a bit with what they’re spending, because if the rates do rise it is very much going to hurt them.”

Jamie Alcock, associate professor at the University of Sydney Business School, believes interest rate rises pose the greatest risk to first home buyers if they lead to hiked mortgage repayments that they can’t handle.

ANZ’s BlueNotes managing editor, Andrew Cornell, recently wrote that “housing is a Gordian knot of complexity and there’s no Alexander the Great to simply untangle it with one swing of a sword. In Australia, while raising interest rates may tamp down some property lending and offer investors relatively more attractive alternative investments, higher rates may also choke off broader economic growth – in turn affecting salaries, employment and business investment.”

The good news for brokers is it’s probably a safe bet that first home buyers will need them more than ever before to help them successfully navigate the increasingly complex road to home ownership.

Many first home buyers find buying a home complicated and stressful. They want someone they can trust and will guide them through the process and make it easy!

This is why we know a majority of first home buyers will seek out a broker to help them, and we recognise the important role they play in helping the next generation of Australians get on the property ladder.

Together we have a critical role to play, which is why it is ANZ’s mission to be Australia’s leading bank for brokers, one that ensures broker customers receive an excellent service, for the life of their loan.

That’s why we’re investing in education, simplifying our processes and ultimately improving the overall ANZ broker experience.

ANZ BDMs can partner and support you, to help navigate rapid industry change and make the most of every opportunity.

Confident first home buyers are important to all of us, and we hope you enjoy MPA’s deep dive into this topic. Contact your ANZ BDM if you’d like further info about how ANZ can help you help your first home buyers.

Simone Tilley,

GM of broker distribution, ANZ