Rate stable at 3.4%, getting closer to RBA target

Inflation continues to track towards the Reserve Bank of Australia’s target of 2% to 3%, with the latest monthly consumer price index (CPI) at 3.4%, the lowest level seen since November 2021.

Industry experts have welcomed the latest data, with economist Stephen Koukoulas going as far to say that “inflation had been beaten”.

The CPI figure, released by the Australian Bureau of Statistics on Wednesday and covering the 12 months to January 2024, held steady at 3.4%.

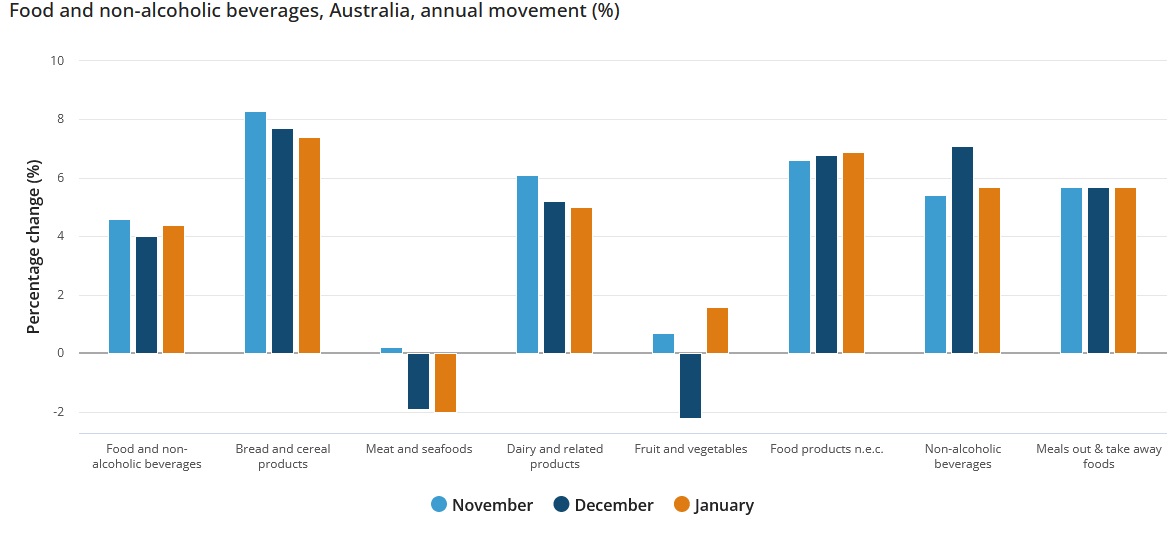

The ABS reported the biggest contributors to the January annual inflation increase were housing (+4.6%), food and non-alcoholic beverages (+4.4%), alcohol and tobacco (+6.7%), and insurance and financial services (+8.2%).

“CPI inflation is often impacted by items with volatile price changes like automotive fuel, fruit and vegetables, and holiday travel,” said ABS head of prices statistics Michelle Marquardt (pictured above centre), in a media release.

“It can be helpful to exclude these items from the headline CPI to provide a view of underlying inflation,” Marquardt said.

Excluding the volatile items from the monthly CPI indicator, the annual rise in was 4.1%, which was a slight decrease from the 4.2% in December.

“Annual inflation when excluding volatile items has been declining since the peak of 7.2% in December 2022,” said Marquardt.

Other inflation drivers

Looking at other contributors to CPI, housing rose 4.6% in the 12 months to January, while new dwelling prices saw a 4.8% rise. Rent prices also increased 7.4%, reflecting a tight rental market and low vacancy rates nationally.

Following the Energy Bill Relief Fund rebates for households, which were introduced in July 2023, annual electricity prices only rose 0.8%.

“Excluding the rebates, electricity prices would have increased 15.3% in the 12 months to January 2024,” said Marquardt.

Industry reaction to inflation figures

Reacting to the latest CPI inflation data via a video on Linkedin, respected economist Stephen Koukoulas, managing director of Market Economics, said to say that inflation had been beaten “was an understatement”.

Koukoulas (pictured above left) said the 3.4% inflation figure was below market expectations. “There was a bit of concern that there would be a couple of seasonal (January) price increases that would push the rate a little bit higher – they weren’t there,” he said.

“It’s no surprise given how weak the economy is, given how the labour market’s deteriorating, so we’ve got inflation locked in at a rate that’s cascading rapidly towards the RBA target.

“This was lower I’m sure than the RBA was forecasting – it just confirms that over the next couple of quarters we will be getting inflation back within the target range.”

Koukoulas described the January inflation rate as “fantastically low”, falling from a peak of 8.4% in December 2022.

“The RBA overhiking interest rates has clearly worked – taking two courses of tablets when you only need one – of course they’re going to work but it risks really killing the economy,” he said.

Koukoulas said the GDP figures would be released next week and these were likely to be “shockingly bad” and would not include the effects of the November interest rate hike.

“All in all, inflation has been beaten – the question now is exactly when the RBA will have the wisdom to move to start cutting interest rates. I think it’s going to be the 7th of May.”

He said he based this prediction on the new quarterly CPI figures which were likely to be low and unemployment heading towards 4.5%.

“An official cash rate of 3.45% is really restrictive – we don’t need a 3.45% cash rate when unemployment’s going up and inflation is back in the target range.”

Canstar group executive financial services Steve Mickenbecker (pictured above right) said the 3.4% annual inflation rate showed the advance of Australia’s inflation towards the 2% to 3% Reserve Bank target band.

“The inflation rate for January was steady, but with record inflation in early 2023 working its way out of the annual data the return to the target doesn’t look so far off,” Mickenbecker said.

“The 3.4 percent annual inflation rate through to the end of January is good news for borrowers. The case for further cash rate increases is all but gone and projections for the timing of rate cuts may be brought forward.”

Mickenbecker said the RBA would remain reluctant to cut the cash rate too soon and had shown far greater faith in quarterly inflation readings.

“The March quarterly release will come too early to signal a rate cut but the June quarterly release in late July could very much raise borrowers’ hopes.

Does the latest inflation rate give you confidence the RBA will cut interest rates sooner rather than later? Comment below