Investor lending has returned with a vengeance, growing at near record levels. MPA editor Sam Richardson asks brokers and industry experts how regulators and the banks might respond and how property investors could be affected

Investor lending has returned with a vengeance, growing at near record levels. MPA editor Sam Richardson asks brokers and industry experts how regulators and the banks might respond and how property investors could be affected

Investor lending is fast becoming the RBA’s mission accomplished moment. While Australia’s Reserve Bank and the former US President George W Bush might not seem to have a lot in common, both prematurely declared victory over foes that came back to haunt them. Bush was never able to vanquish Iraqi insurgents and it seems the RBA is losing the battle against red-hot growth in investor lending and, consequently, spiralling house prices.

APRA’s 10% speed limit on investor lending growth helped for a while, cooling investor lending from 2015-16. Yet now investor lending is back with a vengeance. As the Australian Bureau of Statistics’ figures for January showed, investor lending had increased by 27.5% in a year, and is coming close to outpacing lending to owner-occupiers. CoreLogic’s Home Value Index showed the effect of investor lending on prices, which rose by 2.6% in Sydney and 1.5% in Melbourne, in the space of a month.

Regulators are beginning to concede defeat. In Australia, RBA assistant governor Michele Bullock admitted the effect of the 10% growth cap was fading and that the RBA was “prepared to do more if needed”. APRA chairman Wayne Byres warned that lenders breaching the 10% limit should be under “no illusions that supervisory intervention, probably in the form of higher capital requirements, is a possible consequence”. In Paris, the Organisation for Economic Cooperation and Development flagged a risk of contagion and disastrous economic consequences should house prices take a downward turn.

Regulators are beginning to concede defeat. In Australia, RBA assistant governor Michele Bullock admitted the effect of the 10% growth cap was fading and that the RBA was “prepared to do more if needed”. APRA chairman Wayne Byres warned that lenders breaching the 10% limit should be under “no illusions that supervisory intervention, probably in the form of higher capital requirements, is a possible consequence”. In Paris, the Organisation for Economic Cooperation and Development flagged a risk of contagion and disastrous economic consequences should house prices take a downward turn.

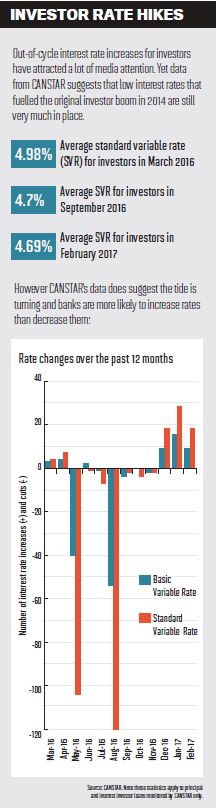

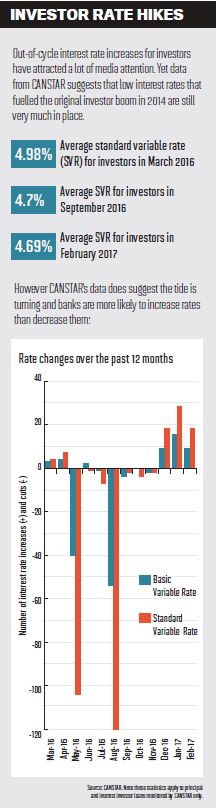

These warnings have not gone unnoticed by lenders, who continue to raise investor interest rates out of cycle and tighten policies.

The CBA and Bankwest have gone the furthest. At the time of writing, in March, they were refusing to accept broker-initiated refinancing for investor clients. Investor lending appears to be approaching a tipping point, when investors could see a more extreme regulatory response from the banks. Here MPA asks what that response could be, and how it could affect brokers.

Investors on the front line

John Manciameli runs Hunterwood Solutions in southern Sydney and has recently set up Slipstream Australia, an aggregator of investment research houses. He has definitely found it harder to finance his investor clients.

“We’re constantly seeing appetite changes; one minute they’re saying no; the next minute they’re saying yes. It’s a challenging environment, and I’ve never seen a time in which the public needs a broker more than now,” he says.

Manciameli’s not the only broker to notice a change. Property Investment Professionals of Australia chairman and broker Ben Kingsley is finding borrowers with multiple properties held back by a tightening of servicing calculators by lenders. While Manciameli says he’s still able to finance all his clients, often through second-tier lenders, Kingsley says there’s a small percentage of clients who are now unable to borrow.

According to Kingsley, “there’s still ways to borrow more for the very sophisticated client who has good cash flow, experience and a good understanding of the household budget, but we normally have to go to second- or third-tier lenders for finance.”

Both brokers say that these difficulties are not putting off would-be investors. Kingsley says his investor-focused brokerage, Empower Wealth, is growing at double digits. Their experience is backed up by the data.

Martin North, principal of research firm Digital Finance Analytics, says there’s still “rabid demand for investor property”. In fact, says North, “All of my surveys say there are more people now considering property investment than a year ago.”

North says Australians are driven to investing for three reasons: the attractive tax breaks for investors, the low returns offered by deposits and savings and the continued expectation of long-term capital appreciation.

To that Manciameli offers a fourth: the considerable equity accumulated by homeowners in Sydney and Melbourne due to increasing property values in recent years.

What’s definitely not driving the surge in investors are rental yields, CoreLogic’s head of research Tim Lawless told MPA. As prices rise and rents remain stagnant, yields are now just 2.8% in Sydney and 2.7% in Melbourne; whereas total gross returns from capital gains in these cities are at 22.1% and 16.5% respectively over a year. Investment is still very much concentrated in Sydney and Melbourne, even if specialists such as Kingsley are advising their clients to look elsewhere.

Investors continue to pile into high-density off-the-plan apartments, despite concerns of inaccurate valuations and poor quality apartments that owner-occupiers don’t want.

“I’d be very surprised if domestic investors hadn’t heard those warnings, whether or not they’re heeding them,” observes Lawless. “But with foreign investors, I just don’t know if those messages or alarm bells are ringing very loudly beyond our shores.”

It wasn’t so long ago that foreign investors were the mortgage industry’s stand-out sector, until regulators cracked down on rule-breaker banks and made it near impossible for foreign investors to get finance. However, the experts MPA spoke to didn’t believe regulators would take similarly decisive action against Australian investors.

“APRA is concerned about the strength of the investment sector and they want to underscore lending standards, but I don’t see any intent from APRA to turn off the investment sector at all,” DFA principal North explains.

“Put those two things together and there really isn’t a reason why investment lending should slow down at all, and I see this trend continuing.”

CoreLogic’s Lawless is less convinced that APRA will sit back: “If we do see investor lending growth continuing to be very strong, then we may see APRA wading in and either further regulatory changes around the speed limit, or new regulations, like what NZ has done by imposing [localised] loan-tovaluation limits.”

One possibility is that APRA could lower its 10% speed limit in an attempt to reduce growth says North.

“Ten per cent is way above inflation; it’s way above wage growth. It is effectively allowing the housing market to continue to run and continue to increase house prices … there is no absolute science – there’s no clarity – as to why it’s 10% rather than 6% or 12%.”

A lower growth target could mean even more chaos for brokers, as demand rapidly switches from one lender to another as they successively hit their speed limits. Furthermore non-banks, who are not subject to APRA’s restrictions, would be given a major opportunity.

What’s more likely is that investors will be hit by further out-of-cycle rate hikes. These are already being used ad hoc by banks to keep their growth under the limit, but according to JP Morgan and DFA a more systematic repricing will soon be required. The Basel 4 capital requirements will require banks to hold more capital for loans “materially dependent on cash flows”, making these loans more expensive, with rate increases of up to 300bp. Although exactly which loans will be affected won’t be confirmed until later this year, JP Morgan predicted that seniors, young affluent borrowers and exclusive professionals will be among the hardest hit groups.

What’s more likely is that investors will be hit by further out-of-cycle rate hikes. These are already being used ad hoc by banks to keep their growth under the limit, but according to JP Morgan and DFA a more systematic repricing will soon be required. The Basel 4 capital requirements will require banks to hold more capital for loans “materially dependent on cash flows”, making these loans more expensive, with rate increases of up to 300bp. Although exactly which loans will be affected won’t be confirmed until later this year, JP Morgan predicted that seniors, young affluent borrowers and exclusive professionals will be among the hardest hit groups.

According to JP Morgan executive director Scott Manning, the rate hikes investors have seen so far are just a “toe in the water” compared with what’s coming. More positively, as banks are forced to further correlate pricing and LVRs the possibilities for refinancing will increase, although an increasing number of borrowers won’t be able to refinance. JP Morgan picked out ANZ as the major bank best placed to capitalise on changes, given their relatively small existing investor book.

In the long term, investor lending could be limited by policymakers as affordability and the problems of first home buyers become ever more pressing issues. Although the federal government has repeatedly insisted that negative gearing tax breaks will not be removed, Labor have made it one of their policies if elected. However, politicians could also increase the appetite for property investment. According to Hunterwood broker Manciameli, major infrastructure projects in the eastern states are creating wealth that people are putting into property.

Finally, there is the widely held assumption that an eventual rise in interest rates will curb investor demand. Change is unlikely to come quickly, however: 27 out of the 32 economists on Finder.com.au’s panel believe the RBA won’t raise rates in 2017. Though a rate rise could catch out certain investors, warns Kingsley: “Whether that be 2018 or 2019, we’ll see who’s been exposed and bought in the wrong markets at the wrong time.”

Yet according to CoreLogic’s Lawless: “It depends how much property values are going to cool. Take Sydney, where property values are rising at 18% per annum; if that rate of capital gains falls down to 8% or 9% or 5%, it’s still a pretty attractive return for an investor.” It’s because of these simple economics that investors, and the brokers that serve them, are looking forward to the future.

“There are generations who’ve seen it be a very stable if not very profitable asset class,” says Manciameli. “Everyone believes that despite what we’re hearing and seeing overseas it seems to be a pretty good asset class.”

Investor lending is fast becoming the RBA’s mission accomplished moment. While Australia’s Reserve Bank and the former US President George W Bush might not seem to have a lot in common, both prematurely declared victory over foes that came back to haunt them. Bush was never able to vanquish Iraqi insurgents and it seems the RBA is losing the battle against red-hot growth in investor lending and, consequently, spiralling house prices.

APRA’s 10% speed limit on investor lending growth helped for a while, cooling investor lending from 2015-16. Yet now investor lending is back with a vengeance. As the Australian Bureau of Statistics’ figures for January showed, investor lending had increased by 27.5% in a year, and is coming close to outpacing lending to owner-occupiers. CoreLogic’s Home Value Index showed the effect of investor lending on prices, which rose by 2.6% in Sydney and 1.5% in Melbourne, in the space of a month.

Regulators are beginning to concede defeat. In Australia, RBA assistant governor Michele Bullock admitted the effect of the 10% growth cap was fading and that the RBA was “prepared to do more if needed”. APRA chairman Wayne Byres warned that lenders breaching the 10% limit should be under “no illusions that supervisory intervention, probably in the form of higher capital requirements, is a possible consequence”. In Paris, the Organisation for Economic Cooperation and Development flagged a risk of contagion and disastrous economic consequences should house prices take a downward turn.

Regulators are beginning to concede defeat. In Australia, RBA assistant governor Michele Bullock admitted the effect of the 10% growth cap was fading and that the RBA was “prepared to do more if needed”. APRA chairman Wayne Byres warned that lenders breaching the 10% limit should be under “no illusions that supervisory intervention, probably in the form of higher capital requirements, is a possible consequence”. In Paris, the Organisation for Economic Cooperation and Development flagged a risk of contagion and disastrous economic consequences should house prices take a downward turn.These warnings have not gone unnoticed by lenders, who continue to raise investor interest rates out of cycle and tighten policies.

The CBA and Bankwest have gone the furthest. At the time of writing, in March, they were refusing to accept broker-initiated refinancing for investor clients. Investor lending appears to be approaching a tipping point, when investors could see a more extreme regulatory response from the banks. Here MPA asks what that response could be, and how it could affect brokers.

Investors on the front line

John Manciameli runs Hunterwood Solutions in southern Sydney and has recently set up Slipstream Australia, an aggregator of investment research houses. He has definitely found it harder to finance his investor clients.

“We’re constantly seeing appetite changes; one minute they’re saying no; the next minute they’re saying yes. It’s a challenging environment, and I’ve never seen a time in which the public needs a broker more than now,” he says.

Manciameli’s not the only broker to notice a change. Property Investment Professionals of Australia chairman and broker Ben Kingsley is finding borrowers with multiple properties held back by a tightening of servicing calculators by lenders. While Manciameli says he’s still able to finance all his clients, often through second-tier lenders, Kingsley says there’s a small percentage of clients who are now unable to borrow.

According to Kingsley, “there’s still ways to borrow more for the very sophisticated client who has good cash flow, experience and a good understanding of the household budget, but we normally have to go to second- or third-tier lenders for finance.”

Both brokers say that these difficulties are not putting off would-be investors. Kingsley says his investor-focused brokerage, Empower Wealth, is growing at double digits. Their experience is backed up by the data.

“There’s still ways to borrow more for the very sophisticated client who has good cash flow, experience and a good understanding of the household budget” - Ben Kingsley, Empower Wealth

Martin North, principal of research firm Digital Finance Analytics, says there’s still “rabid demand for investor property”. In fact, says North, “All of my surveys say there are more people now considering property investment than a year ago.”

North says Australians are driven to investing for three reasons: the attractive tax breaks for investors, the low returns offered by deposits and savings and the continued expectation of long-term capital appreciation.

To that Manciameli offers a fourth: the considerable equity accumulated by homeowners in Sydney and Melbourne due to increasing property values in recent years.

What’s definitely not driving the surge in investors are rental yields, CoreLogic’s head of research Tim Lawless told MPA. As prices rise and rents remain stagnant, yields are now just 2.8% in Sydney and 2.7% in Melbourne; whereas total gross returns from capital gains in these cities are at 22.1% and 16.5% respectively over a year. Investment is still very much concentrated in Sydney and Melbourne, even if specialists such as Kingsley are advising their clients to look elsewhere.

Investors continue to pile into high-density off-the-plan apartments, despite concerns of inaccurate valuations and poor quality apartments that owner-occupiers don’t want.

“I’d be very surprised if domestic investors hadn’t heard those warnings, whether or not they’re heeding them,” observes Lawless. “But with foreign investors, I just don’t know if those messages or alarm bells are ringing very loudly beyond our shores.”

It wasn’t so long ago that foreign investors were the mortgage industry’s stand-out sector, until regulators cracked down on rule-breaker banks and made it near impossible for foreign investors to get finance. However, the experts MPA spoke to didn’t believe regulators would take similarly decisive action against Australian investors.

“APRA is concerned about the strength of the investment sector and they want to underscore lending standards, but I don’t see any intent from APRA to turn off the investment sector at all,” DFA principal North explains.

“Put those two things together and there really isn’t a reason why investment lending should slow down at all, and I see this trend continuing.”

CoreLogic’s Lawless is less convinced that APRA will sit back: “If we do see investor lending growth continuing to be very strong, then we may see APRA wading in and either further regulatory changes around the speed limit, or new regulations, like what NZ has done by imposing [localised] loan-tovaluation limits.”

One possibility is that APRA could lower its 10% speed limit in an attempt to reduce growth says North.

“Ten per cent is way above inflation; it’s way above wage growth. It is effectively allowing the housing market to continue to run and continue to increase house prices … there is no absolute science – there’s no clarity – as to why it’s 10% rather than 6% or 12%.”

A lower growth target could mean even more chaos for brokers, as demand rapidly switches from one lender to another as they successively hit their speed limits. Furthermore non-banks, who are not subject to APRA’s restrictions, would be given a major opportunity.

.JPG)

“Ten per cent is way above inflation; it’s way above wage growth. It is effectively allowing the housing market to continue to run and continue to increase house prices” - Martin North, Digital Finance Analytics

What’s more likely is that investors will be hit by further out-of-cycle rate hikes. These are already being used ad hoc by banks to keep their growth under the limit, but according to JP Morgan and DFA a more systematic repricing will soon be required. The Basel 4 capital requirements will require banks to hold more capital for loans “materially dependent on cash flows”, making these loans more expensive, with rate increases of up to 300bp. Although exactly which loans will be affected won’t be confirmed until later this year, JP Morgan predicted that seniors, young affluent borrowers and exclusive professionals will be among the hardest hit groups.

What’s more likely is that investors will be hit by further out-of-cycle rate hikes. These are already being used ad hoc by banks to keep their growth under the limit, but according to JP Morgan and DFA a more systematic repricing will soon be required. The Basel 4 capital requirements will require banks to hold more capital for loans “materially dependent on cash flows”, making these loans more expensive, with rate increases of up to 300bp. Although exactly which loans will be affected won’t be confirmed until later this year, JP Morgan predicted that seniors, young affluent borrowers and exclusive professionals will be among the hardest hit groups.According to JP Morgan executive director Scott Manning, the rate hikes investors have seen so far are just a “toe in the water” compared with what’s coming. More positively, as banks are forced to further correlate pricing and LVRs the possibilities for refinancing will increase, although an increasing number of borrowers won’t be able to refinance. JP Morgan picked out ANZ as the major bank best placed to capitalise on changes, given their relatively small existing investor book.

In the long term, investor lending could be limited by policymakers as affordability and the problems of first home buyers become ever more pressing issues. Although the federal government has repeatedly insisted that negative gearing tax breaks will not be removed, Labor have made it one of their policies if elected. However, politicians could also increase the appetite for property investment. According to Hunterwood broker Manciameli, major infrastructure projects in the eastern states are creating wealth that people are putting into property.

Finally, there is the widely held assumption that an eventual rise in interest rates will curb investor demand. Change is unlikely to come quickly, however: 27 out of the 32 economists on Finder.com.au’s panel believe the RBA won’t raise rates in 2017. Though a rate rise could catch out certain investors, warns Kingsley: “Whether that be 2018 or 2019, we’ll see who’s been exposed and bought in the wrong markets at the wrong time.”

Yet according to CoreLogic’s Lawless: “It depends how much property values are going to cool. Take Sydney, where property values are rising at 18% per annum; if that rate of capital gains falls down to 8% or 9% or 5%, it’s still a pretty attractive return for an investor.” It’s because of these simple economics that investors, and the brokers that serve them, are looking forward to the future.

“There are generations who’ve seen it be a very stable if not very profitable asset class,” says Manciameli. “Everyone believes that despite what we’re hearing and seeing overseas it seems to be a pretty good asset class.”