MFAA report also reveals fewer mortgage brokers writing commercial loans

The proportion of broker-originated home loans settled with the major banks and white-label lenders dropped in the last quarter when compared to the last three months of 2022, according to the latest MFAA data.

The latest insights into the mortgage broking industry released by MFAA in its 16th edition Industry Intelligence Service report, covers the six-month period from October 1, 2022, to March 31, 2023.

In the January to March 2023 quarter, major banks and white label lenders lost market share due to increases in market share by the other types of lenders and international banks.

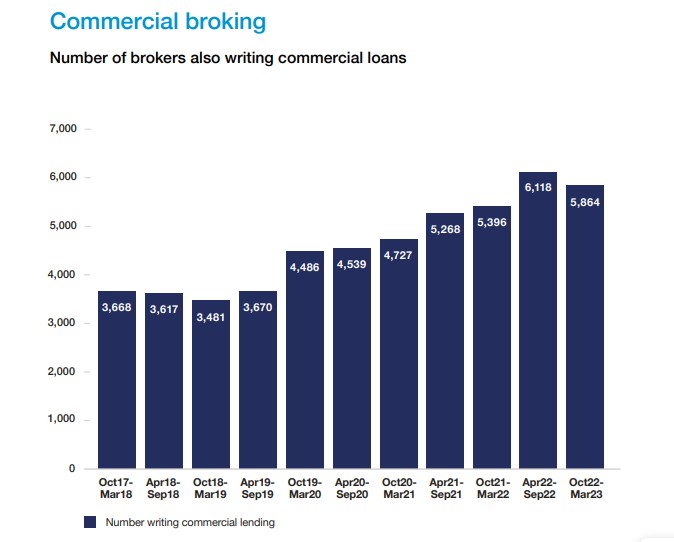

The report, which uses data supplied by the industry’s 11 leading aggregator brands, also revealed the number of mortgage brokers writing commercial loans decreased in the six-month period to 5,864 brokers. However, this is the second highest number of brokers writing commercial loans to date.

MFAA CEO Anja Pannek (pictured above) said the report reinforced feedback from members on the impact interest rate rises and record levels of refinancing had on brokers and their clients.

“The period covered in the report coincided with a period of intense refinancing as fixed rate mortgages reverted to variable, clients encountered serviceability constraints and a moderation of property prices in some markets,” Pannek said.

“This confluence of factors can be seen in this industry research; however, the outstanding service mortgage brokers deliver to their clients has remained a constant throughout this time.”

Fewer broker loans from major banks, white label lenders

According to the report, the proportion of broker-originated home loans settled with lenders from the major banks fell by 4.1 percentage points from 49.9% December 2022 quarter to 45.8% in the March 2023 quarter, whilst other types of lenders (such as Macquarie Bank and AMP Bank) increased their share by 3.7 percentage points from 14.3% to 18%.

White label lending decreased by 1.6 percentage points, which was offset by the same proportional increase by international banks.

Regional banks aligned to the majors increased by 0.9 percentage points over the same period from 12.5% to 13.4%.

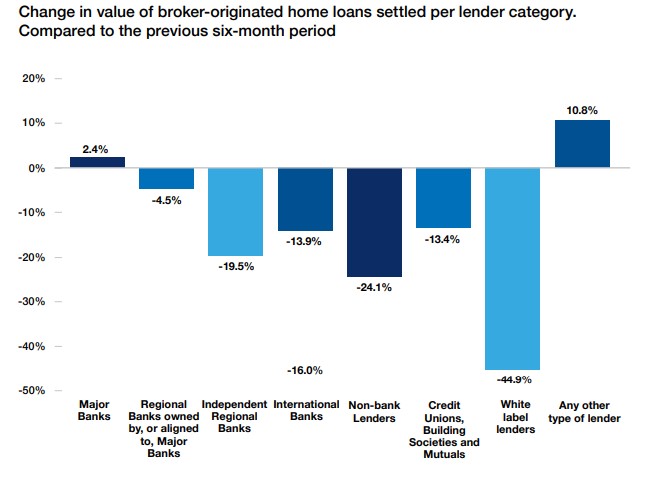

Comparing the October 2022 to March 2023 period to the previous six months, all segments recorded negative growth with the exception of the major banks and other types of lenders.

The report found the only segment to achieve double-digit growth was other types of lenders with 10.8% growth – in comparison the major banks only achieved an increase of 2.4%.

The market share of the non-bank lender segment was stable between the June and September 2022 quarters; however, this was followed by two successive quarters of decline with share decreasing to 5.3% in the December 2022 quarter, and 5.0% in the March 2023 quarter.

White label lending saw a record decline in the value of new settlements in the March 2023 quarter to its lowest value of $2.18 billion and lowest market share of 2.8%.

Following two consecutive quarters of decline in the September and December 2022 quarters, the credit unions, building societies and mutuals segment stabilised in the March 2023 quarter at $2.98 billion, with market share increasing to 3.8%.

Mixed results for commercial lending

Despite the number of mortgage brokers writing commercial loans decreasing in the six months to March 2023 to 5,864 brokers, down from a record high of 6,118 in the previous six-month period, this is the second highest number to date. Year-on-year, there was an increase of 468 mortgage brokers or 8.67%.

Compared to April 2022 to September 2022 period, this was a decline of 254 mortgage brokers or 4.15%.It was the first period-on-period decline since October 2018 to March 2019.

However, the value of commercial loans settled by mortgage brokers for the six-month period was $16.49 billion, up $516.43 million or 3.23% compared year-on-year.

Period-on-period, the value of commercial loans settled by mortgage brokers fell by $744.25 million or 4.32% from $17.24 billion.

In an effort to support brokers in the commercial lending space, MFAA is holding more commercial workshops for brokers, one in Sydney and the other in Melbourne.

During the period, mortgage brokers maintained a strong market share, writing 69.6% of all residential home loans in the March 2023 quarter, (which has since dropped to 67.2% in the June quarter), while in the 12 months to March 2023 mortgage brokers settled a record $358.68 billion in home loans.

The report also shows that in comparison to the October 2021 to March 2022 period, the total value of loans settled by mortgage brokers declined 8.63%.

However, Pannek noted that despite this fall the broker channel outperformed the overall home loan lending market with broker settled loans falling 8.63% compared to 10.89% for the overall market, which includes both broker and proprietary channels.

The report found the number of brokers in the sector remained above 19,000 for the second consecutive six-month period, at 19,456, a 4.69% increase year-on-year.

Following three successive periods of decline, the proportion of female brokers was 26.9% during the period, up from 25.4% as reported in the previous period.

“It’s really pleasing to see an increase in the proportion of female brokers in the industry, however progress still remains slow,” Pannek said/

Were you surprised by any of the findings in the MFAA report? Share your thoughts below.